KUALA LUMPUR (July 17): Ikhmas Jaya Group Bhd plans to raise some RM33.8 million via private placement, to be used as general working capital, including payment to suppliers and sub-contractors.

The construction firm said the private placement will involve the issuance of up to 52 million new shares — equivalent to 10% of its share capital — to identified investors at an issue price to be fixed later.

For illustrative purposes, it assumed that the placement shares would be issued at 65 sen a piece, which represents a discount of 9.6% to its five-day volume weighted average market price of its shares up to July 7 of 71.9 sen.

On completion of the corporate exercise, Ikhmas Jaya said its share capital will expand to 572 million shares from 520 million currently.

As a result, Ikhmas Jaya said its gearing will be pared down to 43% from 50% currently, while its earnings per share may initially be reduced as a result of the increase in its share base.

Arranged by RHB Investment Bank Bhd, Ikhmas Jaya expects to complete the private placement exercise by the third quarter of this year.

According to the latest report by JF Apex Securities, Ikhmas Jaya's orderbook currently stands at RM369.3 million.

Listed on the Main Market since July 2015, shares in Ikhmas Jaya closed 0.5 sen or 0.72% lower at 69 sen today, for a market capitalisation of RM358.8 million. — theedgemarkets.com

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

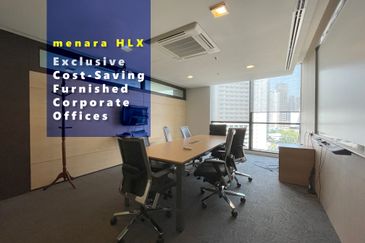

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Seksyen 5, Kota Damansara

Kota Damansara, Selangor

Seksyen 8, Kota Damansara

Kota Damansara, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)