KUALA LUMPUR (June 6): Eastern & Oriental Bhd (E&O) shares rose as much as 3.8% today to a high of RM1.65 in the early trades today on news that its group managing director (MD) Datuk Seri Terry Tham Ka Hon ups stake in the lifestyle property developer.

At 10.15am, the stock was traded at RM1.64, still up five sen or 3.14% after 769,200 shares were traded, making it one of the top gainers across the local exchange.

It had earlier risen to a high of RM1.65 shortly after opening bell.

Last Friday, E&O announced Tham has become the single largest shareholder in the group with the acquisition of additional 10% stake from Sime Darby Bhd for RM327.54 million.

E&O said Tham, via his private investment vehicle Paramount Spring Sdn Bhd, has acquired an additional 125.98 million shares in E&O at RM2.60 per share or RM327.54 million from Sime Darby. This reduces the latter's stake to 12% from 22%.

Tham also now holds a 21% stake in E&O from 11% previously.

In a note to clients today, MIDF Research's analyst Jessica Low Jze Tieng viewed this as long-term positive to E&O as it reflects key management personnel's continued conviction and confidence in the group's long-term value.

Earlier, E&O also announced Tham will relinquish his post as group MD and will be appointed as executive deputy chairman this July.

"The increase in Tham's stake in E&O should strengthen investors' confidence in the long-term growth prospect for E&O especially with the all-important Phase 2 of Seri Tanjung Pinang (STP2) project underway.

"We believe Tham would ensure the smooth execution of STP2 project," she added.

Despite this, Low kept her earnings forecasts on E&O unchanged for financial year 2017 and 2018 (FY17 and FY18).

She has a "neutral" call with a target price of RM1.60 on E&O, as the stake acquisition does not impact its revalued net asset value valuation (RNAV) due to the unchanged number of E&O shares.

"We are keeping our steep discount of 65% to RNAV due to high net gearing of E&O," she said, adding potential catalyst could emanate from the securement of level 1 strategic investor for STP2 which would unlock the value of E&O and reduce its net gearing.

Do not ask your gardener about the value of your home. Go to The Edge Reference Price to find out.

TOP PICKS BY EDGEPROP

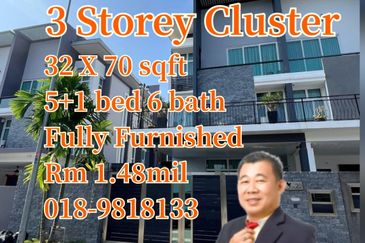

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Teega Residences, Puteri Harbour

Kota Iskandar, Johor

Taman Tasik Semenyih (Lake Residence)

Semenyih, Selangor