PROPERTY prices on Kota Kinabalu’s secondary market have been rising over the last five years, albeit at a marginal rate, observes Rahim & Co branch manager Max Sylver Sintia when presenting The Edge/Rahim & Co Kota Kinabalu Housing Property Monitor 3Q2016.

“Secondary market properties priced at RM500,000 and below will continue to be in highest demand among buyers,” he says. However, to find properties at such prices, buyers may need to compromise on the location and type of property, he adds.

As there is a limited number of new residential properties in the city centre due to the scarcity of land, Sintia expects an increase in secondary market transactions, particularly of condominiums and 2-storey terraced houses near the city centre and within the price bracket of RM600,000 to RM900,000.

Overall, Sintia remarks, the residential property market in Kota Kinabalu remained challenging in 3Q2016, recording moderate activity.

Referring to the National Property Information Centre data for residential transactions in Kota Kinabalu, which indicated a 52.07% decline in volume to 231 transactions in 1Q2016 from 482 in 1Q2015, and a 49.02% drop in value to RM115.01 million in 1Q2016 year on year, Sintia opines that house prices in Sabah are not likely to drop as they are sustained by strong demand.

He explains that the slowdown in the residential property market in Kota Kinabalu has been mostly due to stringent lending conditions, making it harder for homebuyers to obtain financing for their purchases. Nevertheless, Sintia believes demand is still strong, especially among the younger generation, for residential properties on the secondary market.

“The strict borrowing guidelines have dampened the chances of the younger generation acquiring their first home, especially in prime locations in Kota Kinabalu, due to the rising prices. Therefore, it is wise for them, especially those who have just started working or are starting a family, to explore the option of buying cheaper properties outside the city centre and wait for the prices to appreciate,” he advises.

Sintia says there are a lot of apartments priced below RM250,000 outside the city centre, in areas such as Telipok, Menggatal, Tuaran and Lok Kawi. “Three years ago, some of these units were priced below RM150,000, some even under RM100,000. The prices of these units will appreciate.”

Prices of 2-storey terraced houses stable

Double-storey terraced houses in Kota Kinabalu, especially those in mature and established areas near the city centre with public facilities and good infrastructure, have always been a popular choice.

There is limited new supply of 2-storey terraced houses in Kota Kinabalu due to the scarcity of land suitable for such developments. As a result, notes Sintia, secondary market properties — especially those located in mature catchment areas — will likely see further price growth.

“This is evident from the stronger price growth recorded by the properties sampled by the monitor,” he says.

