![Ho: The master lease [at Ngee Ann City], together with the extension of the master tenancy agreements for the Malaysia properties, provides the REIT with income stability and growth. (Photo by The Edge) Ho Sing](http://dbv47yu57n5vf.cloudfront.net/s3fs-public/editorial/my/2016/September/01/HoSing.jpg) STARHILL Global Real Estate Investment Trust prides itself on owning landmark retail properties on the most prominent stretch of Orchard Road. Since the global financial crisis, however, the fortunes of luxury goods and upscale fashion brands that dominate the shopfronts in the area have waned. That is weighing on occupancy rates and rents. Nevertheless, SG REIT is managing to keep distribution per unit (DPU) firm enough to draw the interest of some analysts, because of advantageous master leases and active management of its portfolio.

STARHILL Global Real Estate Investment Trust prides itself on owning landmark retail properties on the most prominent stretch of Orchard Road. Since the global financial crisis, however, the fortunes of luxury goods and upscale fashion brands that dominate the shopfronts in the area have waned. That is weighing on occupancy rates and rents. Nevertheless, SG REIT is managing to keep distribution per unit (DPU) firm enough to draw the interest of some analysts, because of advantageous master leases and active management of its portfolio.

A slowing economy and growing tendency for shoppers to make their purchases online have been blamed for weak sales at brick-and-mortar stores over the last couple of years. Shops on Orchard Road appear to have been especially hard hit, a reflection of their dependence on big-ticket discretionary consumption, unlike suburban malls, which thrive on sales of daily necessities such as groceries.

According to JLL, in 1H2016, retail rents in the Core Central Region fell 6.1%, bringing the total correction since the peak in 4Q2014 to 10.4%. Vacancy rates in the Orchard Road area stood at 9.1% at end-2Q2016 versus 7.8% for the whole of Singapore, JLL says. In 2Q2016, retail sales, excluding motor vehicles, fell 3%. That’s despite tourist arrivals rising 11% in 2Q2016, with a 65% increase in arrivals from mainland China.

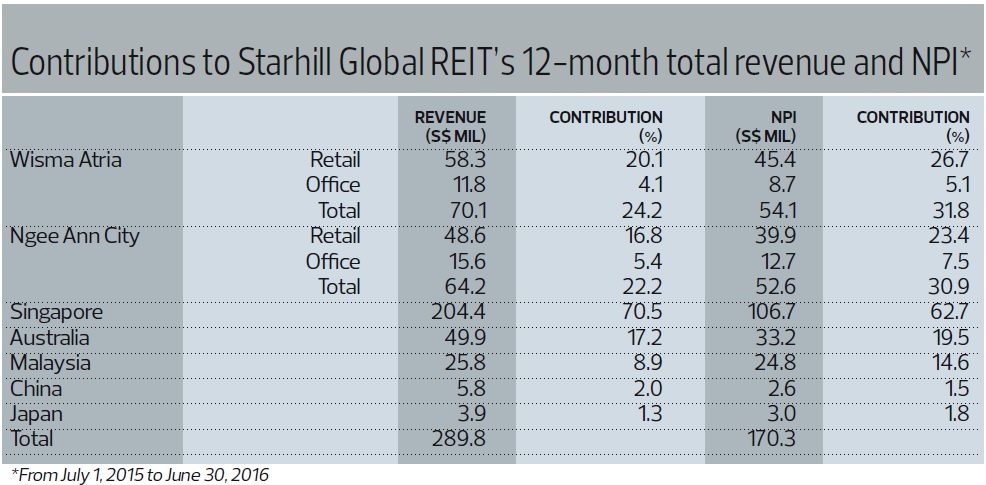

The pressure at Wisma Atria — in which SG REIT holds a 73% stake, and which accounts for 31.7% of its portfolio by value and contributes 31.8% to net property income — looks especially stark. For 4QFY2016 ended June 30, shopper traffic at Wisma Atria rose 2.3% y-o-y, but tenants’ sales declined 2.5% y-o-y. Occupancy during the quarter was 97.7%, down from 98.1% in 4QFY2015. According to SG REIT, this was due to tenant transitions and reconfigurations, and a tepid retail environment. NPI contribution from the retail space at Wisma Atria declined 3.8% y-o-y to s$10.9 million during the fourth quarter.

