HOUSE prices in Kota Kinabalu are expected to rise slowly but steadily, says Rahim & Co branch manager Max Sylver Sintia when presenting The Edge/Rahim & Co Kota Kinabalu Housing Property Monitor for 2Q2016.

“We see stable price growth in 2H2016. This is based on the market’s performance in 2Q2016 and despite the current cautious sentiment due to stringent bank borrowing guidelines, escalating construction cost, weakening ringgit, land scarcity, falling global commodity prices and challenges in the employment market,” he says, adding that the secondary market saw positive quarter-on-quarter and year-on-year price growth in the second quarter of the year.

Prime areas that enjoy good accessibility, such as Luyang, Damai, Jalan Lintas and Jalan Bundusan, continued to be hot spots and recorded higher prices, especially for landed and stratified properties, on the secondary market.

The asking price for 2-storey terraced houses in these areas has reached RM1 million while average prices are hovering at RM500,000 to RM850,000, says Sintia. “Some houses in established residential developments that were sold on the secondary market saw a more than 100% capital appreciation from 5 to 10 years ago.”

The asking price for 2-storey terraced houses in these areas has reached RM1 million while average prices are hovering at RM500,000 to RM850,000, says Sintia. “Some houses in established residential developments that were sold on the secondary market saw a more than 100% capital appreciation from 5 to 10 years ago.”

In the suburbs, especially Tuaran, Menggatal and Inanam in the north and Penampang, Kepayan and Putatan in the south, demand for landed homes remained strong, albeit at higher prices, Sintia notes.

For example, the 2-storey houses in Bandar Sierra that are located on Jalan Tuaran are currently priced from RM400,000 to RM600,000 on the secondary market compared with RM250,000 six years ago, representing a capital appreciation of more than 40%. “Similar house types in the vicinity are going for about RM450,000 with encouraging take-up on the primary market,” Sintia observes.

High-end condominiums continued to do well on the primary and secondary markets. “We expect positive performance at projects such as SkyVue Residence and Triconic Tower as we observe most buyers — young professionals and families — are avoiding the more expensive landed homes. This has resulted in improved take-up rates for smaller high-rises,” Sintia points out.

Located on Jalan Penampang ByPass, the 22-storey SkyVue Residence (developed by NBLand and EH Property) comprises 200 condos and offers 24-hour security guard surveillance, CCTV, intercom, high-speed broadband infrastructure, a swimming pool, multipurpose hall, meeting room, landscaped garden and children’s playground. Sintia says the project is scheduled to be launched in 2H2016 at RM490 psf to RM671 psf (regular units) and RM694 psf to RM751 psf (penthouses).

Meanwhile, Triconic Tower — a development by Kinsabina Sdn Bhd — offers 768 condos housed in three 16-storey blocks.

“Despite the mushrooming of condominiums on the primary market, we note growing demand for landed homes on the secondary market in mature parts of Kota Kinabalu,” Sintia says, adding that the prices of landed properties are skyrocketing in areas such as Putatan, Penampang, Inanam, Kepayan, Menggatal and Tuaran, which are offering homebuyers newer and more affordable alternatives.