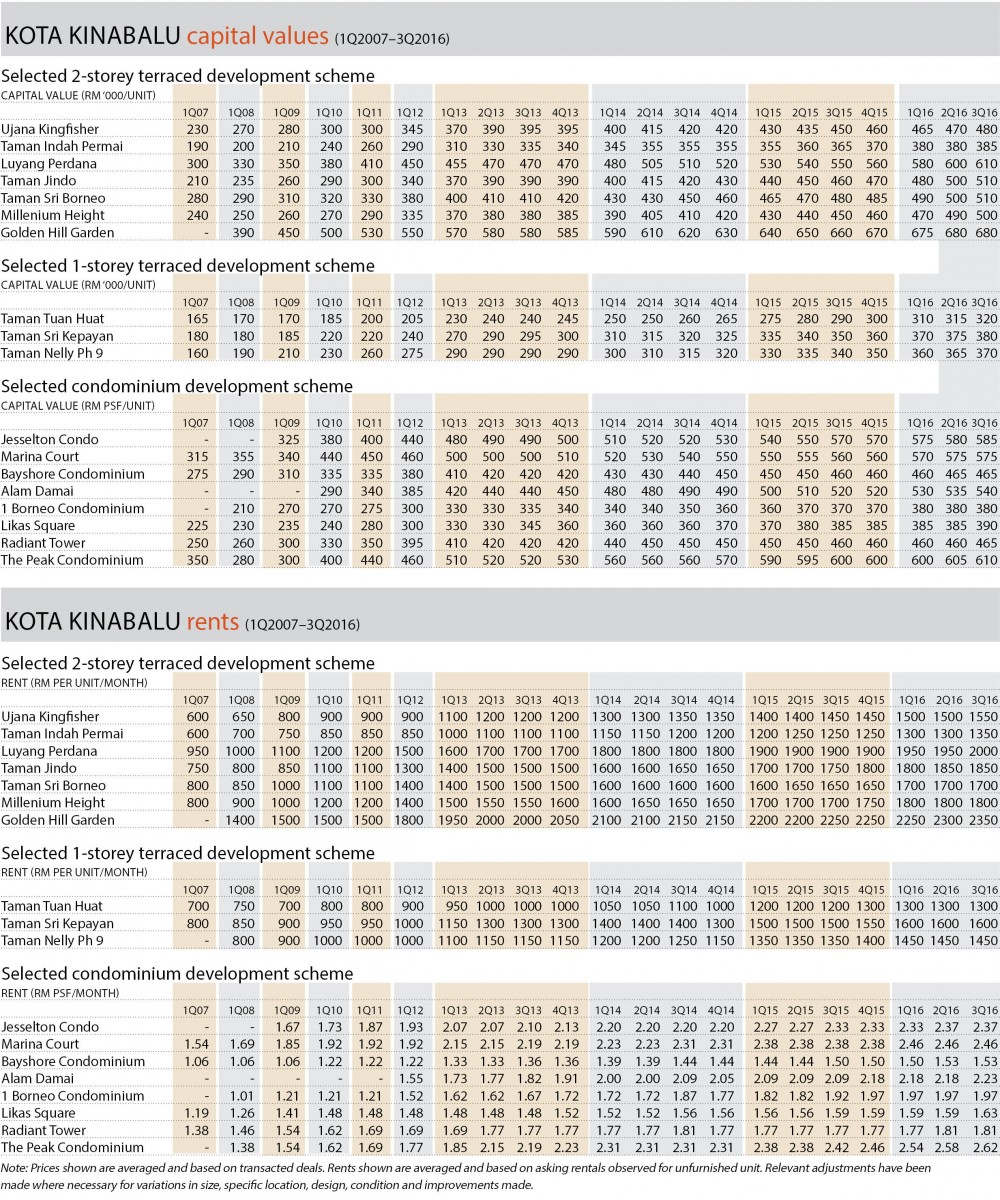

In 3Q2016, the 2-storey terraced houses sampled saw an average growth of 7.76% year on year or about RM40,000.

The highest year-on-year price growth for 2-storey terraced houses was seen at Millenium Height (+11.11% to RM500,000). This was followed by Luyang Perdana (+10.91% to RM610,000), Taman Jindo (+10.87% to RM510,000), Ujana Kingfisher (+6.67% to RM480,000), Taman Sri Borneo (+6.25% to RM510,000), Taman Indah Permai (+5.48% to RM385,000) and Golden Hill Garden (+3.03% to RM680,000).

On a quarter-on-quarter basis, the prices grew 1.89% or by RM7,857.

The best quarter-on-quarter growth was recorded by Ujana Kingfisher (+2.13%), followed by Millenium Height (+2.04%), Taman Jindo and Taman Sri Borneo (+2%), Luyang Perdana (+1.67%) and Taman Indah Permai (+1.32%). Prices in Golden Hill Garden remained unchanged quarter on quarter.

“We conclude that the price growth of 2-storey terraced houses remained stable, given the difference of less than 1% recorded both yearly and quarterly,” says Sintia.

A significant transaction on the secondary market during the quarter under review was that of a 2-storey terraced house in the mature catchment area of Taman Kobusak Perdana in the Kobusak vicinity. The 1,759 sq ft property was transacted at RM800,000.

Sintia also highlights the transactions of recently completed 2-storey terraced houses in Taman Ganang Phase 2 in the Kepayan area at RM891,199 to RM1,269,999. The units in this new development have modern designs and boast bigger land areas of 2,334 to 4,100 sq ft.

“Two-storey terraced houses in mature areas in Kota Kinabalu remain the most attractive residential product. People are willing to buy the limited units on the primary market even at high prices. Landed properties, especially 2-storey terraced houses, are a solid investment for the long run,” says Sintia.

Prime residential development Golden Hill Garden, which is strategically located in Jalan Pintas Penampang, has been registering slower growth in the past four quarters, notes Sintia. “However, it is normal for expensive high-end properties to see slower price growth than more affordable properties,” he says.

1-storey terraced houses much sought after

Prices of 1-storey terraced houses sampled by the monitor grew an average 9.25% year on year or about RM30,000 in 3Q2016.

The best year-on-year price growth was recorded by Taman Tuan Huat (+10.34% to RM320,000), followed by Taman Nelly Ph 9 (+8.82% to RM370,000) and Taman Sri Kepayan (+8.57% to RM380,000).

