SINGAPORE (Oct 27): DBS is maintaining its “hold” call on CapitaLand Retail China Trust (CRCT) with a target price of S$1.60, citing factors out of its control such as currency depreciation and higher property taxes.

In a Wednesday report, lead analyst Mervin Song remains positive on CRCT’s medium-term outlook, despite the recent depreciation of the RMB and higher property taxes in Beijing capping the REIT’s near-term performance.

“However, should there be any share price weakness, we recommend investors to increase exposure to CRCT, especially given rising acquisition opportunities in China,” says Song.

And with several properties still in a transition phase, the potential of its malls have not been maximised, highlights Song.

These includes Grand Canyon (acquired in 2014) which generates annualised net property income yield of 5.3% instead of an expected 7% to 8%, and recently acquired Galleria mall, whose margins are sub-optimal owing to the previous management by third-party operators.

Acquisitions also provided an uplift, as Song notes that CRCT’s gearing will stabilise around 37%, below the 45% Monetary Authority of Singapore limit. Price expectations from potential sellers are now lower, notes Song, with retail mall operators looking to exit the sector more acquisition opportunities arise for the REIT, which has debt headroom.

Units in CRCT traded down 2.5 cents at S$1.525. — theedgemarkets.com.sg

TOP PICKS BY EDGEPROP

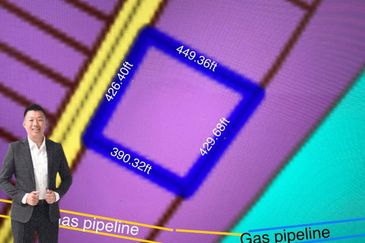

Telok Panglima Garang Industrial Zone

Telok Panglima Garang, Selangor

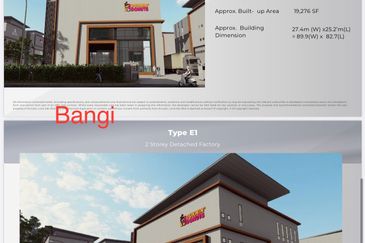

Kinrara Residence

Bandar Kinrara Puchong, Selangor

COMPASS @ Kota Seri Langat

Banting, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)