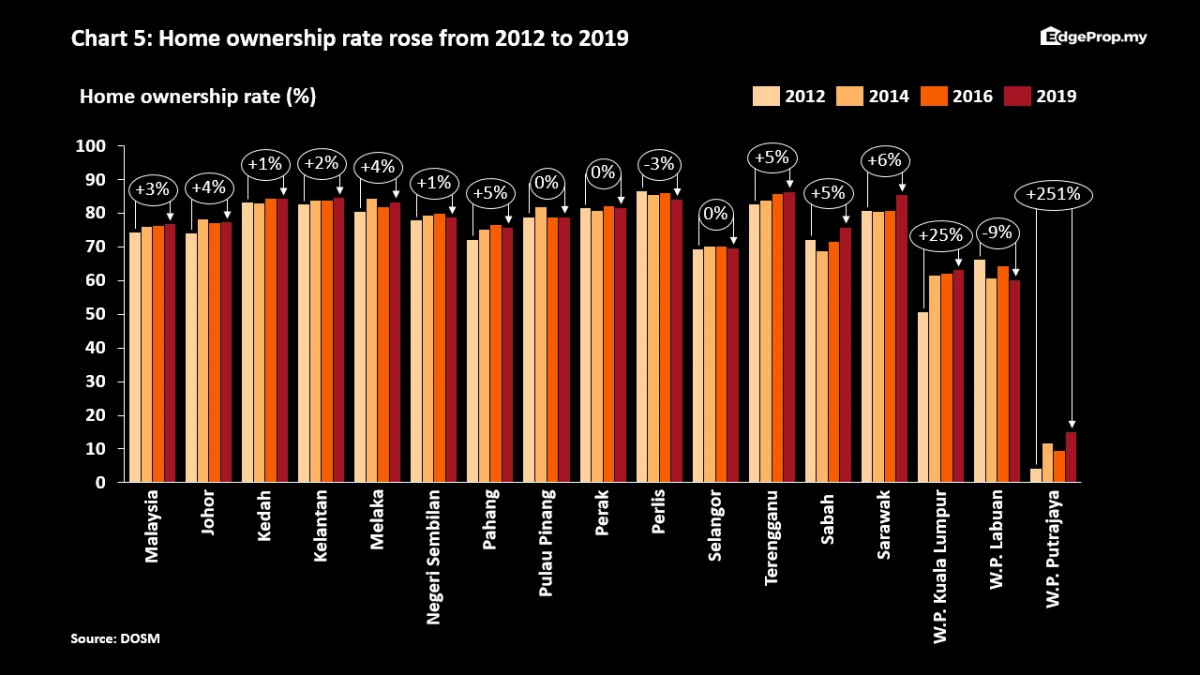

- Home ownership rates rose from 2012 to 2019 across the country, except for Perlis and the Federal Territory of Labuan, according to a DoSM survey . This is consistent with the department’s finding that the average home price to average household income fell from 2012 to 2022

Let us start with the definition of myth: (a) a widely held but false belief; and (b) an exaggeration or idealised conception of a thing.

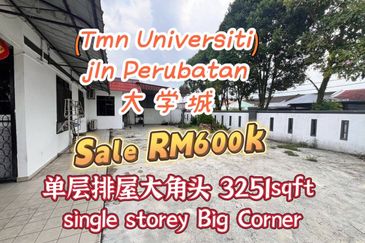

The dominant narrative in the discourse on home ownership and affordability in Malaysia is best captured in this one-page highlight in the Bank Negara Malaysia Annual Report 2021 (see Chart 1). The data is from Bank Negara, the Department of Statistics Malaysia (DoSM) and the National Property Information Centre (Napic) of the Ministry of Finance.

Others parties like Khazanah Research Institute (KRI), Ministry of Finance (MoF) and Ministry of Housing (MoH) also share similar conclusions (one feeding on the other). For example, take a look at KRI’s December 2022 report “Residential Settlements and Spatial Inequality”.

The widely held conclusions are therefore: (a) house prices in Malaysia are seriously unaffordable with the majority of Malaysians not earning enough wages to afford a home; (b) house price increases have outstripped income growth, and therefore wages must go up faster than before; (c) find ways to reduce the cost of building houses for prices to fall or go up by less (for example, Construction Industry Development Board Malaysia’s technical report number 188 on the use of the industrialised building system, IBS); (d) not enough affordable houses are being built, while overpriced properties are left unsold; (e) the property market is inefficient, uncompetitive and not meeting the needs and demand of homebuyers; and (f) houses are overpriced.

Policy proposals range from: (a) those who cannot afford to buy should rent instead; (b) financing innovations like rent-to-own, or government to step in to guarantee the repayment for home purchases by the lower-income group; (c) government intervention to more aggressively build affordable housing; (d) government should intervene in the labour market by pushing up salaries from minimum wage to reach that in the middle-income group; (e) government should regulate the property industry more to ensure the market is competitive and speculation is minimised (KRI’s December 2022 report), such as setting up an approving committee in the MoH to approve all residential projects in the country, including the selling prices and the products (the assumption is that the market lacks knowledge, is not competitive or efficient … and a bunch of people sitting around a table can make better decisions than the hundreds of property developers who risk their own millions of ringgit in investments).

All the proposed solutions involve government intervention, government funding, the government taking on the risks, and a “government knows best” mindset. Some create new layers for corruption and rent-seeking opportunities to profit from. The disasters of past interventions like PR1MA homes are forgotten (read Au Fong Yee’s piece entitled “Total rethink on PR1MA needed” in her column, The Real Deal, in The Edge Malaysia, Sept 18, 2023, and Fara Aisyah’s piece in The Malaysian Reserve, May 6, 2019, “An expensive failure at PR1MA”). And the fact that the Malaysian property development industry is one of the most competitive and open is not acknowledged.

Let us now look at the facts.

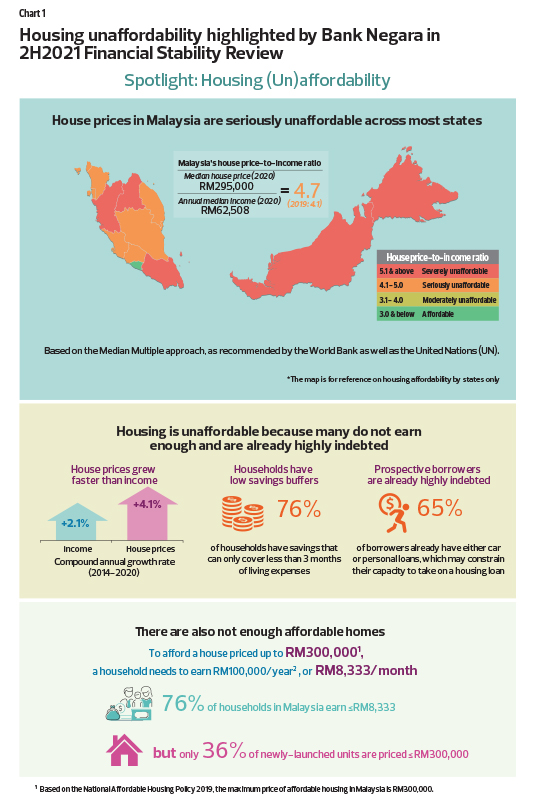

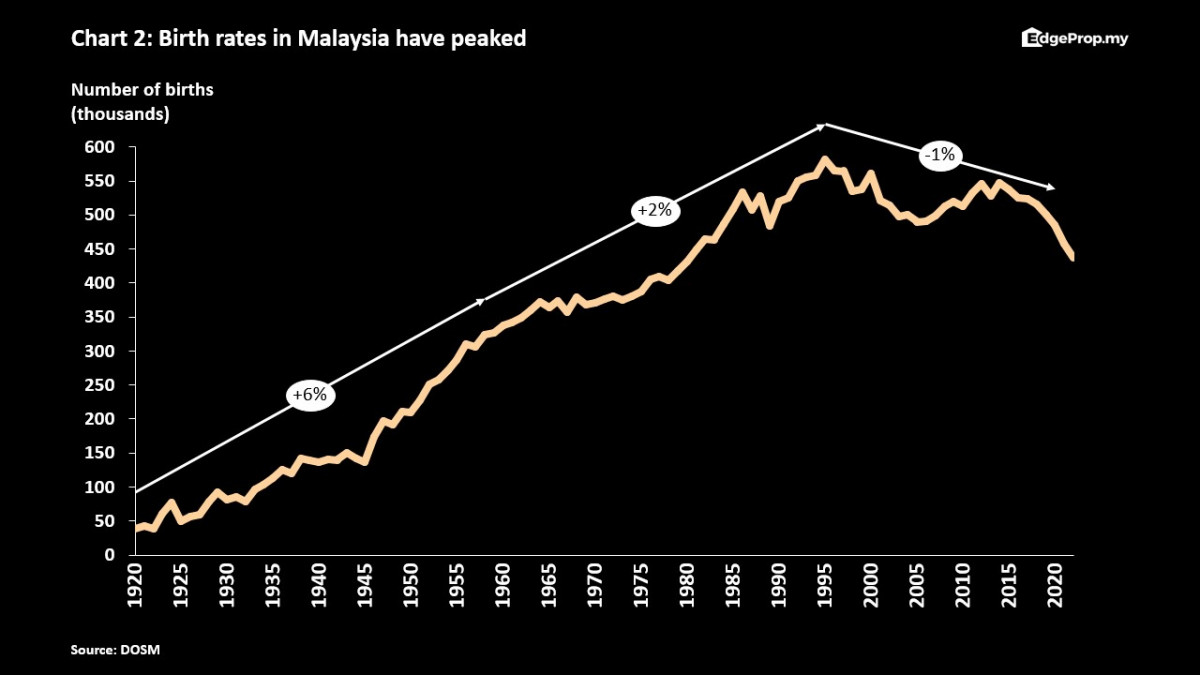

Although birth rates in Malaysia have peaked (see Chart 2), the total population is still rising (Chart 3). With average household sizes falling, the number of Malaysian households has continued to increase (see Chart 4). Thus, the need for homes will continue to rise. Housing is a necessity and a human right, not just an economic privilege, and therefore a matter of public interest. And I would further argue that home ownership is an important core for national stability; those who own homes are less likely to destroy the property of others. So, yes, home ownership is an extremely important national issue that must be addressed, even if there are indeed serious impediments.

Home ownership rates rose from 2012 to 2019 across the country, except for Perlis and the Federal Territory of Labuan, according to a DoSM survey (see Chart 5). This is consistent with the department’s finding that the average home price to average household income fell from 2012 to 2022 (see Chart 6). Household income grew faster than house prices from 2012 to 2022. From 2009 to 2012, it was indeed the case that the rise in household income fell behind the increase in house prices (we will explain why later).

This contradicts Chart 1. The widely held false belief (myth) is that houses are increasingly unaffordable. Yet, the data sources are the same. According to Chart 1, 76% of households do not make enough wages to afford a house priced up to RM300,000 (according to Napic, the median house price in Malaysia was RM289,646 in 2019, RM296,944 in 2018, RM303,000 in 2017 and RM298,000 in 2016). Yet, more than 76% of households own a home.

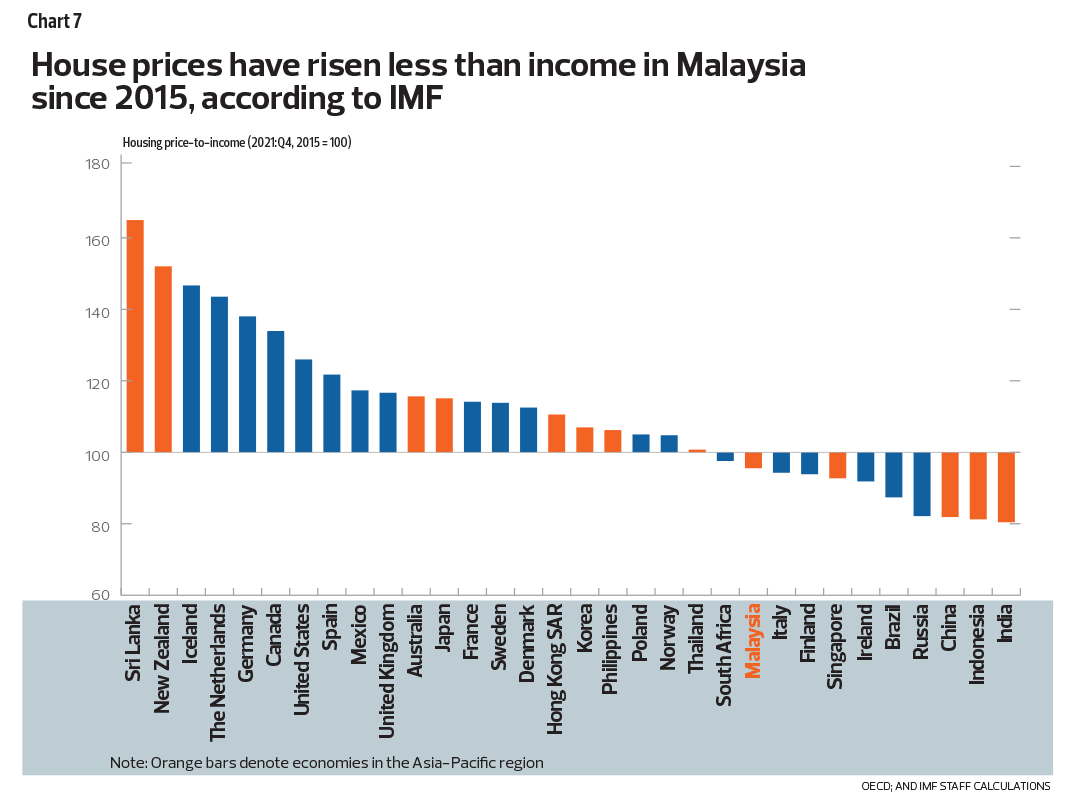

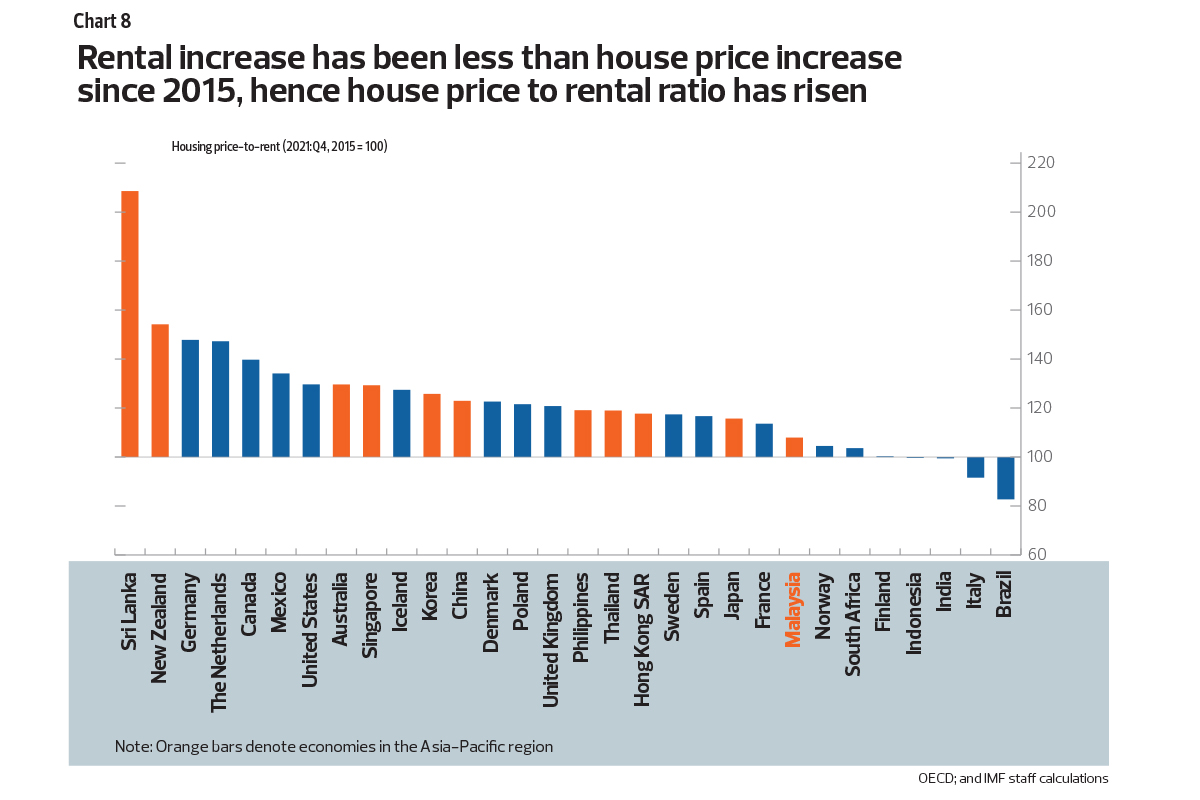

Given this apparent contradiction, we searched for collaborative evidence and present the data from the Organisation for Economic Co-operation and Development (OECD) and the International Monetary Fund (IMF) in Charts 7 and 8 (on next page). Chart 7 says that in terms of housing price to income from 2015 to 2021, a score of below 100 indicates that house prices rose less than income in Malaysia. And Chart 8 says that rental increase was even less than the house price increase (supporting our narratives in Charts 5 and 6). And Malaysia did well in comparison to many countries in that house prices did not rise faster than household income.

Why did we arrive at different conclusions with the same data sources? We can think of a few reasons.

