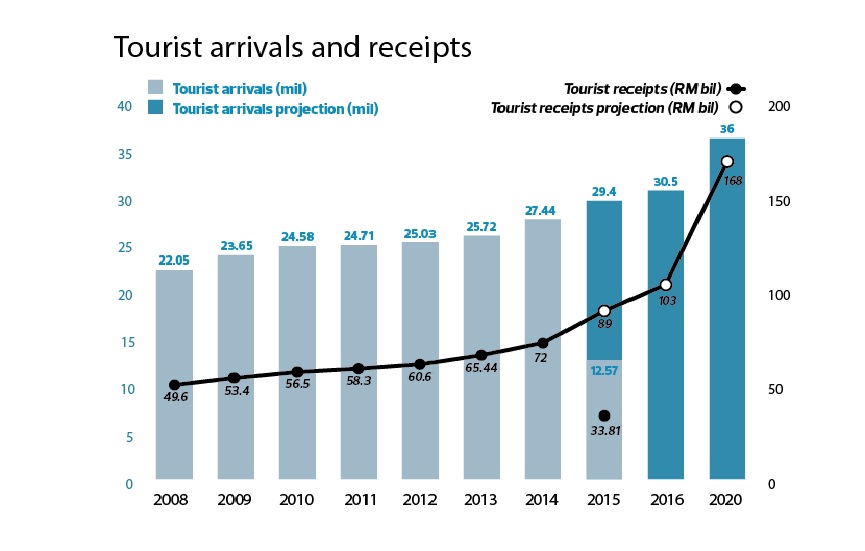

With fewer than six weeks to the end of the year, tourism industry players doubt that Malaysia will hit its annual arrivals target of 29.4 million.

Tourist arrivals for the first half of the year stood at just 43% of the full-year target and businesses in the sector have remained subdued.

Recent reports do not paint a rosy picture of the second half.

Kuala Lumpur Tourism Bureau general manager Norazah Yusof said recently that foreign tourist arrivals have slumped 20% year to date and described the situation as “worrying”. Kuala Lumpur is among the destinations in the country with the highest tourist count. The numbers exclude excursionists or day trippers, who are only considered tourists if they stay for one night.

Tourism Malaysia director general Datuk Mirza Mohammad Taiyab holds the same view.

“No doubt, 2015 has been very challenging for the tourism industry thus far. We are still feeling the effects of the three aviation tragedies that happened last year and the continued threat to our general safety and security situation, which has led to the issuance of travel advisories.

“In addition to all the problems, there has been a general slowdown in [tourist] movement in the region. Our immediate neighbour, Singapore, is also facing a similar situation,” he tells The Edge via email.

“2014 was a very tough year for the country. The effects of what happened last year can still be felt this year. Negative publicity by foreign media on safety issues affected the decision of tourists who were planning a trip to Malaysia. Besides the air tragedies, route rationalisation by Malaysia Airlines Bhd also affected the tourism industry, as it stopped flying to several destinations such as Brisbane, Frankfurt and Istanbul.

However, neither the Ministry of Tourism and Culture nor its marketing arm, Tourism Malaysia, has any plans to revise this year’s target downwards.

Despite fewer tourists, per capita spend in 1H2015 has increased by 5.7%. “This shows that the demand for the right [high yield] market segment has remained resilient and it keeps growing,” Mirza says, adding that each tourist spent RM2,688.30 on average, for a total of RM33.81 billion in receipts. But this is far from the RM89 billion target in tourism receipts for the full year.

While Minister of Tourism and Culture Datuk Seri Mohamed Nazri Abdul Aziz has repeatedly said that the weaker ringgit is a boon to Malaysia, hotels and tour and travel agents are not celebrating as the impact has yet to be seen.

“In general, 2015 has been a very difficult year for many in the hotel industry,” says vice-president of The Malaysian Association of Hotels (MAH), Mohammad Halim Merican. Year to date, the performance of many hotel operators have been below expectation. For whatever reason, October saw healthy occupancy, but business seems to be slow again in November and December (forward bookings). Overall, many hotels are down compared with last year and at best, at par.”

On whether hotel operators are seeing a positive impact from the weaker ringgit, he stresses that “more than just a weaker currency is required to attract tourists”. “There is increasing competition in the market too,” says Halim, who is also vice-president of the Malaysian Association of Hotel Owners (MAHO).

Malaysian Association of Tour and Travel Agents (Matta) president Hamzah Rahmat describes inbound travel in 2015 as “volatile”. “Theoretically, a weaker ringgit is supposed to help but we are not seeing the numbers we had expected. It has not yet materialised.”

World Express Tours group president Tunku Iskandar Tunku Abdullah says his agency has not seen any improvement in inbound travel in 2H2015, which is “similar to 1H2015”.

His inbound business is predominantly from Australia and Europe. Year to date, he has seen 15% fewer travellers from Western Europe, and 25% to 30% fewer from Australia.

