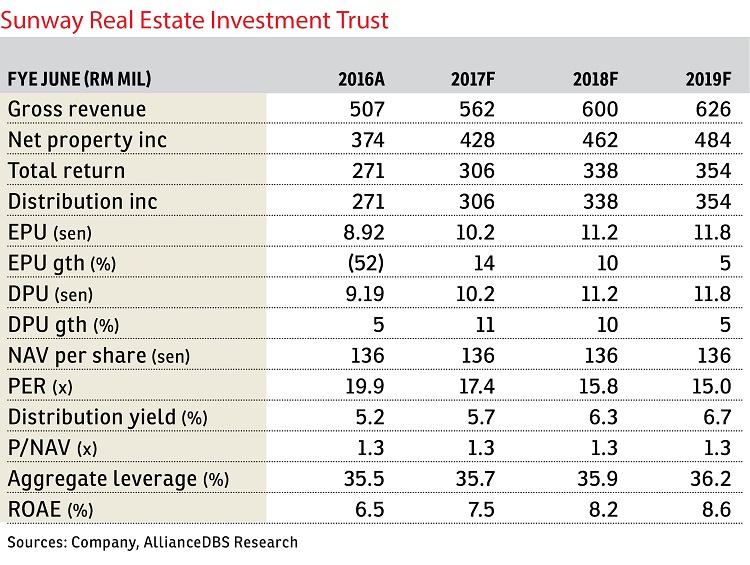

Sunway Real Estate Investment Trust (Oct 28, RM1.78)

Buy rating with a rise in target price to RM1.95: We remain positive on Sunway Real Estate Investment Trust (SunREIT) as its distribution per unit remains attractive in the near to medium term, following the completion of refurbishment works for Sunway Putra assets which include a mall, an office and a hotel as well as full-year income contribution from Sunway Hotel George Town.

Furthermore, we expect further earnings accretion from the asset enhancement work done on Sunway Pyramid Hotel, slated to be completed by the second quarter of 2017 (2QFY17).

Furthermore, SunREIT could benefit further from the continued expectations of further easing of monetary policy.

SunREIT’s management plans to embark on a refurbishment project for Sunway Pyramid Hotel which saw its occupancy rate dropping to 55% in 3QFY16 (3QFY15: 74%).

The decline is mainly due to lower demand from corporates and the progressive closure of the hotel pre-prior to the commencement of its refurbishment plan, with the expected completion date to be in 2QFY17.

The project is expected to commence progressively in April with full closure of the hotel by 4QFY16 for approximately 12 months with a budgeted capital expenditure of RM120 million. The net property income foregone (FY15: RM18 million) will be offset by the recent inclusion of assets.

SunREIT’s sponsor and shareholder which has a 37% stake, Sunway Bhd, has a large pipeline of potential assets for injection under its “build-own-operate” model.

Future injections could include Sunway University and Monash University campuses, The Pinnacle office tower, Sunway Giza mall, Sunway Velocity mall and Sunway Pyramid Phase 3.

These underpin an attractive growth pipeline for SunREIT. We are optimistic about potential injections from sponsor Sunway Bhd to meet SunREIT’s RM7 billion asset target.

The key risks to our view include the pace of acquisitions. SunREIT’s yields are on par with its larger peers. The draw is the potential to secure steady acquisitions. — AllianceDBS Research, Oct 28

This article first appeared in The Edge Financial Daily, on Oct 31, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Norton Garden Semi D @ Eco Grandeur

Bandar Puncak Alam, Selangor

Kawasan Industri Desa Aman

Sungai Buloh, Selangor

Kawasan Perusahaan Telok Mengkuang

Telok Panglima Garang, Selangor

Laman Anggerik, Nilai Impian

Nilai, Negeri Sembilan

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur