Hua Yang Bhd (July 14, 97.5 sen)

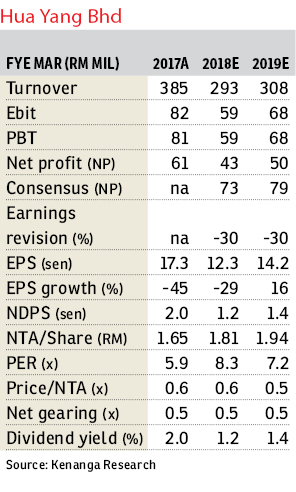

Downgrade to underperform with a lower target price (TP) of 95 sen: Hua Yang Bhd’s first quarter of financial year 2018 (1QFY18) core net profit (CNP) of RM1.7 million was disappointing, accounting for 2.8%/2.3% of our and streets’ full-year estimates.

1QFY18 sales of RM52.2 million were also behind our and management’s full-year target of RM331 million and RM400 million respectively. No dividend was declared as expected. Downgrade to “underperform” with a lower TP of 95 sen (from “market perform”; TP: RM1.14).

The poorer-than-expected performance stemmed from the following reasons: i) slower-than-expected progressive billings recognised due to timing issues as its newly launched projects had yet to reach a significant billing stage; and ii) higher costs partly due to the interests cost incurred for the acquisition of the 30.9% stake in Magna Prima Bhd.

Its lower-than-expected sales were due to the poor response from its Klang Valley project — Astetica Residences. 1QFY18 CNP saw a drastic decline of 93% year-on-year (y-o-y) as its revenue came off by 63%, and its pre-tax margins down by 19 percentage points (ppts) to 6% coupled with a higher effective tax rate of 39% (+13ppts, y-o-y).

The sharp drop in revenue was mainly due to a timing issue as its newly launched projects had yet to reach a meaningful billing stage which resulted in the slump in revenue, while the compressions in pre-tax margins were due to higher operating costs and also higher interest costs incurred in acquiring the 30.9% stake in Magna Prima.

On a quarter-on-quarter basis, the 82% decline in its 1QFY18 CNP was also due to similar reasons above. Going forward, we would not expect any major land bank activities from Hua Yang, as we believe that it needs to focus on its future launches and also future plans with Magna Prima, considering their unbilled sales, which fell to a low of RM204 million which would only be adequate for another one to two quarters. We opine that Hua Yang should be more aggressive driving its sales from its launched projects, which have received slow response from the market.

Nonetheless, we do not rule out a potential cash call exercise if Hua Yang acquires the remaining 70% stake in Magna Prima in the future.

Following its weak result, we slash our FY18 to FY19 CNP by 30% after factoring in a higher operating cost and retiming our billing progress. That said, we also reduce our FY18 and FY19 sales targets by 24% and 29% to RM253 million and RM322.3 million respectively.

Following our reduction in earnings due to its weak performance, we are downgrading Hua Yang to “underperform” with a lower a TP of 95 sen as we apply a steeper discount factor of 70% to its revised net asset value of RM3.10 (previous discount factor at 63%) higher than its peak of 65.8% due to its consecutive disappointment in achieving its sales target and earnings delivery.

Risks to our call include: i) stronger-than-expected sales; ii) lower-than-expected administrative costs; iii) positive real estate policies; iv) conducive lending environments; and v) higher-than-expected dividend payout. — Kenanga Research, July 14

This article first appeared in The Edge Financial Daily, on July 17, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Taman Cahaya Alam, Seksyen U12

Shah Alam, Selangor

Bennington Residence @ Sky Arena

Setapak, Kuala Lumpur

Seksyen 5, Kota Damansara

Kota Damansara, Selangor

Seksyen 8, Kota Damansara

Kota Damansara, Selangor

Seksyen 5, Petaling Jaya

Petaling Jaya, Selangor

Section 14, Petaling Jaya

Petaling Jaya, Selangor

Section 22, Petaling Jaya

Petaling Jaya, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)