1. The Napic data on house prices.

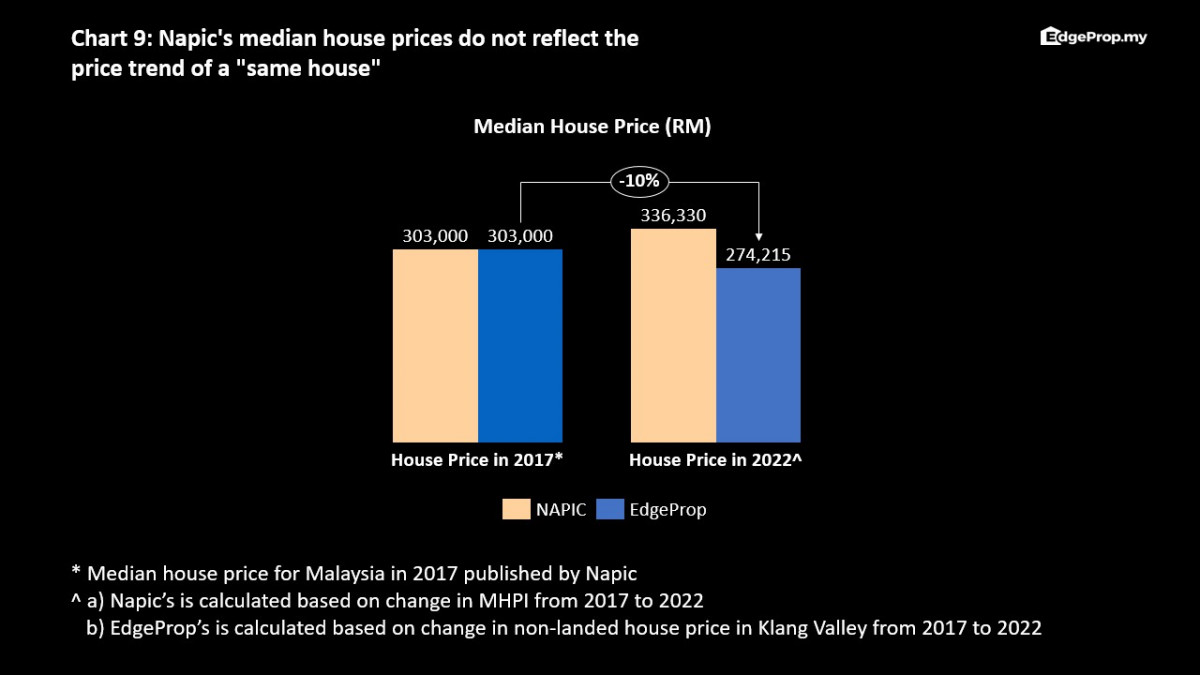

We think the data is biased upwards. Chart 9 shows the Napic median house prices and our own “same house” prices (from EdgeProp). We believe Napic’s data is biased towards new launch prices. When comparing “same house” prices over time (the concept of “same store sales”), median prices from 2017 to 2022 had gone down instead. A 2022 house is not the same product as a 1990 house, for example.

Also, the median house price increase of 4.1% from 2014 to 2020 in Chart 1 taken from Napic contradicts its own numbers of median house prices of RM270,000 in 2014 and RM295,000 in 2020 (which is more like a 1.5% compound annual growth rate (CAGR), less than the 2.1% CAGR for income). This is consistent with Charts 6 and 7, supporting our narrative.

Unfortunately, Napic does not allow access to its data, except for valuers. This is unlike in most other countries. Napic is afraid that its data could be misinterpreted and, therefore, restricts it to professional valuers only. This is like arguing that publicly listed companies on Bursa Malaysia will make available their financial and annual reports only to professional analysts. Because data is critical for decision making, and the property sector is a huge part of the economy with major consequences to the banking sector, employment and the people, this data must be made readily available to all users. It needs to be challenged and tested, to be analysed and explained. It is indeed shocking that in this age of digitalisation, such data is still being hoarded … or worse, selectively used and profited from.

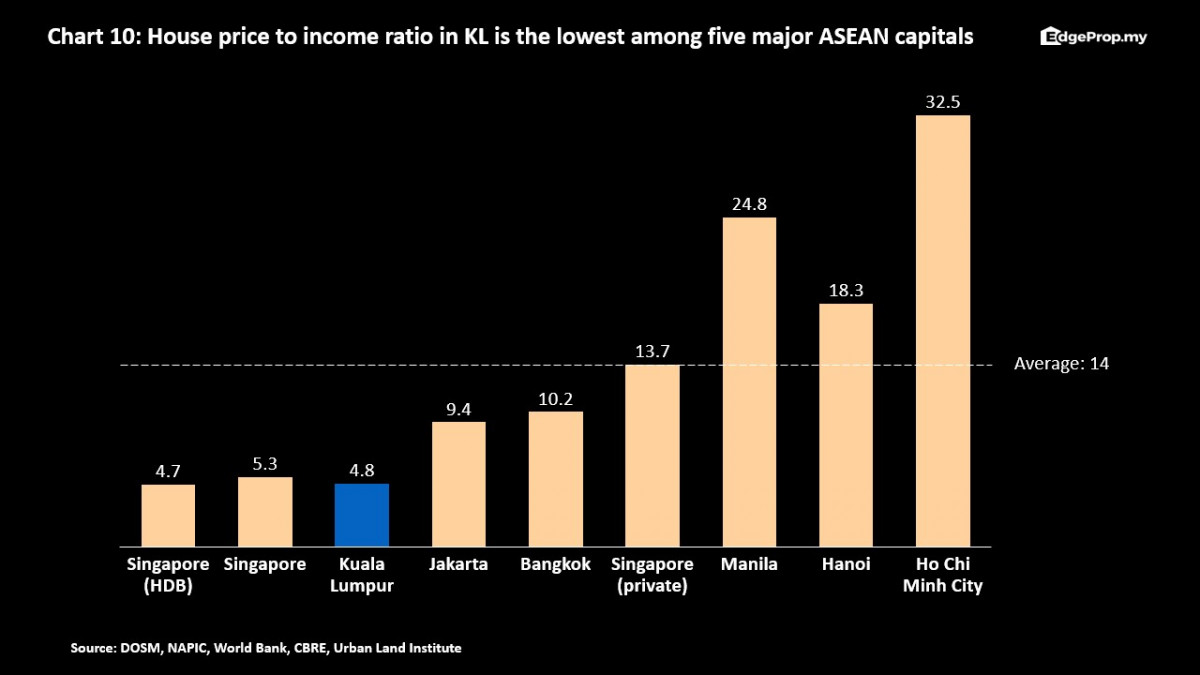

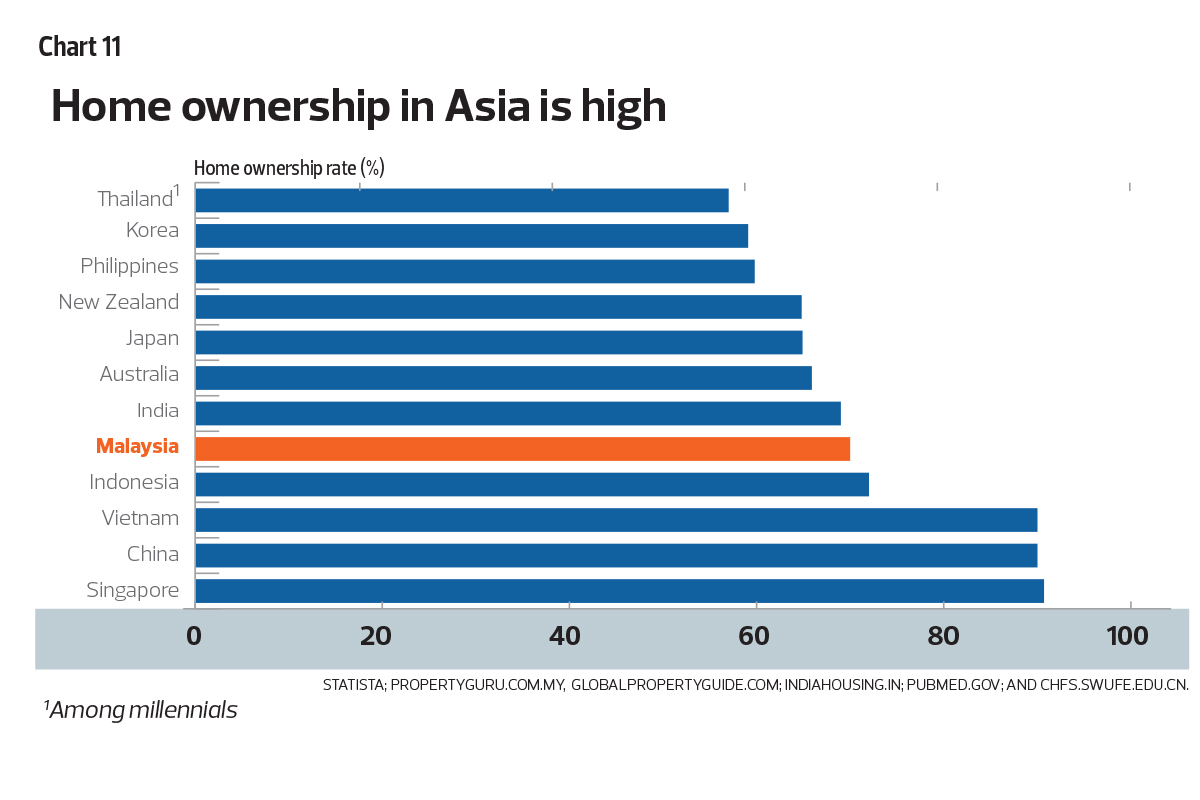

2. The Median Multiple Approach to determine housing affordability, recommended by the World Bank and the United Nations. It is termed “affordable” only when the median house price is equal to or less than three years’ income. It is seriously unaffordable if it is more than 4.1 years of income and severely unaffordable at more than 5.1 years of income. If this were indeed the facts — and throughout Asia, homes are unaffordable by this yardstick — how is it possible that most Asians still own their homes (see Charts 10 and 11)? Note, in terms of house price to income ratio, Kuala Lumpur is in fact the lowest among the five major Asean capitals.

Clearly, facts do not correspond to this simple multiple approach. The question is why?

Concepts promoted in the West do not always apply in Asia. First, homes in the West, such as the wood-framed single-family dwellings common in North America and Europe, are not constructed to last for generations. Second, westerners constantly upgrade or downsize their homes depending on circumstances (the life cycle of houses are shorter). Third, the concept of a nucleus-family is different between Westerners and Asians (one generation to multi-generational). Fourth, lifestyles and needs and wants are different — where budgets for holidays, for example, is a necessity for Westerners, for Asians, owning a home is all-consuming, besides providing for their children’s education.

Fifth, reported income is different in the West compared with much of Asia, including Malaysia. In Asia, the grey economy is large, versus being almost non-existent in the West. Sixth, gross income to disposable income is hugely different between the developed countries and the developing nations. Developed nations have remarkably high personal, consumption and property taxes, as well as prohibitive costs of insurance and healthcare.

So, what is the right yardstick that would be reasonable for Malaysians?

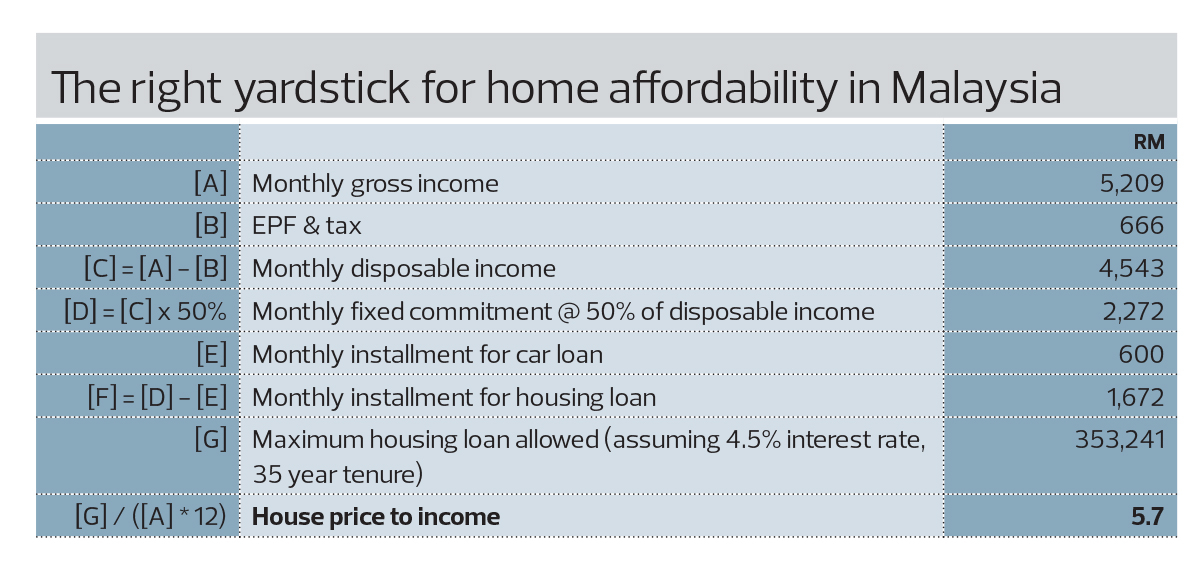

According to DoSM, the median household income for Malaysians in 2020 was RM5,209 a month or RM62,508 per annum. This statistic is also applied by others, such as Bank Negara. After tax and other statutory deductions like those to the Employees Provident Fund (EPF), disposable income is RM4,543 a month. Assuming only 50% is spent on fixed commitments like car loans and housing mortgages, it translates into an affordable house price to income ratio of 5.7 years, with RM353,241 as the affordable price. (See table entitled “The right yardstick for home affordability in Malaysia” on opposite page).

To check the reasonableness of these numbers, banks generally will lend the equivalent of up to 30% of a person’s gross income to service the monthly payments towards home mortgages. Thirty per cent of RM5,209 is RM1,562.70. And these are approximately the same numbers we arrived at in the table. That is, given the household income in Malaysia, it supports a median house price of RM330,000 and where the house price to income ratio is about 5.3 years.

Our data, analysis and conclusions are aligned with the facts. Almost 80% of households do own homes, supported by the current levels of household income. The situation for home affordability overall is not in such a crisis as is narrated. It turns out that homes in Malaysia are indeed generally still affordable.

For sure, we can and must aim to be better. Progress is a necessity for humanity. But we must be careful to differentiate facts from myths and idealised conceptions, or once again, we will have policy measures that do more harm than good.

There are those with low to no income or who have health issues who need social housing, low-cost housing and subsidised housing. This is like in the rest of the world. It is a specific challenge that requires a specific targeted solution. And there are many successful cases and failures elsewhere that we can learn from. Housing for those who need help is a necessary provision by all governments.

Calls for the government to directly intervene must be viewed with suspicion. The market is efficient and meets the needs of homeowners. Is there room to be even more efficient, and lower the costs of buildings? There is, and we will address this in the second part of this two-part series. But this is a vastly different proposition from the earlier narrative that residential properties are unaffordable to 76% of the population and therefore there is a need for huge macro-government intervention. As we will show in part 2 next week, there are effective market-based policies that can make the industry more cost-efficient and benefit both homeowners and the industry overall.

