Kimlun Corp Bhd (Oct 5, RM1.30)

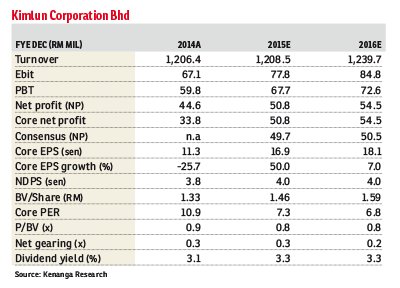

Maintain outperform with unchanged target price of RM1.63: Kimlun Corp Bhd (Kimlun) is the only contractor under our coverage with its first half 2015 (1H15) results coming in better than expected due to execution of higher margin construction projects, as most of the lower margin projects were completed in first quarter 2015 (1Q15) and better manufacturing margin from tunnel lining segment and jacking pipe sales order.

Year-to-date (YTD), the group’s estimated outstanding order books for construction and manufacturing are RM1.15 billion and RM0.22 billion respectively.

In terms of YTD new contracts, Kimlun has clinched RM554 million worth of new contracts, which is on track with our full-year new contracts assumption of RM700 million.

Management is still confident of achieving RM700 million of new contracts for financial year 2015 (FY15) and we believe the target is achievable, given that 80% of its target was achieved in 1H15.

However, management has a slightly conservative target of RM500 million to RM600 million new contracts for FY16, excluding public sector projects, namely Mass Rapid Transit Line 2 (MRT2) and the Refinery and Petrochemical Integrated Development project (Rapid) given that building construction jobs are slowing down.

This is in line with our FY16 new contracts assumption of RM550 million, whereby we expect contracts to be secured from public infrastructure and MRT Line 2 projects.

On top of that, Kimlun’s current tender book stands at RM1 billion mainly from affordable housing and infrastructure-related projects.

To date, Kimlun has secured RM108 million worth of manufacturing orders, which met our forecast of RM100 million and is fairly close to management’s FY15 higher target of RM120 million.

Looking forward to FY16, while we do not have management’s guidance on manufacturing numbers, we expect RM200 million new orders for the manufacturing segment, as we expect higher orders to come from public infrastructure and MRT2 projects, which are likely to be announced in 2016.

Moreover, management guided that its Senawang plant is currently running at 30% to 40% utilisation rate. Assuming the execution of Thomson Line coincides with the MRT2 project, it will boost the utilisation rate to 60% to 70%, which is still manageable for the group.

Management is expecting better margins this year as capital expenditure had been invested previously in the construction of high-rise building projects, better manufacturing margins from Singapore projects and engagement of more experienced subcontractors. — Kenanga Investment Bank Research, Oct 5.

This article first appeared in The Edge Financial Daily, on Oct 6, 2015.

TOP PICKS BY EDGEPROP

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Seksyen 6, Kota Damansara

Kota Damansara, Selangor

De Tropicana Condominium

Kuchai Lama, Kuala Lumpur

Taman LTAT Bukit Jalil

Bukit Jalil, Kuala Lumpur