• Today, we look at price growth and indicative asking rental yields for non-landed residences in KLCC. From analysis of transactions by TheEdgeProperty.com, the average transacted price for non-landed residences in the secondary market was RM1,167 per square foot (psf) in 1Q2015, growing 9.8% y-o-y.

• On closer inspection, the growth in average price is derived from a lack of transactions in the relatively lower-end segment. Few observed projects displayed significant actual appreciation in capital values.

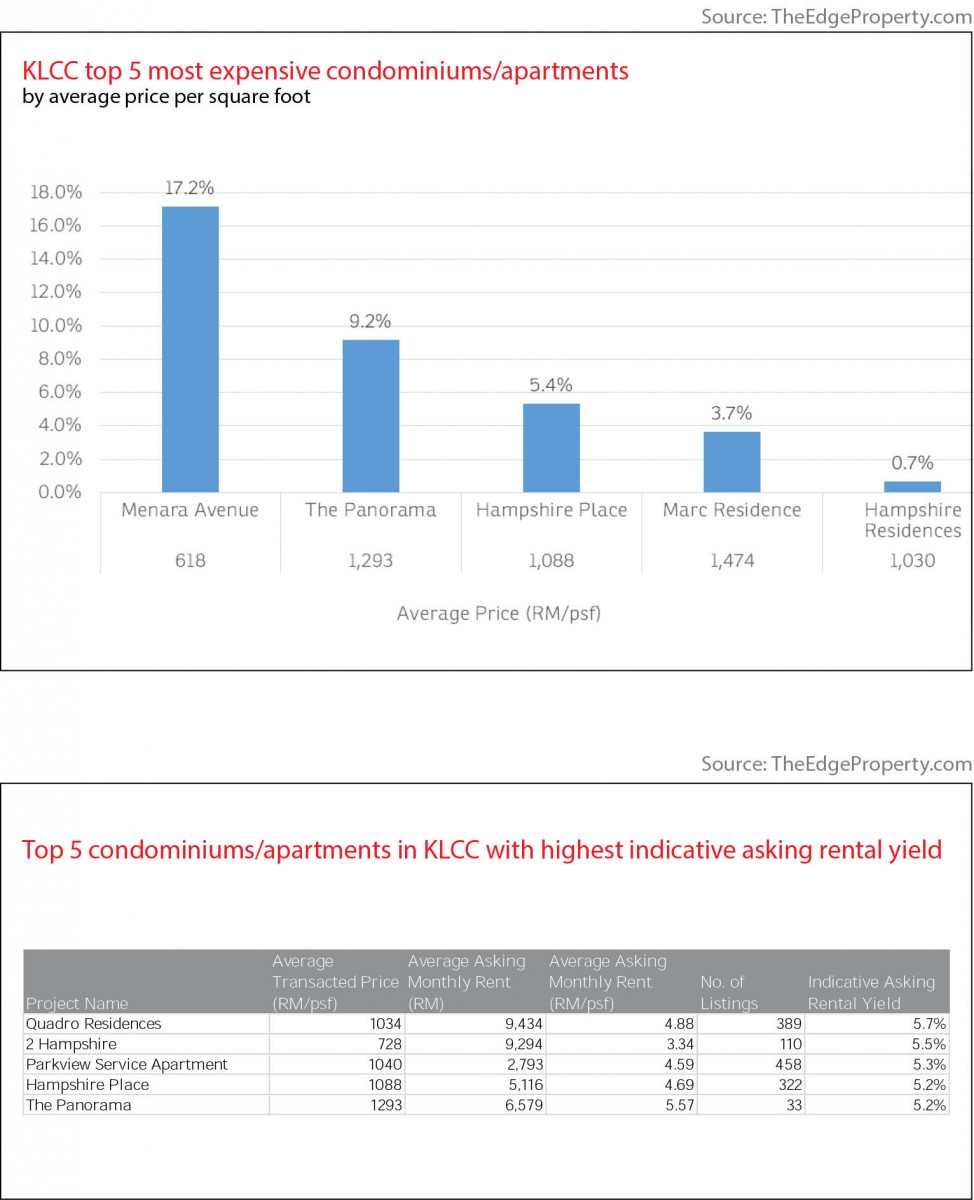

• The highest relative price growth can be found at Menara Avenue. Located further away close to Persiaran Hampshire, the prices here had gained 17.2% y-o-y to reach an average of RM618 psf in the 12 months to 1Q2015. Despite this impressive gain, prices here remain at an affordable level relative to the KLCC area. Buyers would find units here generously sized, starting from 840 square feet (sq ft) for a 1-bedroom unit. Transacted prices in the period ranged from RM600,000 to RM925,000.

• The highest absolute price growth can be found at The Panorama. Also located off Persiaran Hampshire, the average price here had gained RM109 psf, or 9.2% y-o-y, to reach RM1,293 psf. Such price levels are among the highest in the Persiaran Hampshire neighbourhood, on par with other condominiums closer to the heart of KLCC.

• With such a high concentration of elite residences, the rental market here is largely driven by expatriates. Rental rates as observed in June 2015 from asking rentals start at about RM3 psf for the older properties and can reach up to RM6 psf for compact residences such as Vipod Residences and Marc Residence.

• Indicative annual rental yields range are decent ranging from 4.4% to 5.7% per annum.

Click here if you are interested to know the price trends at Menara Avenue.

The Analytics are based on the data available at the date of publication and may be subject to revision as and when more data becomes available.

TOP PICKS BY EDGEPROP

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

De Tropicana Condominium

Kuchai Lama, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur