- The group also said it has issued a clarification to bondholders via Malaysian Trustee Bhd on the issue, as well as its mall sale proceeds, bond collateral and the appointment of a new auditor.

KUALA LUMPUR (April 26): YNH Property Bhd (YNH) said it has remedied the "technical default" involving its sukuk programme that led to a downgrade of the company's rating by MARC Ratings recently, and assured that it will maintain compliance to prevent further technical defaults.

"The balance for the second monthly payment due April 26, 2024 has also been met by topping up the fund in the SPA account," YNH said in a statement, referring to its Islamic Medium-Term Notes (Sukuk Wakalah) programme.

The group also said it has issued a clarification to bondholders via Malaysian Trustee Bhd on the issue, as well as its mall sale proceeds, bond collateral and the appointment of a new auditor.

MARC had in an April 8 statement claimed YNH was in a “technical default” for its Islamic Medium-Term Notes Programme (Sukuk Wakalah) as it had failed to deposit the second monthly payment of RM6.1 million due on March 28, 2024, as part of the build-up in the reserve account. It subsequently downgraded YNH's rating further to BBB-, from BBB+, three months after it assigned a negative watch on the property group.

YNH has an outstanding RM323 million under the rated programme, of which the first tranche of RM153 million will mature on Feb 28, 2025, said MARC.

Sale of Kiara 163 in final stages

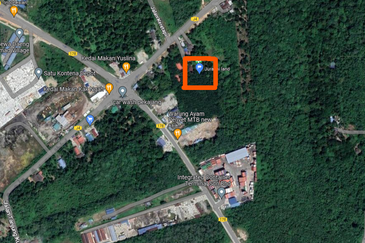

YNH also explained that the sale of its Kiara 163 Retail Park to Sunway REIT for RM215 million is in its final stages, pending shareholders’ approval at an upcoming extraordinary general meeting.

The transaction is scheduled to be completed by June 2024, YNH said.

It also reaffirmed that the bond collateral information provided in its information memorandum to bondholders is accurate as it is based on independent valuations conducted by real estate agency and advisory firm, Jones Lang Wootton. "To date, there have been no material changes to the bond collateral information," it added.

The explanation came after the group announced earlier on Friday that the conditional period of the sale and purchase agreement for the disposal of the property, which had expired on the same day, had been extended by two more months to June 26 following a supplemental agreement Sunway REIT inked with D'Kiara Place Sdn Bhd.

YNH, in its statement, said this disposal aligns with its commitment to maximise the value of its assets while ensuring the long-term sustainability of its business operations.

In addition, YNH said it has appointed Morison LC PLT as its external auditor.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Laman Bakawali @ Kota Seriemas

Nilai, Negeri Sembilan

Peranakan Straits, Setia Eco Templer

Rawang, Selangor

Midfields Condominium

Salak Selatan, Kuala Lumpur

TAMAN DATO ABDUL SAMAD

Port Dickson, Negeri Sembilan

Taman Bukit Nibong Flat

Seremban, Negeri Sembilan

Taman College Heights (Sikamat)

Seremban, Negeri Sembilan

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

Taman Perindustrian Tanjung Pelepas

Gelang Patah, Johor