On a quarter-on-quarter basis, the price growth of 1-storey terraced houses averaged 1.43% or about RM5,000.

The highest quarter-on-quarter growth was seen in Taman Tuan Huat (+1.59%), followed by Taman Nelly Ph 9 (+1.37%) and Taman Sri Kepayan (+1.33%).

The prices of 1-storey terraced house remained stable during the quarter under review, notes Sintia. “Strong price appreciation was recorded in the Kepayan Ridge area, mainly due to its location near the city centre and availability of public transport and ample amenities.

“Demand for 1-storey terraced houses is expected to remain strong, especially among genuine homebuyers, because they are more affordable than 2-storey terraced houses,” Sintia adds.

Secondary market condos see strong demand

The prices of condominiums in Kota Kinabalu rose to RM501 psf in 3Q2016, up 2.12% from 3Q2015.

The highest year-on-year growth for condominiums was seen at Alam Damai (+3.8% to RM540 psf), followed by Marina Court (+2.7% to RM575 psf), 1Borneo Condominium (+2.7% to RM380 psf), The Peak Condominium (+1.7% to RM610 psf), Likas Square (+1.3% to RM390 psf), Bayshore Condominium and Radiant Tower (+1.1% to RM465 psf).

Quarter-on-quarter, the average price growth for condominiums was 2.12%.

The prices of condominiums on the secondary market remained on an upward trend, albeit slower than in the previous quarters, which saw significant growth.

Sintia says condominium prices will remain stable, supported by strong demand for the property type, which caters for a modern lifestyle and offers facilities, security and accessibility in established communities.

“The demand for high-rises on the secondary market has also been attributed to the affordability of these residential properties based on their prices in quantum figures, particularly for the smaller units, which are relatively cheaper than landed properties,” he adds.

Rental rates

Rents for 2-storey terraced houses grew at an average 5.6% year on year. The highest year-on-year price growth was recorded in Taman Indah Permai (+8% to RM1,350 per month), followed by Ujana Kingfisher (+6.9% to RM1,550), Millenium Height (+5.88% to RM1,800), Taman Jindo (+5.71% to RM1,850), Luyang Perdana (+5.26% to RM2,000), Golden Hill Garden (+4.44% to RM2,350) and Taman Sri Borneo (+3.03% to RM1,700).

Rental growth for 1-storey terraced houses averaged 7.47% year on year with Taman Tuan Huat registering the highest growth (+8.33% to RM1,300 per month), followed by Taman Nelly Ph 9 (+7.41% to RM1,450) and Taman Sri Kepayan (+6.67% to RM1,600).

For condominiums, rents grew at an average 3.51% year on year. The best rental growth during the quarter was recorded by The Peak Condominium and Alam Damai at 7.94% to RM2.62 psf and 6.52% to RM2.23 psf respectively. The other condominiums sampled by the monitor recorded less than the average growth.

