Magna Prima Bhd (Aug 21, RM1.45)

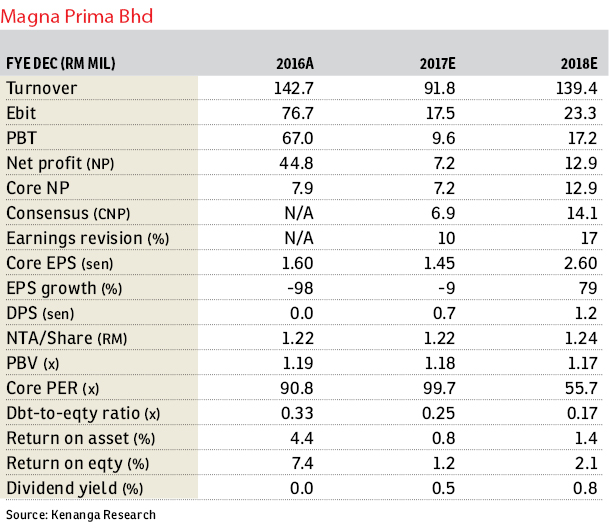

Upgrade to outperform with an unchanged target price (TP) of RM1.60: The first half of financial year 2017 (1HFY17) core net profit (CNP) of RM4.6 million came in above expectations, at 70% of our RM6.5 million forecast and 67% of consensus’ RM6.9 million estimate. This was thanks to higher-than-expected profit before tax (PBT) margins (1HFY17 at 31% vs our 10%) and higher recognition of unbilled sales. No dividend was announced, as expected.

Year-on-year, 1HFY17 CNP reversed to RM4.6 million from a core loss of RM3.8 million on lower tax impact (-67%) as the second quarter of financial year 2016 (2QFY16) saw a one-off recognition of fair value gain on investment property of RM49.2 million. Excluding the fair value gain, core PBT weakened 22% from RM16.1 million to RM12.6 million on lower development revenue recognised (-11%). Quarter-on-quarter, the 2QFY17 CNP reversed to RM6 million from a core loss of RM1.4 million on higher development revenue (2.3 times to RM30.9 million) from higher recognition of unbilled sales.

The 3QFY17 earnings could be softer, as we note that 2QFY17 revenue of RM30.9 million made up 63% of unbilled sales of RM49 million as of end-March 2017. However, in the medium term, we expect new sales from the existing inventory of about RM200 million in Boulevard Business Park, Jalan Kuching, and Desa Mentari, Jalan Kelang Lama, which could make earnings recognition more volatile as the momentum of inventory sales is tough to determine, while sales recognised provide immediate bottom-line impact.

Meanwhile, longer-term earnings should be supported by its Shah Alam and Kepong projects. Investors could see a further boost should Magna monetise its 2.6 acres (1.05ha) of land in Jalan Ampang valued at about RM400 million, which we have not imputed into our estimates. In the long term, we also look forward to potential collaborations with its new major shareholder, Hua Yang Bhd.

Revise up FY17-FY18E (estimate) CNP by 10%-17% to RM7.2 million-RM12.9 million as we tweak up our margin assumptions.

Our fully diluted (FD) revised net asset value (RNAV) per share of RM2.94 is driven by an 11% weighted average cost of capital, 15% net margin for a planned RM2.5 billion gross development value, RM48 million unbilled sales, and full warrants conversion. Our TP is based on 35% property RNAV discount rate, among the narrowest for Klang Valley developers because its land banks can be readily launched. We note its FY17-18E FD price-earnings ratios of 100 times and 56 times are substantially above peers’ average as implied by the price paid by Hua Yang of RM1.85 per share, which affirm the company value on a “land acquisition basis”. This may have raised the pricing benchmark for the stock ahead of current earnings and tightened the gap of its RNAV discount. We opine that the 5% decline in Magna’s share price since our initiation is in line with the sector’s recent share price weakness, and we think our recommendation is apt given the earnings recovery, strategic Klang Valley land banks, joint venture possibilities with Hua Yang and a potential windfall from its Jalan Ampang land bank. — Kenanga Research, Aug 21

This article first appeared in The Edge Financial Daily, on Aug 22, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

One Cochrane Residences

Kampung Pandan, Kuala Lumpur

Taman Sengkang @ Pasir Panjang

Port Dickson, Negeri Sembilan

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor

Bandar Kinrara 2

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 2

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 3

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor