- “Our joint venture with them for this Diamond City project is ongoing. So far, there is no impact from the holding company’s financial issues.”

- L&G owns a 45% stake in Diamond City while the remaining 55% is held by Hong Kong-listed Country Garden.

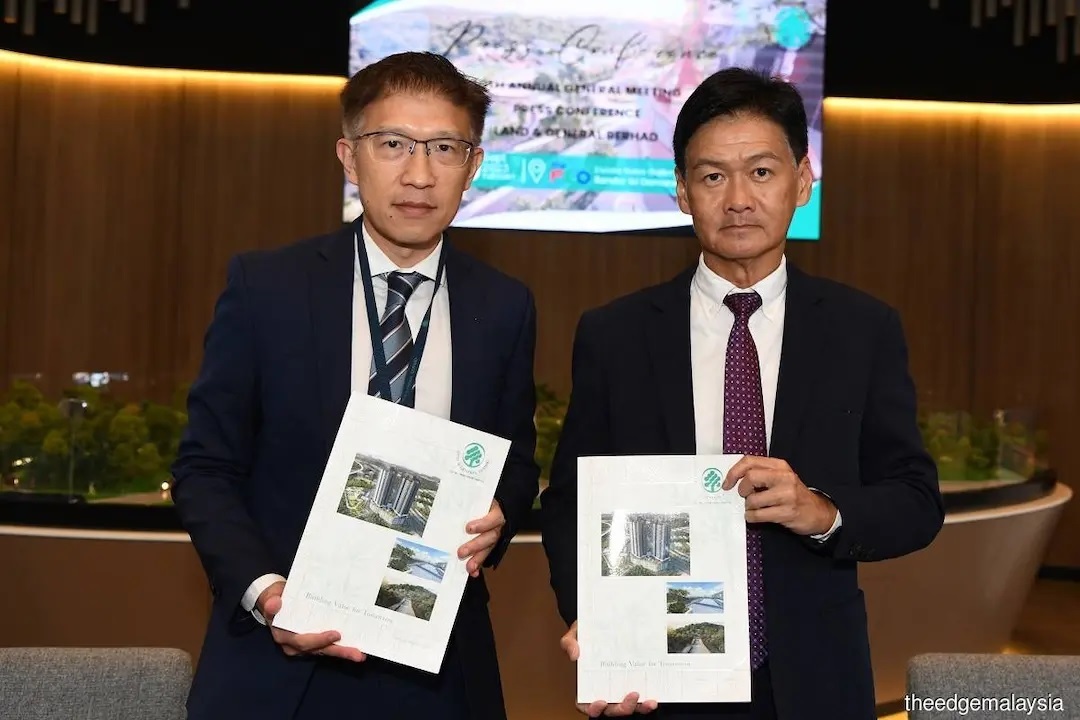

KUALA LUMPUR (Sept 19): Land & General Bhd (L&G) allayed concerns that liquidity issues faced by joint venture partner Country Garden would have a negative spillover effect on their 167-acre township development in Semenyih that started in 2014.

Speaking to the media after the company’s AGM, L&G managing director Low Gay Teck said the project is now financially self-sustaining.

“Our joint venture with them (Country Garden) in Semenyih, Diamond City, I would say about 70% to 75%. We are three quarters of the way for the entire Diamond City development.

“The whole project is divided into plot A and plot B. Plot A is all done in the earlier years,” said Low at the media briefing.

“Plot B, phase one, phase two and phase four, it's all completed and 100% sold. All these are terrace houses. We are now in the midst of building and selling phase five, 201 units of terrace houses, of which we have sold 163 units. That will represent just slightly above 80%. So with that kind of sales, this project is basically self-sustaining and there is also a bridging financing from financiers.

“Our joint venture with them for this Diamond City project is ongoing. So far, there is no impact from the holding company’s financial issues,” he explained.

L&G owns a 45% stake in Diamond City while the remaining 55% is held by Hong Kong-listed Country Garden.

Mayland Parkview Sdn Bhd, a unit under Mayland Group that is controlled by its founder Tan Sri David Chiu, is the single largest shareholder in L&G with a 34.7% stake.

The group’s current landbank stands at 3,288 acres, of which 2,495 acres are estate lands, according to Low.

“The estate lands, of course, for it to be converted into master township development, it may take many years. But if you remove that parcel of land, we will still have approximately about 800 acres of land,” said Low.

Meanwhile, L&G’s current unbilled sales amount to RM163 million, while the group’s balance sheet has a gearing ratio of 0.2 times, said its chief financial officer Benjamin Leong Wye Hoong.

“We still have about RM112 million in cash, so net gearing is about 0.1 times. I think we are in a pretty comfortable position, which also allows us to potentially acquire new landbank,” he said.

Shares of L&G slipped half a sen or 3.85% to close at 12.5 sen, giving it a market capitalisation of RM371.64 million.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Taman Sri Gombak Heights/Gombak Groove @ Sri Gombak

Gombak, Selangor

Razak City Residences

Salak Selatan, Kuala Lumpur

Taman Tasik Semenyih (Lake Residence)

Semenyih, Selangor

Kawasan Perindustrian Kajang Jaya

Semeyih, Selangor

Cahaya SPK (Cahaya Heights)

Shah Alam, Selangor