- The restraining order, which will last for a period of three months from April 19, 2024, is to enable Ivory Gleneary Sdn Bhd (IGSB), a wholly-owned subsidiary of Ivory Properties, and its creditors to formalise the proposed scheme of arrangement and thus allow for the extension of time to submit the company's regularisation plan in order to get out of the PN17 status.

KUALA LUMPUR (May 8): Practice Note 17 (PN17) company Ivory Properties Group Bhd (KL:IVORY) said in a Bursa Malaysia filing on Wednesday it had been granted a restraining order by the High Court of Malaya in Penang to restrain all further proceedings against the company including winding up, execution and arbitration from its creditors.

The restraining order, which will last for a period of three months from April 19, 2024, is to enable Ivory Gleneary Sdn Bhd (IGSB), a wholly-owned subsidiary of Ivory Properties, and its creditors to formalise the proposed scheme of arrangement and thus allow for the extension of time to submit the company's regularisation plan in order to get out of the PN17 status.

To recap, Ivory Properties on Jan 10, 2024 said that in addition to the appointment of M&A Securities Sdn Bhd as the principal adviser for the extension of time application, it had also appointed Baker Tilly Insolvency PLT as its scheme advisor to assist in restructuring IGSB’s financial obligations in accordance with the provision of the Companies (Amendment) Act 2024.

As such, the court on April 19, 2024 had directed for a restraining order to be granted to Ivory Properties to allow for a court-convened meeting between the company and its creditors for the purpose of considering and, if thought fit, approving with or without modification the proposed scheme of arrangement.

The court had also appointed an insolvency practitioner to chair the meeting and to assess the viability of the proposed scheme of arrangement and directed him to report the results of the meeting to the court.

Ivory Properties had slipped into PN17 status in 2022 after its external auditors Messrs KPMG PLT expressed a disclaimer of opinion on the company’s audited financial statements for the financial year ended March 31, 2022 (FY2022).

According to KPMG, Ivory Properties reported a net loss of RM79.51 million during FY2022, while the group’s liabilities exceeded their current assets by RM60.22 million.

The auditors also noted that the group’s cash and bank balances as at March 31, 2022 stood at RM1.67 million, while the group recorded negative operating cash flow of RM8.9 million for FY2022.

Subsequently, KPMG said the group missed the repayment of interest and principal payments that amounted to RM1.98 million for certain loans and borrowings, of which the outstanding amount totalled RM49.73 million.

Shares of Ivory Properties were down 0.5 sen or 7.69% at six sen per share on Wednesday's market close, as its market capitalisation stood at RM27.3 million.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Idaman Warisan Puncak Alam

Bandar Puncak Alam, Selangor

Norton Garden Semi D @ Eco Grandeur

Bandar Puncak Alam, Selangor

Pusat Perdagangan Alam Jaya

Bandar Puncak Alam, Selangor

The Trees, Bukit Lanjan

Damansara Perdana, Selangor

Summerglades, Perdana Lakeview West

Cyberjaya, Selangor

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

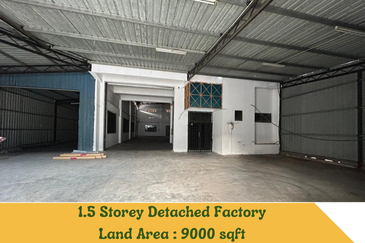

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)