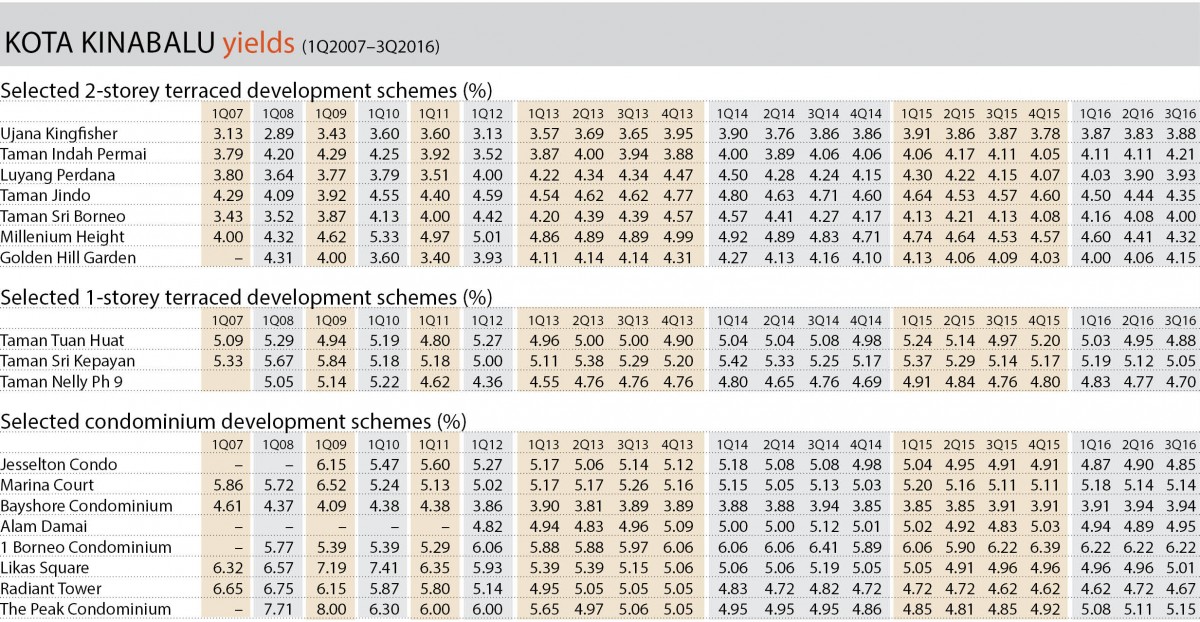

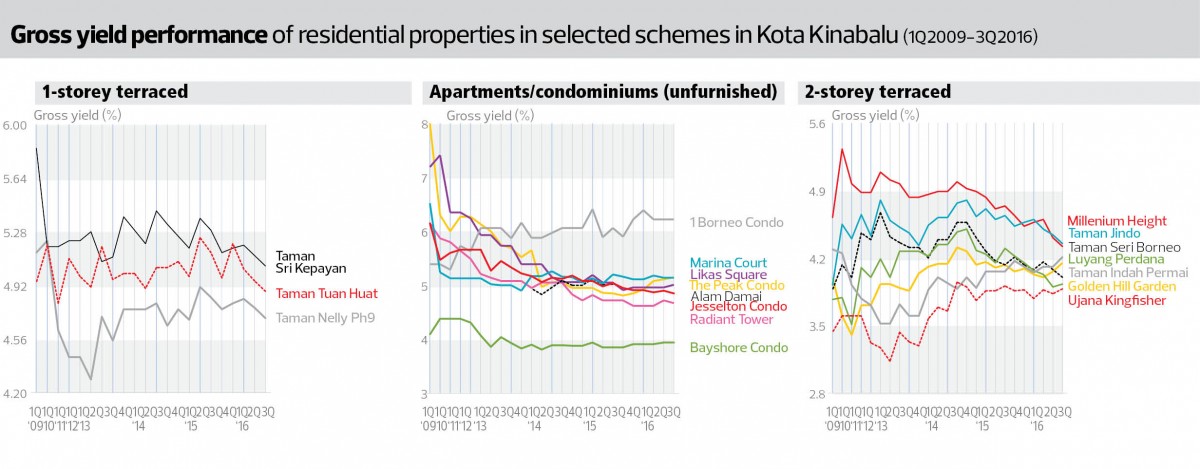

Meanwhile, average gross yields for 2-storey terraced houses and 1-storey terraced houses were 4.12% and 4.88% year on year respectively during the quarter under review.

For condominiums, the average gross yield during the quarter was 4.99%, up 0.06% from 3Q2015. The highest yield was registered by 1Borneo Condominium (+6.22%), followed by The Peak Condominium (+5.15%), Marina Court (+5.11%) and Likas Square (+5.01%). The rest of the condominiums sampled by the monitor registered gross yields of between 4.67% and 4.95%, save for Bayshore Condominium, which posted 3.94%.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Nov 28, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Peranakan Straits, Setia Eco Templer

Rawang, Selangor

Isle of Kamares, Setia Eco Glades

Cyberjaya, Selangor

Setia Marina 2, Setia Eco Glades

Cyberjaya, Selangor

Liu Li Garden, Setia Eco Glades

Cyberjaya, Selangor

Setia Marina 2, Setia Eco Glades

Cyberjaya, Selangor

Setia Marina 2, Setia Eco Glades

Cyberjaya, Selangor

Setia Marina 3, Setia Eco Glades

Cyberjaya, Selangor

Setia Marina 3, Setia Eco Glades

Cyberjaya, Selangor

Lepironia Gardens, Setia Eco Glades

Cyberjaya, Selangor

Charms of Nusantara, Setia Eco Glades

Cyberjaya, Selangor

Isle of Botanica, Setia Eco Glades

Cyberjaya, Selangor

Oxford Residences @ Pavilion Embassy

Keramat, Kuala Lumpur

Oxford Residences @ Pavilion Embassy

Keramat, Kuala Lumpur

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)