Landed homes

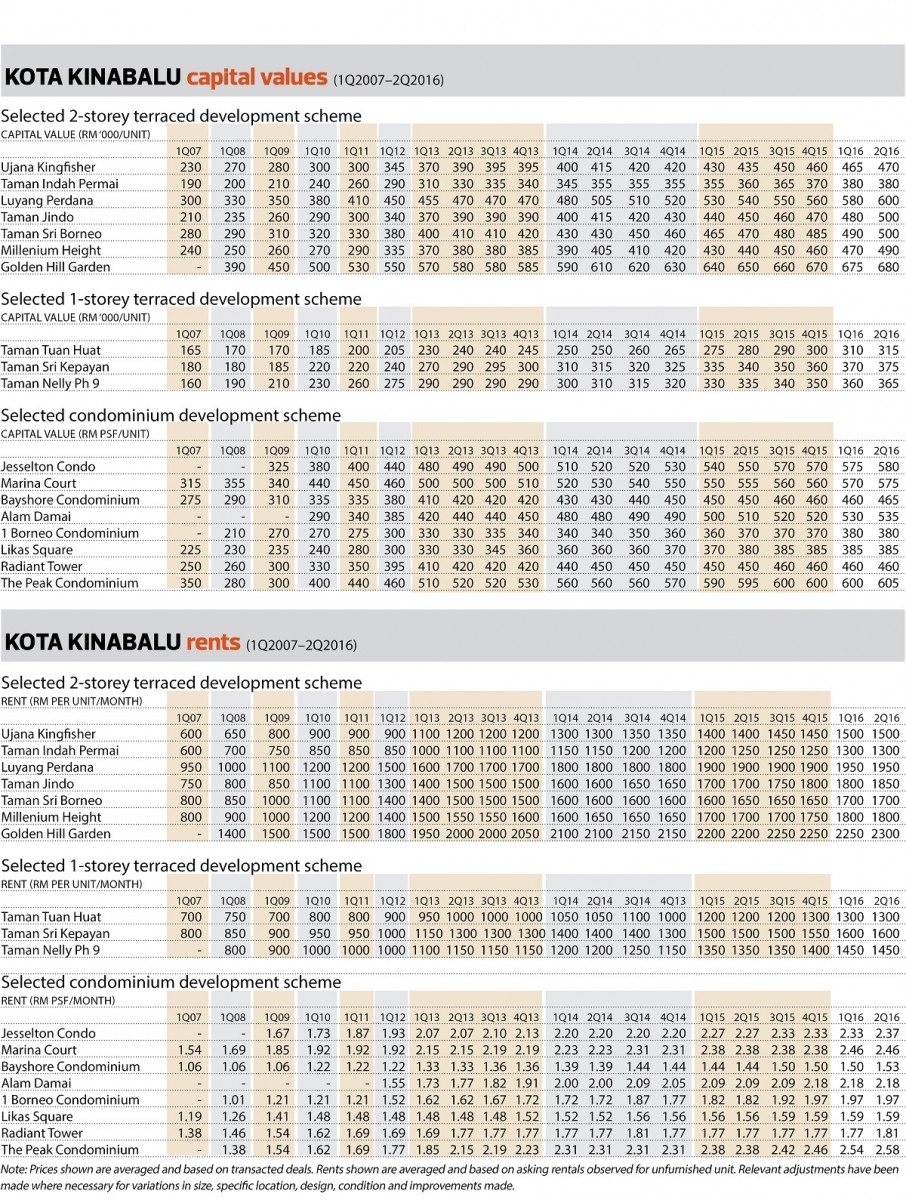

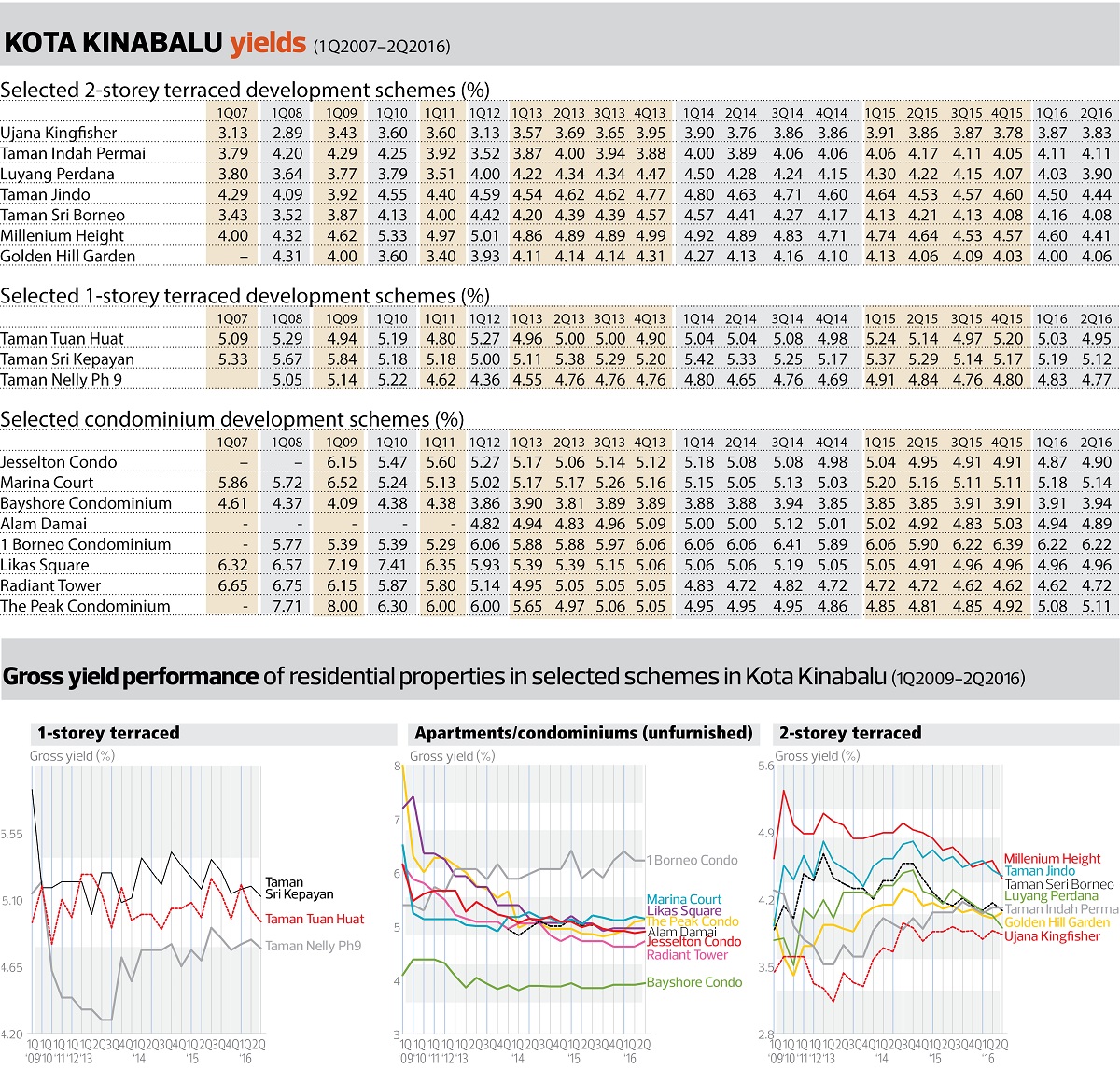

The prices of 2-storey terraced houses sampled by the monitor rebounded from an average of 1.92% in 1Q2016 to 2.25% in 2Q2016.

Millenium Height, Luyang Perdana and Taman Jindo recorded an average q-o-q growth of RM20,000, followed by Taman Sri Borneo at RM10,000 and Ujana Kingfisher and Golden Hill Garden at RM5,000. Only Taman Indah Permai did not register any growth.

The samples recorded an average growth of 8.31% or RM40,838 year on year.

Meanwhile, the 1-storey terraced houses sampled by the monitor recorded an average y-o-y growth of 10.58% or RM33,333 in 2Q2016. The highest growth was seen in Taman Tuan Huat (+12%), followed by Taman Nelly Ph 9 (+8.06%) and Taman Sri Kepayan (+7.94%).

On a q-o-q basis, the prices of 1-storey terraced houses grew 1.45% or by about RM5,000. The best growth was seen at Taman Tuan Huat (+1.61%), followed by Taman Nelly Ph 9 (+1.39%) and Taman Sri Kepayan (+1.35%).

Condominiums

The condominiums sampled recorded an average y-o-y growth of 3.15% during the second quarter of the year. The better performers were Jesselton Condominium (+5.5%), Alam Damai (+4.9%), Marina Court (+3.6%), Bayshore Condominium (+3.3%), 1 Borneo Condominium (+2.7%), Radiant Tower (+2.2%), The Peak Condominium (+1.7%) and Likas Square (+1.3%).

On a q-o-q basis, the average price growth for condominiums was 0.58%.

Try out one of our super tools, the rental yield calculator, here.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Aug 29, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

Ridgewood Canary Garden @ Bandar Bestari

Klang, Selangor