While the industrial and logistics segment is expected to remain the bright spot in the property industry, CBRE|WTW managing director Foo Gee Jen said there will be great potential in worker accommodation.

He pointed out that a proper plan-and-build worker accommodation is very much in need now to lower the risk of Covid-19 cluster outbreaks in construction sites.

“A properly-built accommodation is a requirement now as many worker accommodations have become construction site cluster outbreaks. Therefore, it is a new opportunity that developers could explore,” Foo said during his presentation session titled “Industrial/Logistics/Worker Accommodation” in the 14th Malaysian Property Summit 2021 (14MPS) which was held on Oct 13, 2021.

The 14MPS titled “Eye on 2022” is organised by the Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector of Malaysia (PEPS), with EdgeProp Malaysia as the media partner.

Foo also added that worker accommodation could be the new driver of the real estate market as it does not only involve new development, but the upgrade of current facilities and relocation or facility-centralisation in one location.

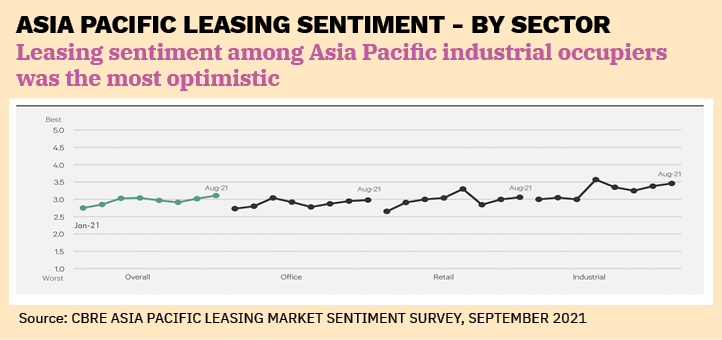

Meanwhile, citing on CBRE | WTW’s recent survey, Foo said most of the industrial players and investor respondents are optimistic on the property segment, which is firmly supported by the rapidly growing e-commerce sector as well as changing shopping behaviour.

“While 93% of manufacturers believe industrial output will enjoy a pent-up demand in the next three years, there are concerns on the escalating transportation, property and labour cost.

“Therefore, choosing the right location (of facility) is very crucial. The modern built facility in mature locations is expected to continue to be high in demand,” he opined.

Foo added that the industrial property segment has been very active in the past two years. Some of the significant deals were the AME Elite Consortium Bhd’s RM434 million land acquisition deal in Iskandar Puteri to build an industrial park. YTL Power International Bhd also acquired land in Johor for RM429 million for an industrial development and Tiong Nam Logistics Holdings Bhd paid RM136 million for two plots in Johor to build warehouses.

Commenting on the logistics sector, although Malaysia recorded a drop in the Logistics Performance Index in 2018, Foo believed the sector has a good prospect as Malaysia is very well located in Southeast Asia and has sufficient facilities to support the sector’s development.

“However, what hinders the growth are too many red tapes in the industry, as well as poor administration support and protection of local policy,” he said.

Moving forward, he deemed that industrial and logistics will continue to thrive on the back of good support from the rapid development of automation, e-commerce and data centres.

“According to data, Malaysia’s e-commerce revenue is expected to increase to US$10.95 billion (RM46 billion) in 2025 from US$6.29 billion currently. To cater to the growth, it is estimated that 4.66 million sq ft of additional space is required in the next four years,” Foo shared.

This story first appeared in the EdgeProp.my E-weekly on Oct 15, 2021. You can access back issues here.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Damansara Foresta

Bandar Sri Damansara, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Pangsapuri Lagoon Perdana

Bandar Sunway, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Kuala Lumpur City Centre

KL City, Kuala Lumpur

Kuala Lumpur City Centre

KL City, Kuala Lumpur

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

JALAN RAWANG -SERENDAH

Batang Kali, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)