IGB Real Estate Investment Trust (July 27, RM1.65)

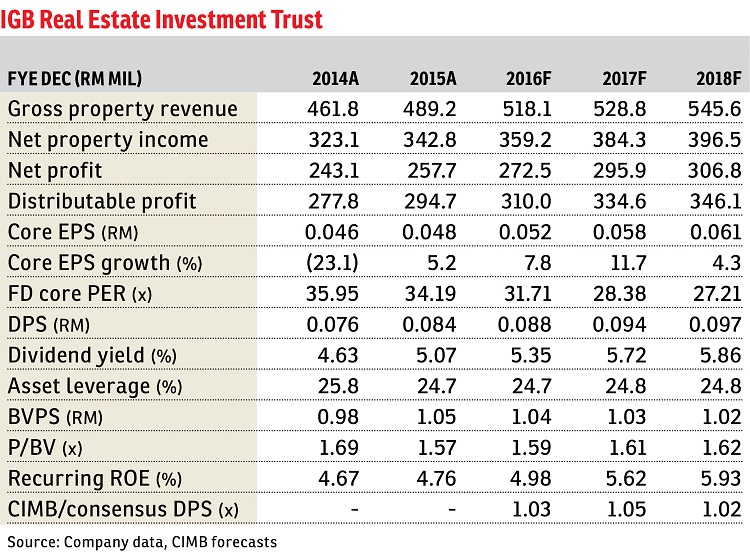

Maintain hold with an increased target price of RM1.62: IGB Real Estate Investment Trust’s (REIT) first half ended June 30, 2016 (1HFY16) revenue and core net profit rose 3.7% and 2.2% year-on-year (y-o-y) to RM255.8 million and RM138.8 million, respectively. This was mostly attributed to higher rental reversions at both its assets — Mid Valley Megamall and The Gardens Mall. As a result, net property income rose 2.2% y-o-y to RM180.3 million despite a 7.3% y-o-y increase in property expenses. All in, average occupancy rates remained steady at 98% to 99% in 1HFY16. IGB REIT also declared a 1HFY16 distribution per unit (DPU) of 4.41 sen (1HFY15: 4.5 sen). This was in line with our expectations and made up 50% of our full-year DPU forecast of 8.8 sen.

Meanwhile, the Mid Valley Southkey Megamall in Johor is on track to meet its target completion by end-2018. We understand that IGB REIT will only inject the mall into its portfolio when the mall reaches stable rental and occupancy rates, and the earliest potential timeline would be by 2021. While management has not started negotiations to fill up the potential mall floor space, it has said that it would like to be more focused on speciality stores while 20% to 30% of the floor space will be dedicated to anchor tenants.

The group has also stated its interest in positioning the mall to attract the middle-class and family-orientated crowd, and the new mall will most likely resemble the Mid Valley Megamall in Kuala Lumpur rather than the high-end mall in its portfolio, The Gardens Mall. For now, the expected potential rental rates for the Mid Valley Southkey Megamall will most likely range from RM9.6 to RM10.8 per sq ft, at an approximate 10% to 20% discount to the Mid Valley Megamall’s current rental rates.

We have reduced our risk-free rate assumption to 3.6% (from 4%) given the recent overnight policy rate cut. We believe the group’s organic growth will be supported by its steady rental reversions and occupancy rates for both of its strategic assets. Nonetheless, we believe that investors have already priced in its superior-quality assets and the potential asset to be injected later from its sponsor. — CIMB Research, July 26

Try out one of our super tools, the rental yield calculator, here.

This article first appeared in The Edge Financial Daily, on July 28, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Mayfair Residences @ Pavilion Embassy

Keramat, Kuala Lumpur

Oxford Residences @ Pavilion Embassy

Keramat, Kuala Lumpur

Oxford Residences @ Pavilion Embassy

Keramat, Kuala Lumpur