The Klang Valley residential market continued to slump for the second quarter of 2015 (2Q2015) in the aftermath of the implementation of the Goods and Services Tax (GST) in April, coupled with the weakening of the ringgit, which have tightened domestic spending.

Developers have become more cautious with their new launches, with some postponing them to next year or 2017, according to Nabeel Hussain, associate director of Savills Malaysia, in presenting the The Edge/Savills Klang Valley Residential Monitors 2Q2015.

While there were fewer launches of landed residences in 2Q, some have enjoyed good take-up. For example, 2-storey terraced houses in Tropicana Aman by Tropicana Corp Bhd sold out after the launch in May, while Eco Sanctuary by Eco World Development Bhd has seen 80% of its 2-storey terraced houses sold since the launch in June.

Nabeel says some developers have opted to offer incentives such as rebates, lucky draws for luxury cars and luxury holiday packages to attract potential buyers. He notes, however, that despite the incentives, the market has shown it is waiting for the unveiling of Budget 2016 in October.

On the lending side, although mortgage approval rates are marginally down, the total value of mortgage applications and approvals increased to 19% and 17% respectively in 2Q from the last quarter.

1-storey terraced houses

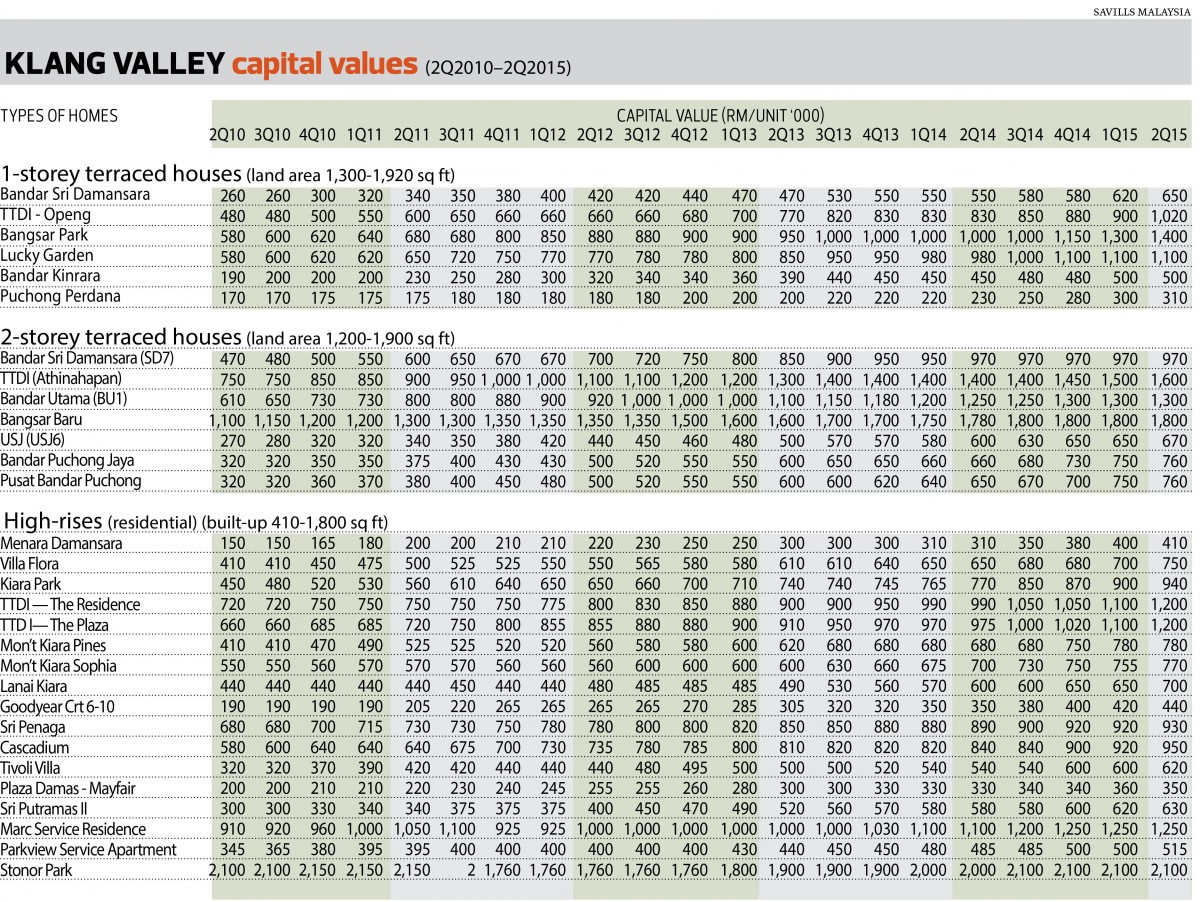

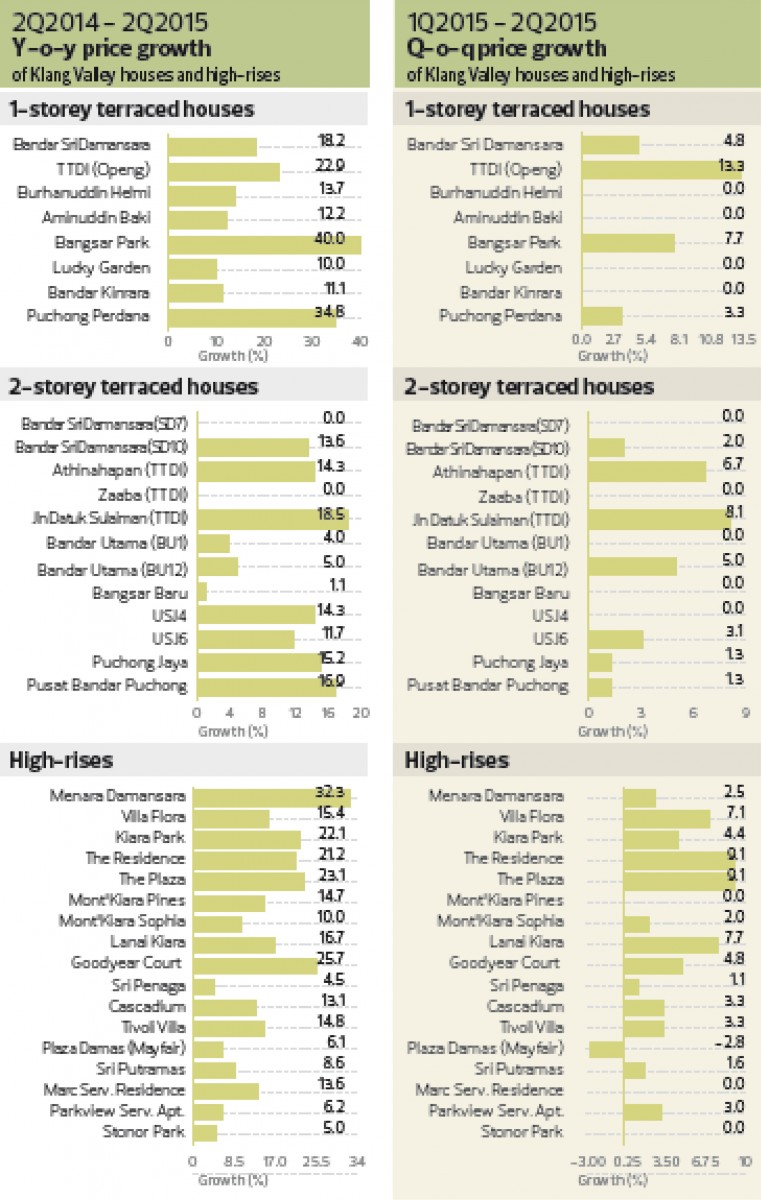

One-storey terraced houses have seen stable growth for the quarter under review due to limited supply in this segment in the Klang Valley. The monitor showed that prices for 1-storey terraced houses in Bangsar Park and Puchong Perdana have increased by 10% to 40% this quarter from a year ago.

Nabeel notes, however, that price appreciation is highly dependent on the maintenance, condition and location of the property.

For the quarter under review, a 1,875 sq ft unit in Bangsar Park enjoyed price growth of 40% to RM1.4 million from RM1 million a year ago. The price for a 1,300 sq ft 1-storey terraced house grew 34.78% to RM310,000 from RM230,000 a year ago.

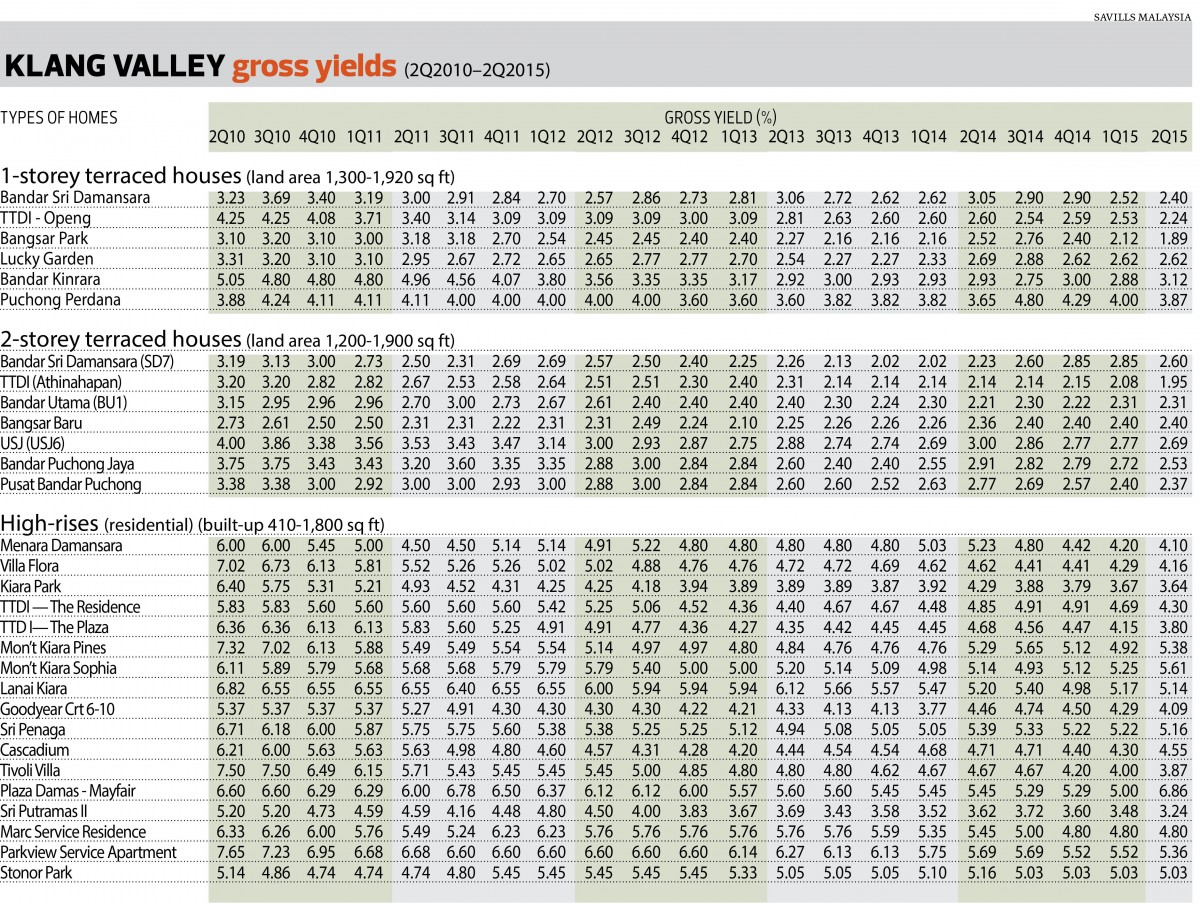

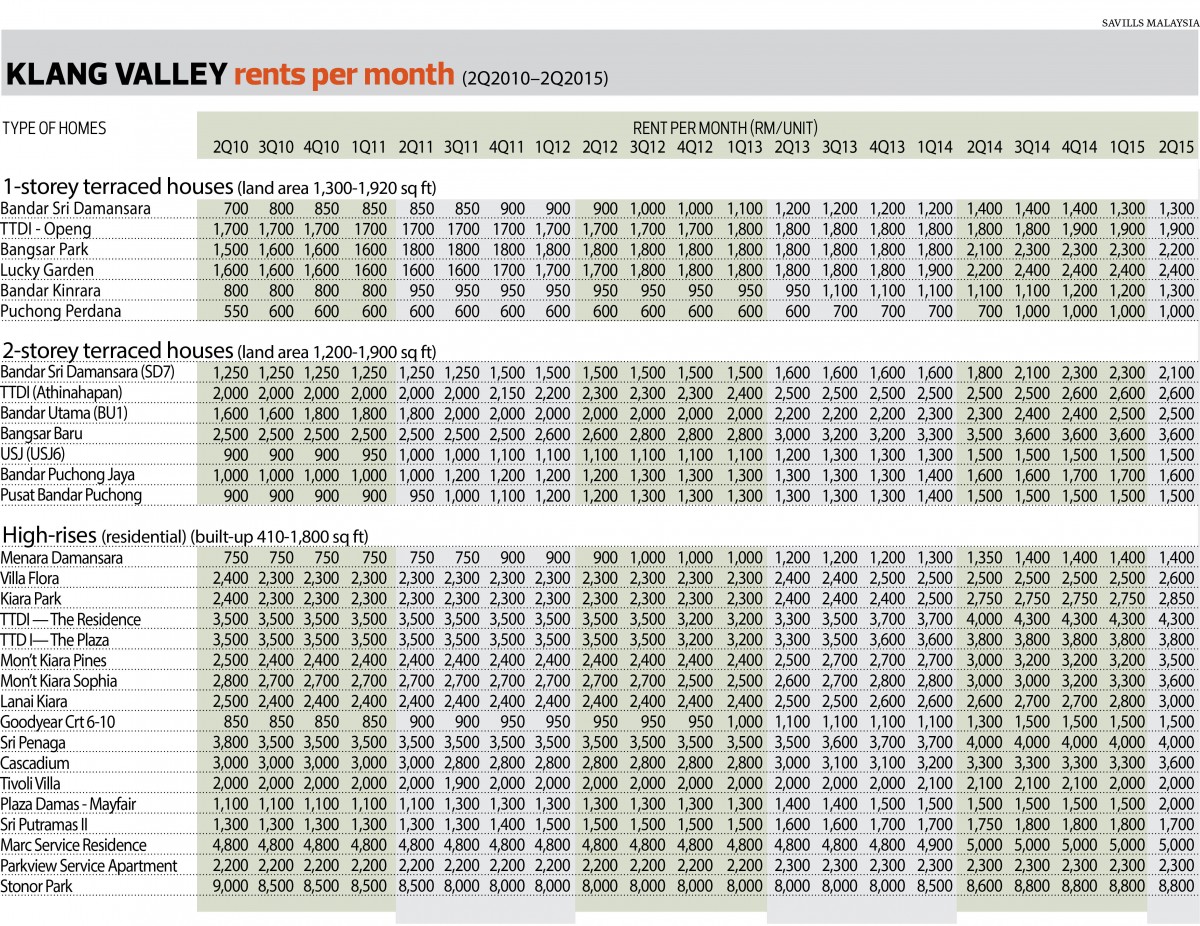

Rents were stable overall, with some areas enjoying some rental growth year on year (y-o-y) such as Bangsar Park and Taman Tun Dr Ismail (TTDI) Jalan Openg (1,760 sq ft), which up 5.5% and 4.7% respectively. However, Bandar Sri Damansara (1,300 sq ft) was the only area that saw a slight decline to RM1,300 per month in 2Q2015 from RM1,400 in 2Q2014.

Lucky Garden in Bangsar, Bandar Kinrara and Puchong Perdana in Puchong saw higher rents for the quarter under review — up by 9%, 18% and 42.8% on a yearly basis.

Nabeel says the 1-storey terraced house segment will remain stable due to limited supply in the Klang Valley and affordable prices. “The demand for this segment will be supported by the demand from baby boomers and may also appeal to first-time homebuyers given the current economic situation,” he adds.

Furthermore, the enhanced accessibility and well-planned public infrastructure — highways, as well as the upcoming rail networks such as the mass rapid transit (MRT) Lines 2 and 3 and LRT in Selangor and Kuala Lumpur, will gradually increase the value of the residential property nearby.

Two-storey terraced houses

Prices of 2-storey terraced houses appreciated 2.3% in 2Q, compared with 2.1% in 1Q. A 2-storey, 1,900 sq ft terraced house in Jalan Datuk Sulaiman, TTDI, had the highest price growth during the period under review, appreciating by as much as 18.5% y-o-y and 8.11% q-o-q to RM1.6 million from RM1.35 million.

“The appreciation could be due to the upcoming MRT Line 1 station in TTDI as well as the recently-announced LRT Line 3 station in Bandar Utama, which will result in an increase in values of nearby properties due to convenience in terms of accessibility,” says Nabeel.

A 1,400 sq ft, 2-storey terraced house in Pusat Bandar Puchong appreciated 16.9% to RM760,000 in 2Q from RM650,000 a year ago, while the average price of a 1,500 sq ft unit in Bandar Puchong Jaya grew 15.2% to RM760,000 from RM660,000 a year ago.

In terms of q-o-q growth for this segment, Jalan Datuk Sulaiman and Jalan Athinahapan in TTDI were the only two areas that enjoyed high price growth, with 2-storey terraced houses of 1,760 to 1,800 sq ft in Jalan Athinahapan appreciating 6.7% to RM1.6 million in 2Q from RM1.5 million 1Q.

