WCT Holdings Bhd Oct 12 (RM1.40)

WCT Holdings has secured RM198 million worth of local contracts in the past month, and the prospects of securing more are good.

It is benefiting from the weaker ringgit as the value of its Lusail project in Qatar has increased 14% to RM968 million on currency translation, lifting earnings contribution from this project.

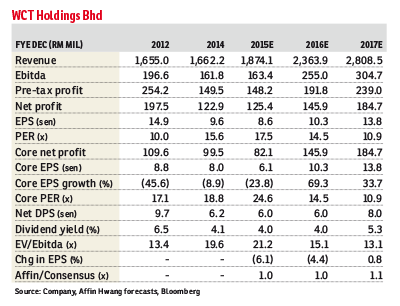

We lift our net profit forecasts by 2% to 12% for the financial year 2015 to 2017 (FY15 to FY17) to reflect potential new construction contracts. We raise our revalued net asset valuation (RNAV)-based target price (TP) to RM1.84 from RM1.64.

After a slow start to the year in clinching new local contracts, WCT was awarded the RM127.4 million Kwasa Damansara earthworks and RM70.4 million Tun Razak Exchange (TRX) earthworks projects recently.

We understand that WCT is one of the front runners for an additional earthworks package in TRX worth about RM700 million to be awarded soon.

It is also bidding for two earthwork packages worth about RM400 million to RM500 million each in the refinery and petrochemical integrated development (Rapid) project, one of the West Coast Expressway (WCE) packages worth RM500 million to RM600 million, and the KL118 Tower project worth RM3 billion (joint venture with Arabtec Construction LLC).

We upgrade our net profit forecasts by 2% to 12% for FY15 to FY17 to reflect the two new contracts secured, and assume it will clinch another RM1.8 billion of new contracts in FY15E to FY16E (estimates).

We did not assume any new contracts previously due to uncertainties in the timing of contract awards. We believe WCT is likely to win the TRX, Rapid and WCE projects, given its strong track record in earthworks and road construction works.

However, we cut our fully-diluted earnings-per-share forecasts by 4% to 6% in FY15 to FY16 to factor in the dilutive impact of the recently issued WCT warrants E 2015/2020.

However, we cut our fully-diluted earnings-per-share forecasts by 4% to 6% in FY15 to FY16 to factor in the dilutive impact of the recently issued WCT warrants E 2015/2020.

We highlight WCT as a top construction mid-cap “buy” as prospects to grow its construction order book have improved with several large-scale building and infrastructure projects taking off over the next 12 months.

A key risk would be lower-than-expected property sales. We lift our RNAV/share to RM2.30 from RM2.04 assuming a higher construction division valuation and rolling forward our discounted cash flow base year to FY16E.

Based on the same 20% discount to RNAV, we raise our 12-month TP to RM1.84 from RM1.64. — Affin Hwang Capital, Oct 12

This article first appeared in The Edge Financial Daily, on Oct 13, 2015.

TOP PICKS BY EDGEPROP

South Brooks @ Desa ParkCity

Desa ParkCity, Kuala Lumpur

Paloma @ Tropicana Metropark

Subang Jaya, Selangor

Indah Damansara

Damansara Heights, Kuala Lumpur

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor