The cautious market seen in Kota Kinabalu, Sabah, in the second quarter of this year is expected to continue in the third quarter with limited price growth in the secondary market, especially for high-end condominiums in the city centre.

Rahim & Co Sabah branch manager Max Sylver Sintia, in presenting The Edge/Rahim & Co Kota Kinabalu Housing Property Monitor for 2Q2015, says the cautious market sentiment can be attributed to the rising cost of living, depreciating ringgit and political situation in Malaysia.

“Although there is strong demand for residential properties for investment and owner-occupation in the secondary market, it is difficult for property purchases to materialise due to the lack of bank financing and tight lending guidelines,” he says, adding that strong housing demand is mainly seen for residential properties priced below RM500,000.

During the period under review, properties covered by the monitor saw both quarter-on-quarter and year-on-year price growths. There were also fewer launches, especially for landed residential developments.

Properties on the outskirts gaining traction

With the rising cost of land as well as its scarcity in the city centre, most new developments are located on the outskirts. Thus, those who want to own a house near the central areas have to look in the secondary market, where prices are expected to continue rising due to the increased demand.

Ongoing developments on the fringes of the city centre include Hasrat Realiti Sdn Bhd’s Sri Khazanah Residence in Lok Kawi. The project will offer 276 two-storey terraced houses with land areas of 1,424 to 3,869 sq ft. Priced from RM556,800 for intermediate units to RM693,800 for corner units, the development has yet to be officially launched and is expected to be completed by 4Q2016 or 1Q2017.

Coming up in Kinarut is Taman Sutera Jaya, by Besta Wijaya Sdn Bhd and the Sabah Housing and Town Development Authority. The project was launched in the first half of this year and currently has a take-up rate of 27%. The low-density development will offer 55 two-storey terraced houses with land areas of 1,423 to 4,079 sq ft, and prices starting from RM471,888.

Another development in the outlying areas and within the vicinity of Tuaran is Timbok Jaya Apartment by Kinsanova Sdn Bhd. Offering 400 units with built-ups of 880 sq ft each, the development is expected to be launched in 3Q2015 and will be priced from RM220,400 onwards. The apartment will have facilities such as a sepak takraw court, volleyball court, badminton court, futsal court and gymnasium.

Sintia says these developments indicate that there is still demand for houses located on the outskirts of the Kota Kinabalu city centre.

Strong secondary market to sustain

As there is limited supply of new landed properties in the city centre and its immediate vicinity, the secondary market for 2-storey terraced houses is expected to continue seeing a strong price performance, especially those located in mature and established residential areas in the Kota Kinabalu city centre. Sintia expects these homes to continue to be most sought after.

Demand for older houses remain strong in hot spots such as Kepayan, Luyang, Jalan Bundusan and Jalan Lintas as these are established residential areas with good infrastructure. They are also located near established commercial areas and public amenities such as mosques, churches and schools.

Nevertheless, Sintia believes that in terms of the price growth of landed properties, the areas to watch are Lok Kawi, Kinarut, Putatan and along Jalan Tuaran, which are located outside the city centre and in the southern or northern parts of Kota Kinabalu.

Two-storey houses in the primary market of Lok Kawi, for example, are currently valued at RM350,000 to more than RM500,000 while new launches of similar house types in the area are priced at around RM550,000. This indicates that older houses in these locations are set to enjoy the spillover effect from higher prices in the primary market.

Sintia remains confident that prices of older properties on the fringes of the city centre, which have yet to reach their peak, will continue to grow. However, despite the gradual increase in house prices, the gap between the prices in the secondary and primary markets still remains wide.

