Land is a property developer’s most important asset as it enables the developer to sustain and grow its business. However, land is a limited resource.

“Land does not give birth to another land. This is the simplest reason that explains the constant rise in land prices especially those in prime areas such as Kuala Lumpur,” says CBD Properties (DU) Sdn Bhd senior real estate negotiator Davis Cheng.

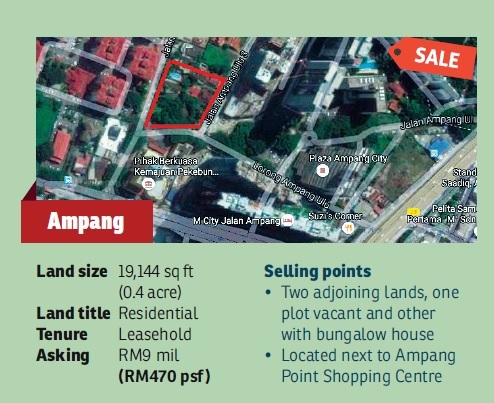

As a negotiator specialising in residential land deals in the Ampang area in Kuala Lumpur, Cheng says Kuala Lumpur’s land prices have generally been holding up despite the overall property market slowdown since two years ago.

“Prices of vacant residential land in Ampang Hilir, for example, are hovering around the level of RM1,000 psf. However, prices could vary depending on various factors such as the surrounding construction, plot size, location and other factors,” Cheng notes.

While prices are holding steady, transactions have slowed significantly since the beginning of this year.

“My team and I closed fewer land deals in 2015 and the situation has become worse this year. We closed even fewer land deals in 2016, and each deal took us a longer time to conclude, mostly because landowners are maintaining their prices while developers are not buying land as aggressively as last year,” Cheng explains.

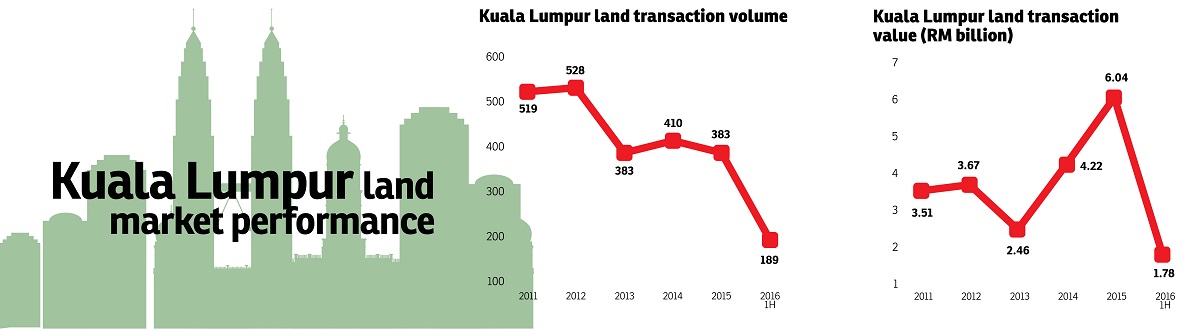

His observation of the Ampang Hilir land market is in line with the overall Kuala Lumpur land market segment performance.

His observation of the Ampang Hilir land market is in line with the overall Kuala Lumpur land market segment performance.

According to data collated by Knight Frank Malaysia, Kuala Lumpur recorded fewer land transactions but the total transacted value was higher in 2015 than 2014. In 2015, there were a total of 383 development land transactions valued at RM6.04 billion compared with 410 transactions with a corresponding value of RM4.22 billion in 2014.

“Despite recording a lower volume of transactions in 2015, the value of transactions was significantly higher by 43.11%,” says Knight Frank Malaysia managing director Sarkunan Subramaniam.

“With the current supply and demand mismatch in key property sectors such as the office, retail and serviced apartment or high-end condominium sectors in selected locations within Kuala Lumpur, coupled with restricted approvals to develop new hotels, luxury hotels and office developments, buyers are not buying for immediate developments hence the slowdown in transaction volume,” he says, adding that investors or developers are now buying for landbanking.

