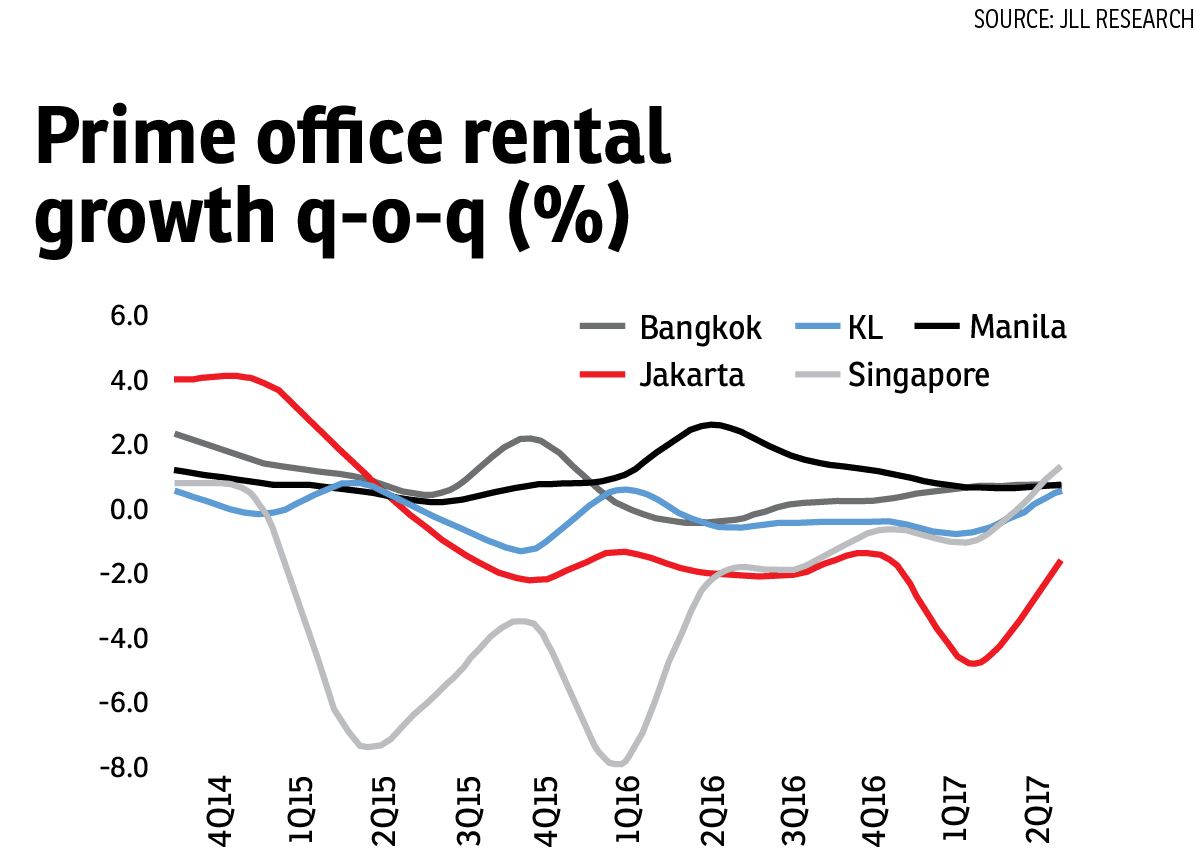

PETALING JAYA (July 31): Kuala Lumpur and Singapore prime office rents rose in 2Q2017 following several quarters of decline, according to JLL Research’s “Southeast Asia Outlook 1H17” report.

The report stated that KL and Singapore’s office markets have been weak in 2016 due to the economic slowdown. However, these markets saw a significant pickup in tenant demand in 1H2017 compared with 2016.

JLL cited prime office rents in Marina Bay, Singapore, which had declined 27% over eight quarters while KL rents fell 3% over a similar period. However, rents in these cities increased for the first time in 2Q2017. This will give a boost to investor confidence, it added.

Although surprised by the office absorption of prime offices in KL and Singapore as well as Bangkok, the real estate consultancy believes that this was due to stronger demand across the region driving average prime office rents in Southeast Asia to rise for the first time in nine quarters.

