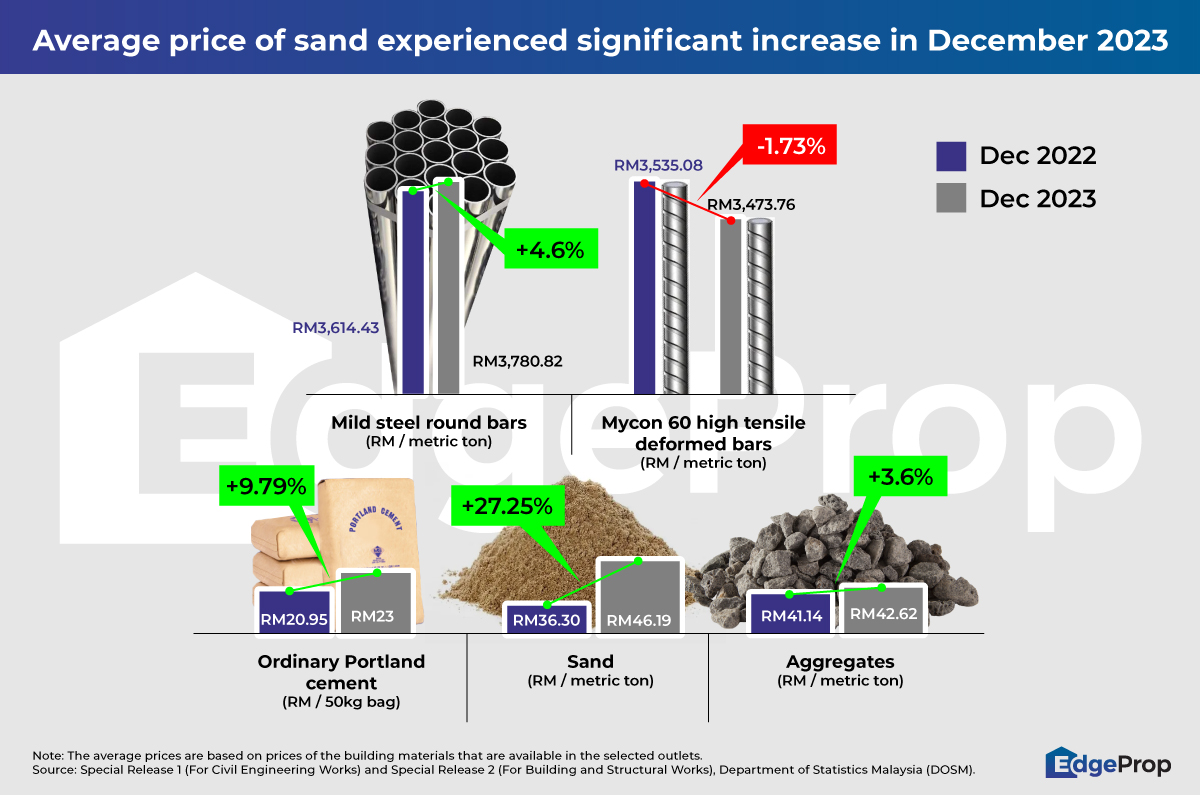

- The substantial hike in average price of sand could be attributed to high demand for the material globally and domestically.

PETALING JAYA (March 29): The Real Estate and Housing Developers’ Association (Rehda) recently stated that building material prices saw a significant uptick in 2023, with 91% of survey participants witnessing a notable surge compared to the previous years at the recent Rehda Property Industry Survey for 2H2023 and Market Outlook for 2024.

Additionally, the respondents noted an annual increase of over 10% in the average price of sand and concrete as at Dec 31, 2023. They foresee a 15% increase in construction cost in 1H2024, which will lead to an inevitable rise in property prices.

Meanwhile, globally, a report by Currie & Brown, a construction and cost management consultancy, highlighted a 3.64% increase in global construction costs in 2023, reflecting a 21% surge over the past five years due to ongoing cost volatility.

According to data for selected building materials from the Department of Statistics Malaysia, the average price of sand rose significantly from RM36.30 in December 2022 to RM46.19 in December 2023, resulting in a 27.25% increase. Cement also saw a price increase from RM20.95 to RM23 for the same period, representing a 9.79% hike.

High demand for sand worldwide

The substantial hike in average price of sand could be attributed to high demand for the material globally and domestically.

The global sand demand is expected to increase significantly, according to a study by Leiden University in the Netherlands, jumping from 3.2 billion tonnes annually in 2020 to 4.6 billion tonnes by 2060, driven mainly by regions in Africa and Asia.

A report by Financial Times stated that extensive land reclamation projects like the Singapore’s Tuas mega port, slated for completion in the 2040s, are causing an escalating demand for sand globally, with China driving the largest increase in global sand demand.

In 2022, Malaysia was ranked as the fourth largest global exporter of silica sands and quartz sands, with exports valued at US$84.6 million (RM399.6 million), according to The Observatory of Economic Complexity. Main destinations for these exports include China and Singapore.

Other factors contributing to construction price hike

From our desktop research, here’s what else we know:

The revival and acceleration of domestic mega infrastructure projects such as the East Coast Rail Link, Johor-Singapore Rapid Transit System, Bayan Lepas Light Rapid Transit, the remaining Pan Borneo Highway, and Sarawak Autonomous Rail Transit may have also boosted demand for building materials.

In January 2023, Bernama news reported that higher global coal prices have caused cement prices to go up because coal is the primary energy source in cement production. With demand expected to remain at similar levels, coal prices are projected to rise in 2023 and stay at that elevated level throughout 2025.

RHB Investment Bank Research reported in October 2023 that cement demand in the country will thrive because of major infrastructure projects, low inventory levels, and adoption of solar panels and electric vehicles.

Bernama noted in its November 2023 report that higher logistics costs are making projects more expensive in the short and long term, which will eventually affect end-users.

In December 2023, a report by the South East Asia Iron and Steel Institute (SEAISI) forecasted a likely increase in Chinese steel prices for 2024, stemming from anticipated slight growth in domestic and international market demand, alongside ongoing cost pressures from high input material prices.

Will property prices be affected?

Currie & Brown’s latest market data and insights report foresees global construction costs rising amid widespread uncertainty in 2024. This uncertainty stems from various factors such as geopolitical tensions, stubborn inflation, acute skills and materials shortages, and stricter sustainability regulations, all contributing to increased construction costs globally.

The predicted rise of construction costs, along with the increase in sales and service tax (SST) from 6% to 8% in March this year, may likely impact property prices in the country. However, it’s important to note that house pricing is influenced by factors beyond construction costs alone, such as the overall economic climate, political stability, market income levels, lending interest rates, and supply and demand interactions, which includes factors such as location, quality and developer reputation.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

De Tropicana Condominium

Kuchai Lama, Kuala Lumpur