• Today, we look at price growth and indicative asking rental yields for non-landed homes in USJ. From analysis of transactions by TheEdgeProperty.com, the average transacted price for non-landed homes in the secondary market was RM456 psf in 1Q2015, up a remarkable 32.6% y-o-y.

• The local average price has been buoyed primarily by transactions at newer and more upmarket projects, most notably at Main Place Residences and Riverdale @ USJ One Park.

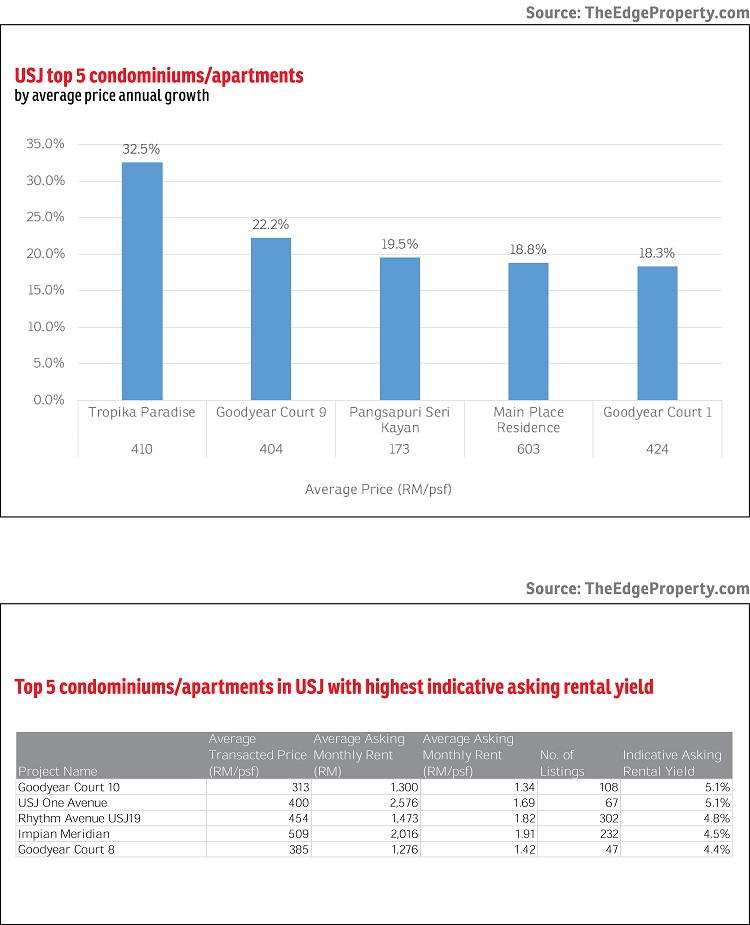

• The highest relative price growth can be found at Tropika Paradise, with the average price up 32.5% or from RM101psf to reach RM 410 psf in the 12 months to 1Q2015. Prices here are likely to have benefitted from new developments. Located in USJ 17, this condominium is a stone’s throw from the newly opened Main Place Mall and One City Mall.

• Goodyear Court 9 in USJ14 also appears to have performed well, with the average price up 22.2% to reach RM404 psf. While the price levels are comparable to those at Tropika Paradise, units here are smaller, hence more affordable.

• The indicative annual rental yield, as calculated from asking rents, are fairly decent, ranging from 3.5% to 5.1%. Rental rates generally range from RM1.30 psf to RM1.50 psf at the Subang Perdana Goodyear Court properties.

• The rental market will be further boosted by the Kelana Jaya LRT extension due at the end of June. The extension includes four new stations at USJ 7, Taipan, Wawasan and USJ 21. These stations have been well-positioned within walking distance to numerous existing properties.

Check out the price trends at Goodyear Court 9 here.

The Analytics are based on the data available at the date of publication and may be subject to revision as and when more data becomes available.

TOP PICKS BY EDGEPROP

Idaman Residence

Iskandar Puteri (Nusajaya), Johor

Bougainvilla, Bukit Prima Pelangi

Bukit Prima Pelangi, Kuala Lumpur

Sungai Kapar Indah Industrial Zone

Kapar, Selangor

Taman Perindustrian USJ 1

Subang Jaya, Selangor