Landed residences

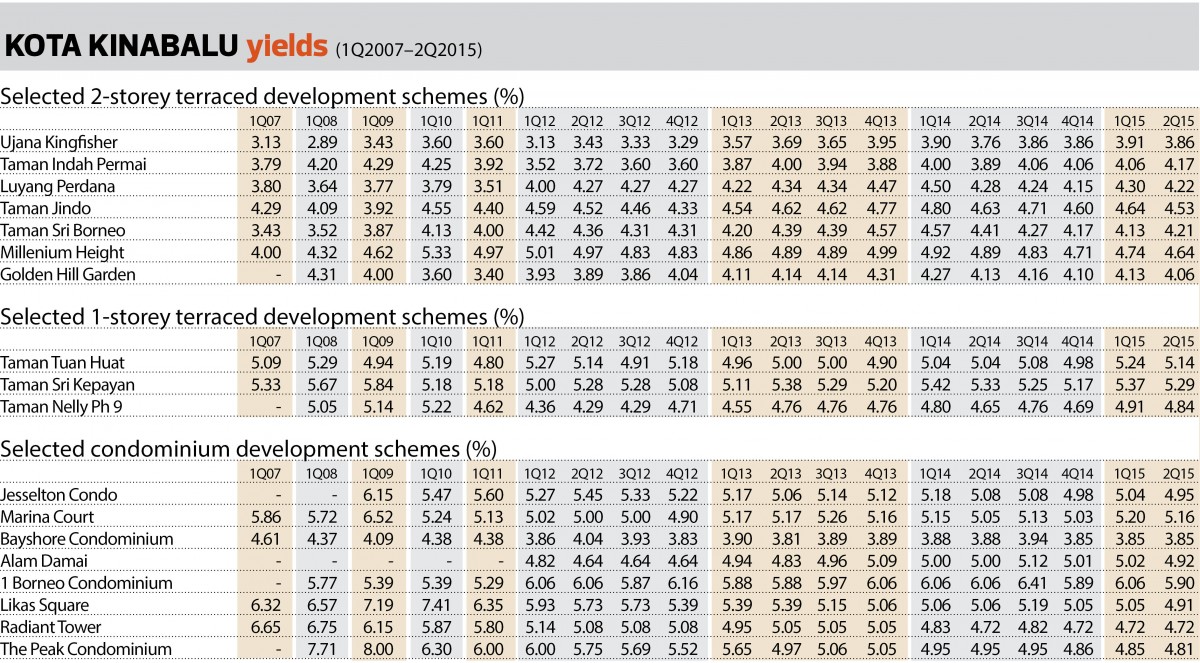

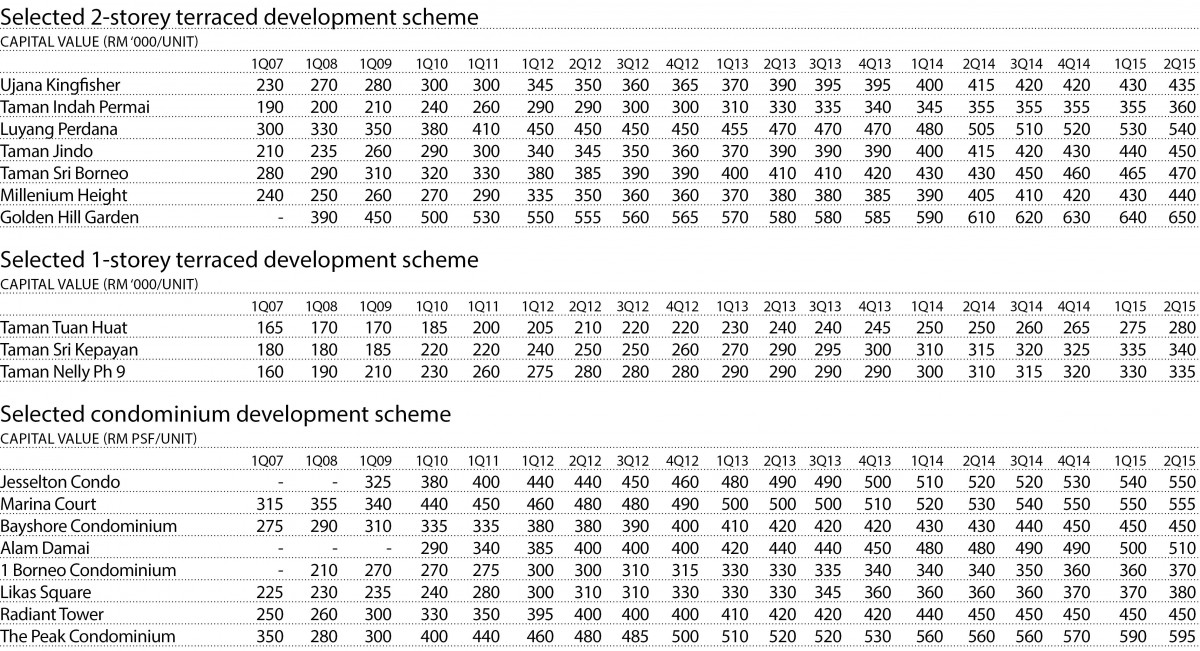

One-storey terraced houses saw an average price growth of RM26,600 or 9.33% y-o-y in 2Q2015, compared with 6.56% in 2Q2014.

The highest y-o-y growth was seen at Taman Tuan Huat, which saw a 12% y-o-y increase to RM300,000. This was followed by Taman Nelly Ph 9 (+8.06% from RM310,000) and Taman Sri Kepayan (+7.94% from RM315,000).

On a q-o-q basis, 1-storey terraced houses saw an average price growth of 1.61% or about RM5,000.

There are no recent launches of 1-storey terraced houses in the Kota Kinabalu city centre as developers are more focused on 2-storey terraced houses and high-rise residences.

However, older 1-storey terraced houses are popular with potential buyers, mostly due to the demand for landed residences as opposed to stratified properties.

“Buyers who prefer landed properties will always favour 2-storey terraced houses over 1-storey houses. However, because of the higher price of 2-storey residences, buyers do not mind buying 1-storey homes. This is one advantage of older 1-storey houses,” says Sintia.

A renovated 1-storey terraced house with a land area of 3,200 sq ft in a mature residential area such as Taman Luyang can fetch RM740,000 in the secondary market.

Meanwhile, 2-storey terraced houses saw an average price growth of 6.58% or about RM30,000 y-o-y in 2Q2015 — lower compared with the previous quarter’s growth of 8.24%.

The highest price growth for 2-storey houses was seen in Taman Seri Borneo — they were up 9.3% from RM430,000 in 2Q2014 to RM470,000 in 2Q2015.

This was followed by Taman Millenium Height (+8.64%), Luyang Perdana (+8.43%), Taman Jindo (+6.93%), Golden Hill Garden (+6.56%), Ujana Kingfisher (+4.82%) and Taman Indah Permai (+1.42%).

Quarter-on-quarter price growth for 2-storey terraced houses was at 1.67% or about RM7,800, at the same rate as the previous quarter.

Taman Millenium Height recorded the highest q-o-q price growth, up 2.33%. This was followed by Taman Jindo (+2.27%), Luyang Perdana (+1.89%), Golden Hill Garden (+1.56%), Taman Indah Permai (+1.41%), Ujana Kingfisher (+1.16%) and Taman Seri Borneo (+1.08%).

Sintia expects 2-storey terraced houses in Taman Seri Borneo and its vicinity, such as Taman Iramanis and Taman Bunga Raja, to continue to be in demand due to their strategic location in Jalan Lintas, which is near the city centre, public facilities and an upcoming flyover in Jalan Lintas/Jalan Bukit Padang that is expected to help ease the traffic congestion.

Serving almost as a ring road, Jalan Lintas is one of the major roads in Kota Kinabalu. It circles the city and connects the districts and suburbs surrounding the city, such as Putatan, Penampang, Luyang, Likas, Inanam, Menggatal, Sepanggar and Tuaran.

High-rise residences

Condominiums in Kota Kinabalu saw an average price growth of 5.25% to RM483 psf in 2Q2015 from RM459 psf in 2Q2014 — a lower y-o-y growth of 1.07% compared with 6.32% in 2Q2014, but a higher q-o-q growth compared with last quarter’s 4.59%.

1Borneo Condominium saw the highest price growth during the period under review — an average increase of 8.8% y-o-y to RM360 psf.

With the exception of Radiant Tower, which recorded no growth y-o-y, Alam Damai and The Peak Condominium (both +6.3%), Jesselton Condominium (+5.8%), Likas Square (+5.6%), and Marina Court and Bayshore Condominium (both +4.7%) saw price increases.

On a q-o-q basis, 1Borneo Condominium saw the highest price growth of 2.8%, followed by Likas Square (+2.7%), Alam Damai (+2%), Jesselton Condominium (+1.9%), Marina Court (+0.9%) and The Peak Condominium (+0.8%). Meanwhile, Radiant Tower and Bayshore Condominium did not see any growth q-o-q.

Rental performance

For 1-storey terraced houses, rental rates grew an average of 11.31% y-o-y, with Taman Tuan Huat registering the highest growth of 14.29% or RM150, from RM1,050 per month in 1Q2014.

Rents for 2-storey terraced houses grew an average of 5.59% y-o-y. Taman Indah Permai saw the highest growth at 8.7% or RM100, from RM1,150 per month in 2Q2014, followed by Ujana Kingfisher (+7.69%).

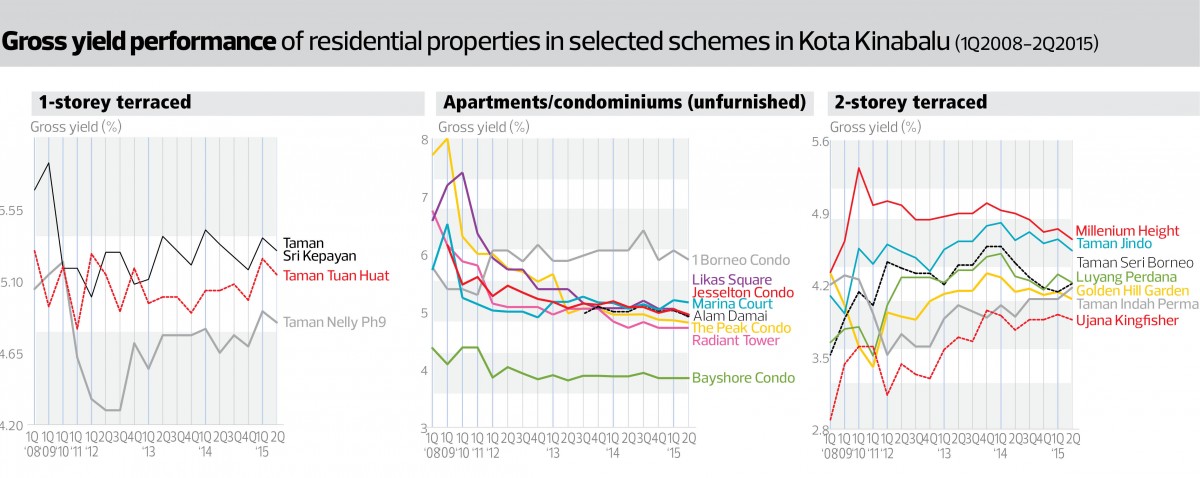

The average gross yield for 1-storey terraced houses was 5.09% (+0.085% from 2Q2014), while for 2-storey terraced houses, it was 4.24% (-0.04% from 2Q2014).

Condos saw an average rental growth rate of 3.77% y-o-y, while the average gross yield stood at 4.9% (-0.07% from 2Q2014). Those in Alam Damai grew 5.9% on average, followed by Marina Court at 5.16%, while the other condos sampled registered yields of below 5%.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Oct 12, 2015. Subscribe to The Edge Malaysia here.

Check out the value of your property with The Edge Reference Price.

TOP PICKS BY EDGEPROP

D'Camellia Apartment @ Setia EcoHill

Semenyih, Selangor

Long Branch Residences

Kota Kemuning, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)