Meanwhile, the higher value of transactions is a reflection of the high land prices which have been holding up strong.

“Land is necessary for property development and so many landowners will hold on to their selling plan to maximise their investment,” he says.

However, Sarkunan adds that the land market looks challenging in the short term in line with the overall property market. Nevertheless, he believes there are many good buying opportunities out there.

However, Sarkunan adds that the land market looks challenging in the short term in line with the overall property market. Nevertheless, he believes there are many good buying opportunities out there.

“There are developers who are actively seeking to increase their landbank but on the other hand there are owners who are looking to sell (land) to pare down debts,” he says.

With the current challenging market environment, price growth will likely be capped in the short term, he offers.

“This is because construction cost continues to remain high while the projected gross development value may be lower due to the current mismatch in supply and demand. All these factors will likely weigh on the decision-making of investors and developers when exploring land purchases,” he says.

He adds that investors and developers would need to have “deep pockets” to be able to hold their land during a downturn for future developments when the market picks up.

He adds that investors and developers would need to have “deep pockets” to be able to hold their land during a downturn for future developments when the market picks up.

Limited room for price growth

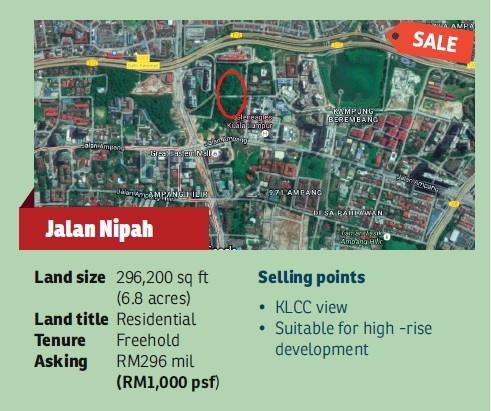

According to real estate agency One Sunterra Properties executive director Lydia Mun, prices of prime land in Kuala Lumpur city centre are within the range of RM2,000 to RM3,000 psf on average.

“Prices of land on the fringes of the city centre such as in the Kuchai area near Old Klang Road are around RM500 psf while in the Sungai Besi and Chan Sow Lin areas, they are in the range of RM400 to RM450 psf,” Mun shares.

Prices, she said, are still stable mainly attributed to the already high prices  recorded over the past few years.

recorded over the past few years.

“In addition, the current weak market sentiment for luxury high-end developments in the city centre has somewhat hindered developers from venturing into more of such developments for now, thus lowering the current demand for land in the city centre,” Mun notes.

She says developers and individual buyers are adopting a cautious approach and will be evaluating land proposals more stringently.

“They [developers] may opt to wait for vendors to agree with their offer prices instead of committing at vendors’ asking prices,” she shares.

She is also expecting the placid market to persist in 2017. “The current high land price is a restraint to price growth and we expect some price adjustments in the short to medium term.”

Meanwhile, CBD Properties’ Cheng reminds landowners to be aware that it is a buyers’ market now.

Meanwhile, CBD Properties’ Cheng reminds landowners to be aware that it is a buyers’ market now.

“Buyers have more choices and are not rushing to buy. I have seen many landowners refusing to lower their asking prices until they are pressured to do so. They will usually wait until the surrounding land are sold or when they start seeing their site being surrounded by construction work. By that time, the value of the land may be affected. Some land have odd sizes and this will also dampen the price of the plot of land,” he says.

Be it for individuals looking to buy small plots of residential land to build a bungalow or two, or for property developers eyeing larger plots, it is probably time to practise their bargaining skills.

This story first appeared in TheEdgeProperty.com pullout on Nov 11, 2016, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

RIMBUN KIARA @ SEREMBAN 2

Seremban, Negeri Sembilan

Oakland Commercial Centre

Seremban, Negeri Sembilan

Ridgewood Canary Garden @ Bandar Bestari

Klang, Selangor

Anjung Sari

Setia Alam/Alam Nusantara, Selangor

Pangsapuri Palma

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pusat Komersial Lobak

Seremban, Negeri Sembilan