Sunway Bhd May 30 (RM3.01)

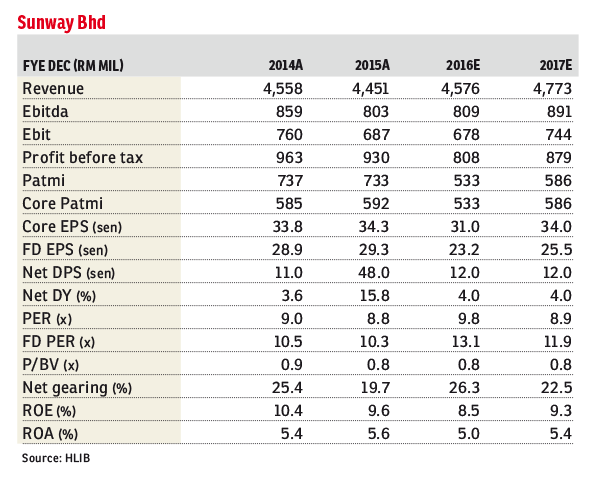

Maintain buy with a slightly lower target price (TP) of RM3.72: Sunway Bhd’s first quarter of financial year 2016 (1QFY16) core earnings were slightly below expectations, falling 20% year-on-year (y-o-y) to RM105 million, making up 17% of our and the consensus full-year forecasts.

1Q is a seasonally weaker quarter, comprising 19% to 22% of its historical full-year earnings.

1QFY16 core profit fell 20% y-o-y to RM105 million, mainly due to weaker contributions from all segments. Revenue dropped by 44% quarter-on-quarter, due to lower progress billings from ongoing local projects and a higher base in 4QFY15, which was boosted by higher recognition from a few projects.

Effective property sales in 1QFY16 were RM198 million (versus RM348 million in 4QFY15), accounting for 18% of the full-year sales target of RM1.1 billion (+21% y-o-y). We expect stronger sales ahead, on the back of RM1.6 billion worth of new project launches.

Major launches in FY16 include Sunway Gandaria (gross development value: RM200 million), Sunway Geo Residences 3 (RM400 million), Casa Kiara 3 (RM200 million), Velocity (RM200 million), Sunway Iskandar (RM400 million) and others.

Its order book currently stands at a record high of RM5 billion, translating into a healthy cover ratio of 2.6 times FY15 revenue. Given its strong track record, Sunway Construction Group Bhd (SunCon) has a strong chance to secure some packages of jobs, such as the Light Rail Transit 3 (RM9 billion), Pan Borneo Highway (RM16 billion), Damansara–Shah Alam Elevated Expressway (RM4 billion) and Sungai Besi-Ulu Kelang Elevated Expressway (RM4 billion). Management is targeting to secure RM2.5 billion worth of new contracts in FY16.

We see potential risks to Sunway in: i) execution risks; ii) regulatory and political risks (both domestic and overseas); iii) rising raw material prices; and iv) an unexpected downturn in the construction and property cycle.

Our FY16 and FY17 earnings estimates are reduced by 10% and 6.5% respectively after incorporating slower progress recognition from property development and lower contribution from construction. Following our downgrading of SunCon’s TP from RM1.94 to RM1.84 post-earnings results, our TP for Sunway is reduced slightly by three sen per share to RM3.72.

We maintain “buy”, with our TP adjusted slightly from RM3.75 to RM3.72. — Hong Leong Investment Bank Research, May 30

This article first appeared in The Edge Financial Daily, on May 31, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Alam Sanjung Serviced Apartment

Shah Alam, Selangor

Suria Residence by Sunsuria

Bukit Jelutong, Selangor

Suria Residence by Sunsuria

Bukit Jelutong, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor