SBC Corp Bhd (Aug 28, 70.0 sen)

Maintain add with an unchanged target price (TP) of RM1.20: The first quarter ended June 30, 2016 (1QFY17) revenue fell 64% mainly due to earlier completion of projects and delays in the launch of new property projects. 1QFY17 net profit was below RM100,000. No interim dividend was declared.

The company has yet to get state approvals for the Jesselton Quay (JQ) project. This has been a major disappointment; SBC signed the joint venture with Suria Capital Holdings Bhd to develop the JQ project in mid-2013. It has been more than three years since the signing, and the company is hopeful that the JQ launch will happen before the end of this year. One major issue is the subdivision of land title, which we hope will be resolved soon.

The company was planning to launch its high-end Kapas Bangsar RM100 million gross development value project this month. However, this launch has since been delayed closer to the end of this year. SBC aims to launch soon the Dex Suites, Bandar Ligamas and the Kota Kinabalu Lot 3 development projects. SBC’s outstanding sales should currently be around RM150 million.

The company’s net debt position was RM81 million or 0.4 times net gearing as at end June. However, operational cash flow should improve once it launches the JQ project. Demand should be strong for JQ as it will be the only integrated seafront project in East Malaysia. SBC’s net debt would have been much lower were it not for the RM50 million year-on-year decline in payables at end-March. Operational cash flow should improve once it launches the JQ project.

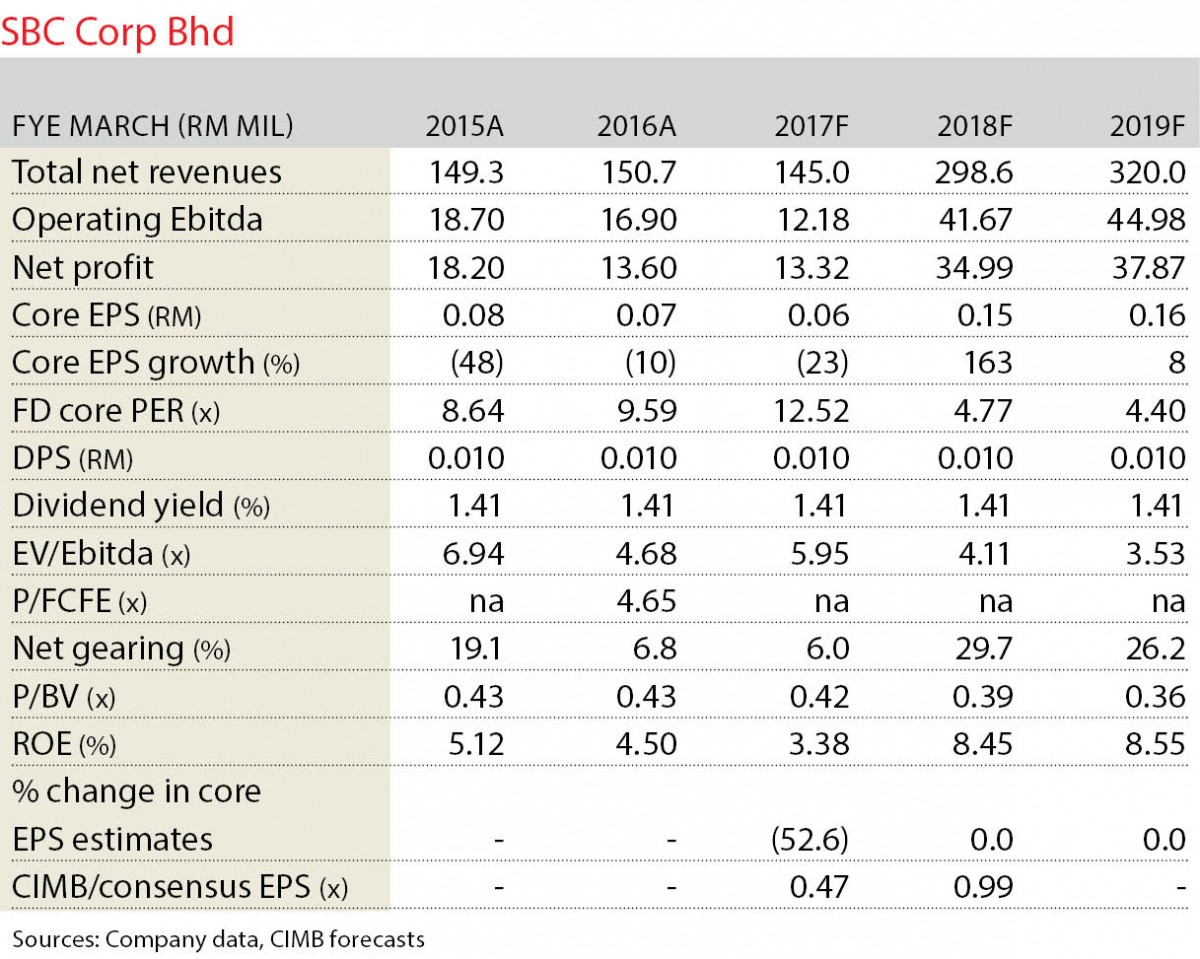

We cut our financial year ending Mar 31, 2017 forecast earnings per share by 53% to reflect the delays in new property launches. Our TP is unchanged at 70% discount to revised RNAV (revised net asset value) per share. Potential rerating catalysts are approvals for JQ and recovery in the domestic property market. Risks are further delays in JQ launch. — CIMB Research, Aug 28

This article first appeared in The Edge Financial Daily, on Aug 30, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Long Branch Residences

Kota Kemuning, Selangor

Bandar Baru Sri Petaling

Sri Petaling, Kuala Lumpur

Taman Bukit Kinrara

Bandar Kinrara Puchong, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Taman Setiawangsa

Taman Setiawangsa, Kuala Lumpur