UEM Sunrise Bhd May 30 (RM1)

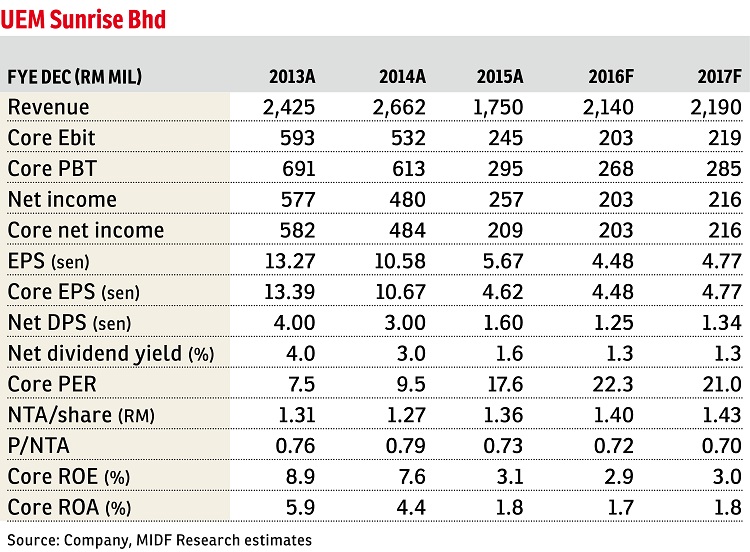

Maintain neutral with a lower target price of RM1.05: UEM Sunrise Bhd’s (UEMS) first quarter of the financial year ended 2016 (1QFY16) core net income (CNI) of RM2.3 million missed our and consensus expectations at 1% of full-year forecast. We gather that project billings are lower due to slower-than-expected work progress for Arcoris and Aurora Melbourne Central. Profit before tax margin has also been affected as interest costs increased by 68% year-on-year to RM21.3 million due to higher debts. As expected, no dividend was announced in1QFY16.

Sales of RM229 million are also lower than expected as they make up only 15% of the management’s annual sales target of RM1.5 billion. The biggest sales contributor in 1QFY16 was Conservatory in Melbourne (76% contribution) followed by Central Region projects (15% contribution). These include Residensi Sefina, Mont’Kiara and Serene Heights, Bangi. We are reducing our sales target by RM200 million to RM1.3 billion as we foresee a challenging market outlook affecting the take-up rate for UEMS projects in Johor.

Separately, UEMS has entered into a joint land development agreement with Telekom Malaysia Bhd (TM) to develop a 1.69 acre (0.68ha) land parcel owned by TM in Jalan Raja Chulan, Kuala Lumpur. The plan is to build a high-rise mixed development comprising serviced apartments and retail elements.

UEMS will pay TM a guaranteed land cost of RM150 million and 5% of project gross development value, which is yet to be determined. We are “neutral” on the news as the earnings’ impact should kick in only from FY18 onwards as UEMS still needs between one and two years to get the necessary approvals before launching the projects.

Its FY16 and FY17 earnings’ estimates are reduced by 52% and 54% respectively to RM203 million and RM216 million. This is reflective of lower earnings before interest and tax margin and sales target assumption. Unbilled sales of RM4.7 billion provide visibility of 2.9 years. — MIDF Research, May 30

This article first appeared in The Edge Financial Daily, on May 31, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

Taman College Heights (Sikamat)

Seremban, Negeri Sembilan

TAMAN DATO ABDUL SAMAD

Port Dickson, Negeri Sembilan

Vision Homes @ Seremban 2

Seremban, Negeri Sembilan