Only World Group Holdings Bhd (Dec 18, RM2.68)

Maintain add with an unchanged target price of RM4.93: We visited Komtar recently for a progress update on the state of launch-readiness. Our earlier expectation was for a launch in two phases — December 2015 and February 2016.

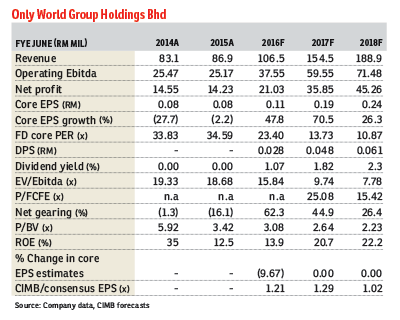

It appears that this has now been changed to a single grand launch on April 1, 2016, so that the project becomes a single coherent destination where all attractions and destinations are ready. As a result, we lower our financial year ending June 30, 2016 (FY16) earnings per share (EPS) by 10% to account for the delay.

Only World Group Holdings Bhd (OWG) project director Kenny Yap took us on a tour of the site. Although Komtar will be launched on a single date, the various components are still targeted to be completed in two phases. In phase one (end-January 2016), the themed attractions I Love Penang gallery, Doraemon, Haunted House, 5D Sea Explorer and Playoke will be completed.

In phase 2 (mid-February 2016), Jurassic Park, Zodiac Park, Mirror Maze, Milliondollar Carousel and 7D Planetarium Dome will be ready.

Our current assumption of a blended ticket rate of RM15 (at one million visitors per annum) for the observation deck is conservative. Based on the comparative pricing for tickets in the Kuala Lumpur Tower and Petronas Twin Towers, Komtar could potentially earn a blended ticket rate of RM40. This would lift our FY16 to FY18 EPS forecasts by 11% to 46%, and could raise our share price valuation to RM6.95.

We have not imputed any revenue and profit contributions from the themed attractions at Komtar in our forecasts as ticket prices have not yet been finalised.  Based on OWG’s historical ticket prices in Genting Highlands, an average RM30 per ticket is not unreasonable. At a pre-tax margin of 30%, the themed attractions division could lift FY16 to FY18F (forecast) EPS by 10% to 25%, and could raise our share price valuation to RM6.03.

Based on OWG’s historical ticket prices in Genting Highlands, an average RM30 per ticket is not unreasonable. At a pre-tax margin of 30%, the themed attractions division could lift FY16 to FY18F (forecast) EPS by 10% to 25%, and could raise our share price valuation to RM6.03.

If we include the upside potential both from higher ticket prices and the themed attractions, our FY16 to FY18F EPS could rise by 16% to 71%, which could lift our share price valuation to RM8. As with all construction projects, the biggest risk to our earnings projections is further delays in the launch of Komtar. — CIMB Research, Dec 17

Interested in investing in properties in Penang after reading this article? Click here.

This article first appeared in The Edge Financial Daily, on Dec 21, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Mutiara Bukit Jalil

Bukit Jalil, Kuala Lumpur

Bandar Kinrara 9

Bandar Kinrara Puchong, Selangor

Midori Green @ Austin Heights

Johor Bahru, Johor