- “The real danger is when borrowers are already struggling to service the monthly loan instalment before the OPR increase, they will definitely find it very difficult to pay for even the slightest increase in loan instalments.”

KUALA LUMPUR (Nov 3): In a reaction to the latest move by Bank Negara Malaysia (BNM) to maintain its overnight policy rate (OPR) at 3%, the National House Buyers Association (HBA) is of the view that it will only be a problem for borrowers who are already struggling with their monthly loans.

“The real danger is when borrowers are already struggling to service the monthly loan instalment before the OPR increase, they will definitely find it very difficult to pay for even the slightest increase in loan instalments,” said HBA.

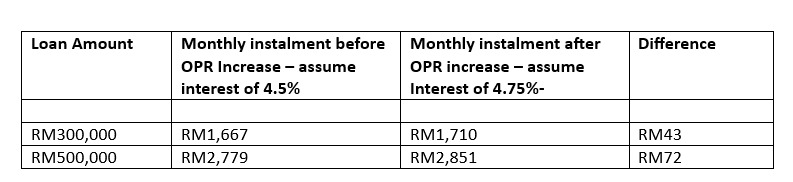

It explained that assuming a housing loan amount of RM300,000 and RM500,000 tenure of 25 years, an increase in the OPR by 0.25% will only result in an increase in monthly loan payment of between RM43 to RM72.

The increase in OPR will not only impact house buyers, but anyone with loans including businesses will certainly pass on the increase to their customers by raising the prices of their goods and services, it added. “This will impact everyone resulting in lower purchasing power.”

With the OPR maintained, the industry (banking and housing developers) “is hoping that consumer sentiment will improve and result in higher volume and value houses being bought/sold”.

Is it a good move or bad move to maintain the OPR?

“BNM is in a very difficult position as the ringgit has weakened against the US dollar and the currency of our Asean neighbours. One way to strengthen the country's currency has always been to raise interest rates to stem the outflow of capital.”

However, increasing interest rates will result in higher loan repayments and borrowing costs, leading to lower purchasing power and companies having to cut staff in order to remain profitable, explained HBA. “This could in turn negatively impact the economy of the country.”

“In our opinion, maintaining OPR would be better as it results in lower pain suffered by the average Rakyat and we can only hope that global economic sentiments can improve and the Malaysian economy can also recover faster.”

“BNM needs to find the balance where the OPR does not burden the public and at the same time, encourage a sustainable property sector that can deliver housing that is affordable to the majority of the Rakyat and not only the rich,” added HBA.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Taman Cahaya Alam, Seksyen U12

Shah Alam, Selangor

Seksyen 5, Kota Damansara

Kota Damansara, Selangor

Seksyen 8, Kota Damansara

Kota Damansara, Selangor

Jalan SP 8 @ Bandar Saujana Putra

Jenjarom, Selangor