On a quarterly basis, some areas only saw slight appreciation, such as Bandar Puchong Jaya (1.33%), Pusat Bandar Puchong (1.33%), USJ 6 in Subang Jaya (3.08%), BU12 in Bandar Utama (5%) and SD10 in Bandar Sri Damansara at 2.04%.

Monthly rents for 2-storey terraced houses were stable with some areas appreciating y-o-y, such as SD7 (16.6%), BU1 (8.7%), Jalan Athinahapan (4%) and Bangsar Baru (2.9%). As for rental growth q-o-q, SD7 and Bandar Puchong Jaya declined 8.6% and 5.8%.

In conclusion, 2-storey terraced houses remained the most popular landed residential property among buyers, says Nabeel.

“The 2-storey terraced houses have become the main residential product in a majority of townships. However, prices will differ depending on the location, demographics of the surrounding area and the features and specifications of the property,” he says. “Demand for this type of property will remain healthy as it is usually an option for first-time homebuyers as well as upgraders, although location plays a role for buyers.”

High-rise homes

High-rise homes performed better in 2Q, with average price growth of 3.31% and 14.88% q-o-q and y-o-y, compared with q-o-q and y-o-y growth of 2.67% and 12.12% in 1Q. “The majority of high-rise residential properties in matured areas have seen significant price growth compared with the previous quarter due to their excellent accessibility, established communities and safety,” says Nabeel.

For the quarter under review, the data showed that The Residence and The Plaza in TTDI experienced the highest price appreciation of 9%, followed by Lanai Kiara in Mont’Kiara with 7.7% growth from 1Q.

As for y-o-y growth, Menara Damansara in Bandar Sri Damansara (916 sq ft) had the highest price appreciation of 32.26% to RM410,000 in 2Q2015 from RM310,000 in 2Q2014. The quarter saw Goodyear Court 6-10 (1,008 sq ft) in Subang Jaya recording the second highest price growth by 25.7% to RM440,000 from RM350,000, while Kiara Park (1,356 sq ft) in TTDI rose 22.1% to RM940,000 from RM770,000 a year ago.

“Price differences are subject to the condition of the unit, facilities offered as well as the surroundings, upcoming property and infrastructure developments.

The demand for high-rise residential properties in the secondary market has been increasing due to their affordability compared with landed properties,” he says.

Rents in most areas remained stable q-o-q, with some high-rise homes experiencing growth. These include 1,248 sq ft units in Villa Flora (4%), 1,356 sq ft units in Kiara Park in TTDI (3.6%), 1,216 sq ft units Mont’Kiara Pines (9.4%), 1,209 sq ft units in Mont’Kiara Sophia (9.1%), 1,125 sq ft units in Cascadium in Bangsar (9.1%), 410 sq ft units in Plaza Damas (33.3%), and 1,421 sq ft units in Lanai Kiara (7.1%) in Sri Hartamas. The quarter witnessed a small decline in the average rent for a 1,295 sq ft unit in Sri Putramas II in Jalan Kuching (5.6%).

On a yearly basis, rents in the high-rise residential segment saw average growth of 3%, with the highest rental growth of 33.3% from Plaza Damas, followed by Mont’Kiara Sophia (20%), Mont’Kiara Pines (16.6%) and Lanai Kiara at 15.3%. However, Tivolli Villa in Bangsar and Sri Putramas II saw rents decline by 4.8% and 2.8%.

Asked about future growth catalysts for the high-rise residential segment, he says the upcoming MRT stations in TTDI and Pusat Bandar Damansara will push prices upwards, especially for properties in TTDI and Bangsar. “Nevertheless, price growth depends greatly on the location, individual lifestyle and surrounding amenities,” he qualifies.

On the outlook, Nabeel notes that the demand for high-rise residential properties remains high due to their relative affordability compared with landed properties.

“Living in a high-rise residence has become a lifestyle or trend among the urban professional community, supported by other contributing factors, such as facilities within the compounds of the high-rises, which are more complete and stylish, as well as security features,” he says.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Sept 28, 2015. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Jalan Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Taman Perusahaan Sungai Lokan

Bagan Lalang, Penang

Country Heights Damansara

Country Heights Damansara, Kuala Lumpur

East Residence @ KLGCC

Damansara, Kuala Lumpur

The Residence, Mont Kiara

Mont Kiara, Kuala Lumpur

The Ritz-Carlton Residences

KLCC, Kuala Lumpur

Monterez Golf & Country Club

Shah Alam, Selangor

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur