ON April 1, URA released its flash estimate of the private residential price index for 1Q2016. While the overall price index fell 0.7% q-o-q, prices of non-landed homes in the high-end segment, or Core Central Region (CCR), bucked the trend, notching up 0.4%.

Market watchers attributed the uptick to the strong sales at Cairnhill Nine. There have been 182 caveats lodged since the project was launched on March 12. Of these, 85% were for one- and two-bedroom units, which could have boosted the price index.

Excluding new sales, however, high-end resale prices could have bottomed and stabilised. But it is still too early to tell whether prices will rebound, given the weak macroeconomic indicators. There could also be transactions at exceptionally low prices that float up now and then, although they are a minority.

Owing to the dearth of transactions in the high-end segment, there is no sure-fire method to establish the price change over two periods.

According to Savills, prices of high-end non-landed homes in its basket of properties rose 1.3% q-o-q in 4Q2015, the first increase seen in 11 quarters. However, its preliminary estimates for 1Q2016 show prices returning to flattish growth of -0.2% q-o-q.

Knight Frank’s quarterly report shows the average resale prices for high-end homes rose 3.8% q-o-q in 4Q2015, marking a second consecutive quarter of increase. Its 1Q2016 data will be released in the coming weeks.

Meanwhile, DTZ says prices are still trending down, albeit modestly. According to the firm, resale prices of high-end non-landed homes were down 1% q-o-q in 1Q2016. This represents a decline of only about S$20 (RM57.5), which is mild, says Lee Nai Jia, its Southeast Asia head of research.

NUS’ Singapore Residential Price Index for resale prices of non-landed homes in the Central Region was also up 0.5% m-o-m in February. This follows 0.6% m-o-m declines in December and January.

Prices increased in 12 of the 22 properties. In Goodwood Residence, for example, a 1,970 sq ft unit on the 10th floor was transacted at S$2,538 psf in October 2015. Meanwhile, a unit directly below it of the same size and facing the same direction, was sold for S$2,570 psf in January, which indicates a 2% price gain between 4Q2015 and 1Q2016 after adjusting for floor level.

However, prices declined for 10 of the 22 properties. At Vida, for example, an 861 sq ft unit on the 10th floor fetched S$1,904 psf in November and a unit located five floors above it of a similar size and facing was sold for S$1,893 psf in February. After adjusting for floor level, the two transactions indicate a 3% price decline between 4Q2015 and 1Q2016.

While the price change varied among the 22 properties, there appears to be sellers’ resistance against more discounts and, at the same time, buyers are more willing to bite.

DTZ’s Lee says most of the price declines in the firm’s basket of properties were confined to less desirable units. On the other hand, prices for premium units, such as those with superior views, are holding firm.

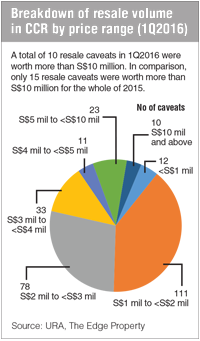

The pickup in resale volume preceded the stabilising prices. Based on URA statistics, there were 278 resale caveats for private non-landed homes in CCR in 1Q2016, up slightly from 235 in the same period last year. Singaporean purchasers accounted for nearly three-quarters of these transactions.

Homes in CCR have led the rebound in resale volume. Last year, the number of resale caveats in CCR rose 36% over 2014. In comparison, they increased 26% in Rest of Central Region and 21% in Outside Central Region. Forty per cent of the CCR resale caveats in 1Q2016 were for properties in the S$1 million-to-S$2 million price range.

This article first appeared in The Edge Financial Daily, on April 20, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Kawasan Perindustrian MIEL

Batang Kali, Selangor

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)