Weak demand for upscale fashion also hit SG REIT in China, where the government has been clamping down on ostentatious consumption. Its Renhe Spring Zhongbei Property in Chengdu posted a 55.8% decline y-o-y in NPI for 4QFY2016 to s$392,000. The Chengdu property has as its tenants names such as Armani Collezioni, Weekend MaxMara, Ermenegildo Zegna, Hugo Boss and Chow Tai Fook. “We are repositioning to stabilise income and evaluating future directions for the asset,” a spokesman says.

Master lease, new asset

None of this affected the overall performance of SG REIT, though. For 4QFY2016, it reported a 3.6% y-o-y rise in revenue to s$53.6 million and a marginal 0.3% improvement in NPI to s$41.4 million. DPU for the quarter was unchanged at 1.29 cents. That’s because most of its major assets in Singapore, Malaysia and Australia are under master leases with step-up rentals, and contributed almost half its gross rental income. These include Wisma Atria; Ngee Ann City, in which it has a 27% stake; Starhill Gallery and Lot 10 in Kuala Lumpur; and the David Jones Building and Plaza Arcade in Perth.

On top of that, SG REIT got a boost during the quarter from the Myer Centre in Adelaide, which was added to the portfolio in May last year. This property is also under a master lease. The assets SG REIT holds that are not under master leases are the Chengdu property and four small properties in Tokyo, which together contribute less than 3% of the REIT’s rental income.

For FY2016 to June 30, SG REIT reported an 11.4% y-o-y rise in revenue to s$219.7 million and a 6.9% y-o-y improvement in NPI to s$170.3 million. Its DPU for the 12 months was 5.18 cents, versus 5.11 cents a year ago.

Master tenancies extended on Malaysian assets

Ho Sing, CEO of SG REIT’s manager, says investors can look forward to continued stability in FY2017 despite the tough outlook in the retail sector. For one thing, SG REIT will benefit from a 5.5% increase in base rent on the master lease of Ngee Ann City, which was effective from June 8. Moreover, on June 28, the master tenancies on its Malaysian assets were extended, with rents that were 6.67% higher.

“The master lease [at Ngee Ann City], together with the extension of the master tenancy agreements for the Malaysia properties, provides the REIT with income stability and growth,” Ho says. “These master leases combined represent approximately 34% of SG REIT’s gross rent, and full-period contributions from the revised rents will benefit FY2017.”

Separately, SG REIT is awaiting permission from the Perth city council for an asset enhancement programme at Plaza Arcade. The REIT also has unutilised gross floor area at the “Spanish Steps” between Ngee Ann City and Wisma Atria, which could yield around 100,000 sq ft of retail space, analysts say. While the development cost of this unused space could come up to some s$2,000 psf — including development charge of s$1,200 psf and construction costs of about s$400 psf — it would still enhance the value of the REIT, analysts say.

Ngee Ann City is carried in SG REIT’s books at s$2,904 psf, while Wisma Atria is carried at s$4,421 psf. Meanwhile, ION Orchard is carried in CapitaLand’s books at s$4,900 psf, while SPH REIT’s The Paragon — which is freehold — is valued at s$5,400 psf.

Units in SG REIT are up 7% this year, lagging the 9% rise in the FTSE REIT Index. In the wake of that underperformance, Maybank Kim Eng has upgraded its rating on the REIT to a “buy” from a “hold”. It is forecasting a 2.3% rise in DPU to 5.3 cents for FY2017, translating into a yield of 6.5%.

Goola Warden is associate editor at The Edge Singapore

This article first appeared in The Edge Malaysia on Aug 29, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

TAMAN DATO ABDUL SAMAD

Port Dickson, Negeri Sembilan

Taman College Heights (Sikamat)

Seremban, Negeri Sembilan

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Broadleaf Residences, Hometree

Kota Kemuning, Selangor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Halya @ Daunan Worldwide

Bandar Puncak Alam, Selangor