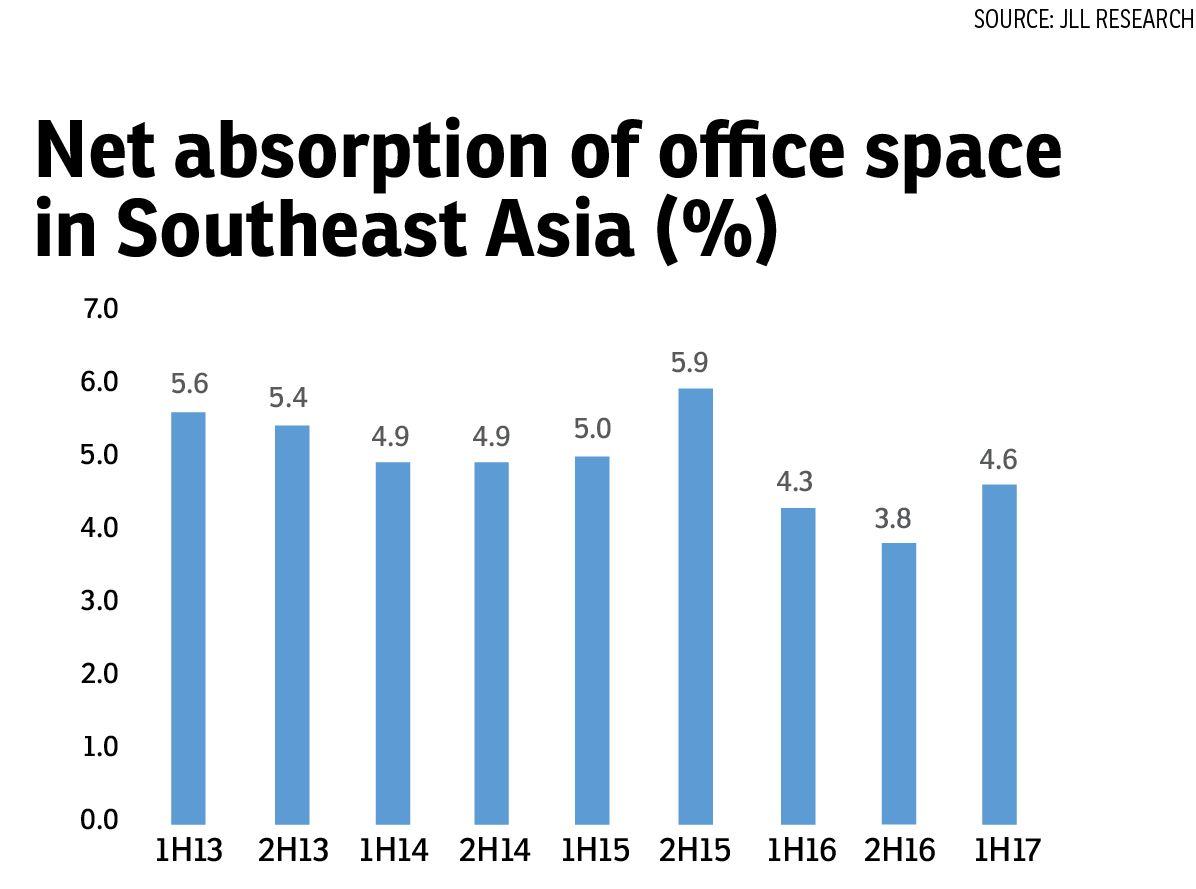

During 1H2017, occupied office space in Southeast Asia increased by 4.6%, compared with 4% in 2016, thanks to leasing demand by e-commerce firms, business services and financial firms.

JLL now expects Singapore prime rents to rise 20% over the next four years.

In 1H2017, Singapore picked up over US$2.2 billion (RM9.4 billion) of investment into office assets, and over US$1.45 billion into residential land from Hong Kong and mainland Chinese investors.

“Singapore remains a key market for many investors due to its long-term positive fundamentals. Real estate transaction volumes in Singapore rose by 6% y-o-y in the first half of the year, as investor sentiment is turning positive after CBD (central business district) office rents bottomed earlier than expected,” said JLL Southeast Asia head of capital markets research Regina Lim.

She also expects Hong Kong and mainland China buyers to continue bargain-hunting in Singapore and the rest of Southeast Asia.

Elsewhere in the region, online gaming operators are contributing to strong office take-up in Manila while technology, fintech and co-working operators are expanding in Jakarta. Office rents in the Indonesian capital declined 16% over the last two years and are likely to continue to slide over the next 18 months due to the high supply in the pipeline.

Nevertheless, Lim said: “We’re seeing growing interest from large-scale mainland Chinese groups looking to invest in Indonesia, as well as Vietnam and the Philippines. These investors are keen to tap Indonesia’s attractive economic and demographic profile. In Jakarta, we expect advance purchases of office assets under construction to remain the most likely point of entry.”

This story first appeared in TheEdgeProperty.com pullout on July 28, 2017. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Baru Kuala Selangor

Kuala Selangor, Selangor

Avenham Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor

Jalan Cakera Purnama 12/19

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor