Sunway Real Estate Investment Trust (May 4, RM1.71)

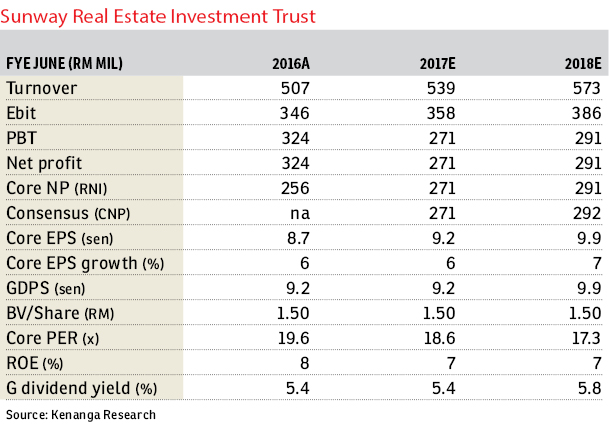

Maintain market perform with a higher target price of RM1.80: Sunway Real Estate Investment Trust’s (REIT) nine-month of financial year 2017 (9MFY17) realised net income (RNI) of RM200.6 million came in within expectations, making up 74% of consensus and our estimates. Note that we have stripped off RM3.2 million from RNI as it is a non-recurring income from a court award for Sunway Putra. The third quarter of FY17’s (3QFY17) gross dividend per unit (GDPU) of 2.37 sen includes a non-taxable portion of 0.47 sen bringing 9MFY17 GDPU to 6.92 sen. However, after stripping off 0.11 sen from the court award, 9MFY17 GDPU is 6.81 sen, which is within our expectation at 74% of FY17 estimates (FY17E) GDPU (5.4% yield).

Year to date, gross rental income was up marginally by 2% mainly from the retail segment (+6.3%), from contributions on all assets, especially Sunway Putra Mall, and the office segment (+3.2%), mainly contributed by Sunway Putra Tower, while the hotel segment was down (-21%) mostly due to the closure of Sunway Pyramid Hotel in 4Q 2016 (4Q16). This was on the back of stable net property income (74%) and RNI (51%) margins.

All in, RNI was up by 3% after stripping out a one-off item of RM3.2 million from recognition of a court award for Sunway Putra in 2QFY17, while we had also previously stripped off RM6.2 million from RNI in 2QFY16 related to another court award for Sunway Putra litigation case.

Management is targeting to spend about RM100 million on capital expenditure (capex) in FY17 mainly for the refurbishment of Sunway Pyramid Hotel East (previously Sunway Pyramid Hotel East and Pyramid Tower Hotel), which we have previously accounted for in our estimates. In terms of leases up for expiry, FY17 has 22% of net leasable area up for expiry and it is a major rental reversion year for Sunway Pyramid (54%) and Sunway Carnival (72%) of which we expect mid-to-high single-digit reversions, while FY18 will only see 15.4% leases up for expiry.

Our spread is close to Malaysian REITs’ average yields of 5.5%, and slightly higher than the retail REITs’ average yield of 5.2% due to earnings fluctuations in Sunway REIT’s office and hotel segments. At the current level, Sunway REIT is commanding gross yields of 5.8% (based on FY18 estimate), which is in line with its peers (more than RM1 billion in market cap) at 5.8%, warranting a market perform call. — Kenanga Investment Research, May 4

This article first appeared in The Edge Financial Daily, on May 5, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

The Elysia Park Residence

Iskandar Puteri (Nusajaya), Johor