LBS Bina Group Bhd (Sept 13, RM1.72)

Maintain add with a higher target price of RM2: LBS Bina Group Bhd’s subsidiary Kemudi Ehsan Sdn Bhd (KESB) and Worldwide Property Management Sdn Bhd, an indirect subsidiary of Perbadanan Kemajuan Negeri Selangor, have entered into a development rights agreement with the Selangor state government (via Menteri Besar Selangor Inc, MBI) to develop 10 parcels of leasehold land in Ijok. Five of these parcels, measuring 470 acres (190.2ha), will be developed by KESB.

KESB will pay RM293 million to MBI for the land parcels over a development period of 12 years.

Based on a preliminary development plan, these land parcels have a gross development value (GDV) of RM1.83 billion, which lift LBS’ GDV by 8% to RM25 billion. If the actual GDV exceeds estimated GDV, KESB will make an additional payment of 5% of the differential sum to MBI.

LBS will finance the acquisition with internal funds and borrowings. Its current net gearing level of 27% could rise to 41% when this acquisition is completed.

We think there is a strong likelihood that KESB’s GDV will exceed RM1.83 billion as its GDV per acre is only about RM3.9 million. KESB’s land parcels are next to Eco World Development Group Bhd’s RM12.5 billion Eco Grandeur project which has a GDV per acre of RM7.4 million. As for the land cost, KESB’s purchase cost is RM14.3 per sq ft, higher than Eco World’s purchase cost of RM12.3 per sq ft. Still, we believe KESB’s cost is fair as the land parcels being purchased are categorised as for “building” purposes while Eco World’s is for agricultural purposes.

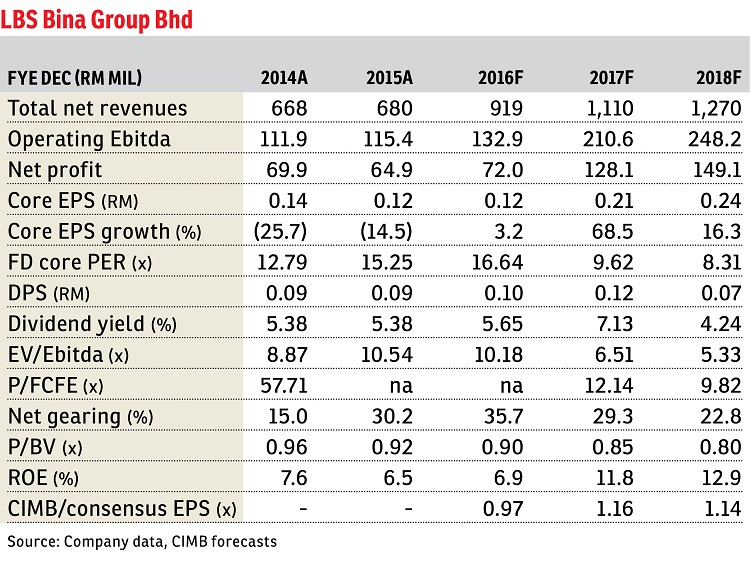

This is LBS’ second major land acquisition for 2016 following the acquisition of 638-acre bumiputra reserved land in Dengkil in August. These two projects will be developed into mass-market townships and could potentially contribute about RM500 million of sales per annum. We expect LBS to launch these townships by mid-2017, which could lift the group’s sales next year to more than RM1.2 billion, its target for 2016. We make no changes to our earnings forecasts pending more information about its development plans.

We continue to value LBS based on 40% discount to its revised net asset value (RNAV). This is wider than the 20% valuation discount we attach to other top-tier developers as LBS has a shorter track record in landbanking and achieving consistent sales growth compared with big developers. This acquisition could narrow the discount if its development is well executed. LBS remains an “add” with stronger sales as potential rerating catalyst. Deterioration of sentiment on the property market is the key downside risk to our call. — CIMB Research, Sept 13

This article first appeared in The Edge Financial Daily, on Sept 15, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Secoya Residences

Pantai Dalam/Kerinchi, Kuala Lumpur

CENTRAL PARK @SEREMBAN 2

Seremban, Negeri Sembilan

Bandar Baru Wangsa Maju

Wangsa Maju, Kuala Lumpur