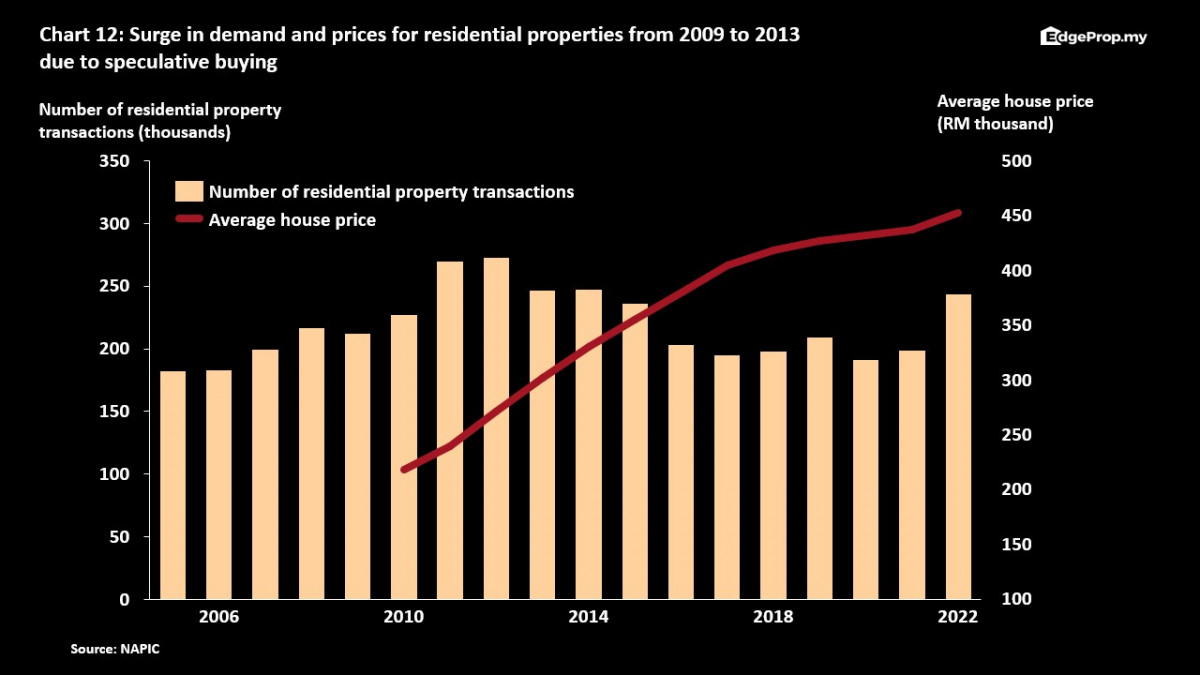

Our concluding remark is on the huge surge in demand and prices for residential properties in Malaysia from 2009 to 2013, which probably sowed the seeds for the present narrative on unaffordable homes, with speculative buying to blame (see Chart 12). The Developer Interest Bearing Scheme (DIBS) was introduced in 2009 and finally abolished in Budget 2014. It serves a purpose, in that new homebuyers would be free from paying interest on a yet-to-be-completed house while still paying rent on the house they are staying in while waiting for their new home to be completed. Unfortunately, it is also extremely tempting to speculators, where gains on tiny investments (the 10% deposits) would be huge from flipping the new houses before completion. It was a policy mistake although made with good intentions, like many of the proposals highlighted earlier.

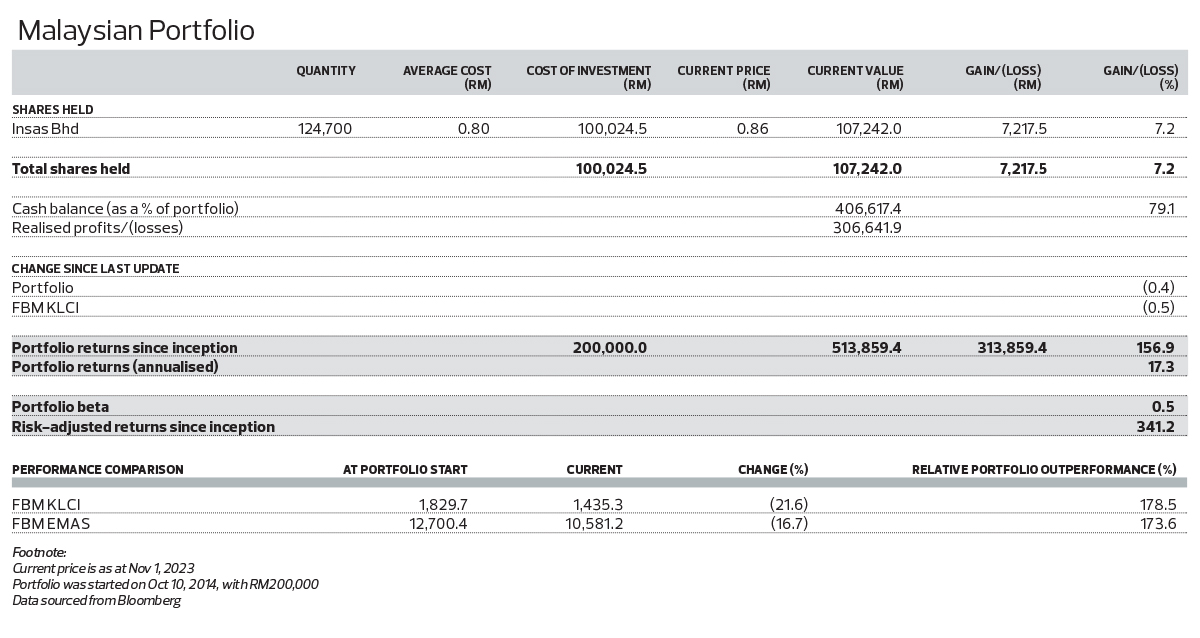

The Malaysian Portfolio fell 0.4% last week, slightly beating the benchmark FBM KLCI, which fell 0.5%, thanks to our high cash holdings. Insas’ share price fell 1.7% for the week. Total portfolio returns now stand at 156.9% since inception. This portfolio is outperforming the benchmark FBM KLCI, which is down 21.6%, by a long, long way.

Disclaimer: This is a personal portfolio for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy/sell stocks. Our shareholders, directors and employees may have positions in or may be materially interested in any of the stocks. We may also have or have had dealings with or may provide or have provided content services to the companies mentioned in the reports.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

D'Summit Residences @ Kempas Utama

Johor Bahru, Johor

D'Summit Residences @ Kempas Utama

Johor Bahru, Johor