“While the ringgit has weakened against the Australian dollar, Australians are feeling the pinch too [as the Aussie has declined against the greenback] and they are not travelling as much.” Similarly, the euro has declined against the US dollar and this has dampened travel sentiment, says Tunku Iskandar.

He also raises an interesting point on foreign airlines that fly into Malaysia. They need traffic in and out of the country, but outbound travel has declined because of the weaker ringgit. At the same time, these airlines are selling tickets at the same price as they did before, in ringgit terms. When converted into the currency of the airlines’ home countries, for example, the euro, they are earning less. This, he cautions, could lead to capacity or route cuts in Malaysia.

Tourism officials, meanwhile, are sticking with the 2015 target of 29.4 million arrivals but to achieve that, the country would need to welcome at least 2.8 million tourists each month. This level of arrivals has been achieved just once — in December 2013 — when Malaysia recorded 2.807 million tourists.

Next year’s official target and how to get there

The government has set a target of 30.5 million tourist arrivals and total tourism receipts of RM103 billion for 2016. How will this be achieved?

Mirza says the focus will be on reviewing travel formalities to help boost demand and increase arrivals immediately. “The introduction of e-visa, announced in the recent Budget 2016 speech, will provide a boost for the South Asia and China markets and contribute to this growth,” he says.

MAS, MAH, Matta, PLUS Malaysia and Express Rail Link, together with state tourism associations and authorities, will pool their resources and activities for greater synergy and economic impact, he adds.

“We conducted a recovery lab recently with industry players to discuss plans for the short (six months), medium and long term. We received good feedback and support from the industry players. Some quick-win initiatives have been carried out in some major markets to boost arrivals and receipts,” says Mirza.

Tourism Malaysia is also planning to give more emphasis to social media, online media and digital marketing as it feels this will be a cheaper communication option to reach a wider audience.

The ministry has been allocated RM1.2 billion under Budget 2016. Mirza says, “More than the actual budget, the actual value in terms of foreign exchange and the rising cost of media is a challenge. It can be overcome by all parties coming together as a team to pool our resources and with the support of our overseas partners.”

Who’s up, who’s down?

A combination of factors — the prolonged effects of 2014’s triple air tragedies, route rationalisation by the Malaysian national carrier and a weaker ringgit — caused tourist arrival numbers to contract in the first half of 2015.

In contrast with what many had expected, the sharp depreciation of the ringgit did not seem to draw more tourists to Malaysia, as shown in the tourist arrival data.

Worse, the government’s budget for marketing and advertising abroad has shrunk substantially because of the weak ringgit. “Due to the drop in the ringgit value, it became very costly for us to continue with the usual promotion and advertising programmes overseas,” says Tourism Malaysia director general Datuk Mirza Mohammad Taiyab.

The number of tourists who visited Malaysia in 1H2015 declined to 12.57 million from 13.88 million in the previous corresponding period. Data from Tourism Malaysia, which is tabulated in cooperation with the Immigration Department, shows a sea of red for 1H2015. Of the top 45 nationalities who came to Malaysia, only two markets showed growth.

Markets that saw sharp drops included Singapore (9.9%), China (11.7%) and Australia (22.2%).

Tourist numbers from Middle East countries, who are typically the biggest per capita spenders, also fell. Arrivals from Saudi Arabia declined 23.5% to 40,395 in the first six months while arrivals from Oman slipped 22.4% to 13,350. The number of tourists from Iran and Iraq dropped 14.2% and 27.1% respectively.

The largest decline was seen in the arrivals from the United Arab Emirates, which fell 30.9% to just 5,484. This equates to a monthly average of just 914 Emiratis who came to Malaysia in 1H2015. This was despite at least six direct flights daily between Kuala Lumpur and Dubai, and between Kuala Lumpur and Abu Dhabi, by Malaysia Airlines, Emirates and Etihad. The rest of the passengers were on transit.

The two markets that grew were South Korea (8.4%) and Taiwan (2.8%). This was attributed to an increase in the number of flights, promotions and offers by airlines. “Jin Air and Eastar Jet offered more seats and increased frequency from South Korea to Malaysia. AirAsia also started flying from Kaohsiung, apart from Taipei,” he says, adding that strong advertising campaigns had also helped keep Malaysia a top-of-mind holiday destination.

This article was first published in The Edge Malaysia weekly, Nov 23-29. Tap here to subscribe for your personal copy.

TOP PICKS BY EDGEPROP

Edusentral @ Setia Alam

Setia Alam/Alam Nusantara, Selangor

Edusentral @ Setia Alam

Setia Alam/Alam Nusantara, Selangor

Maxim Citylights @ Sentul KL

Sentul, Kuala Lumpur

Maxim Citylights @ Sentul KL

Sentul, Kuala Lumpur

D'Sara Sentral Serviced Residence

Sungai Buloh, Selangor

Maxim Citylights @ Sentul KL

Sentul, Kuala Lumpur

Jalan Taman Bukit Kinrara 1/4

Bandar Kinrara Puchong, Selangor