Kimlun Corp Bhd (Aug 19, RM1.23)

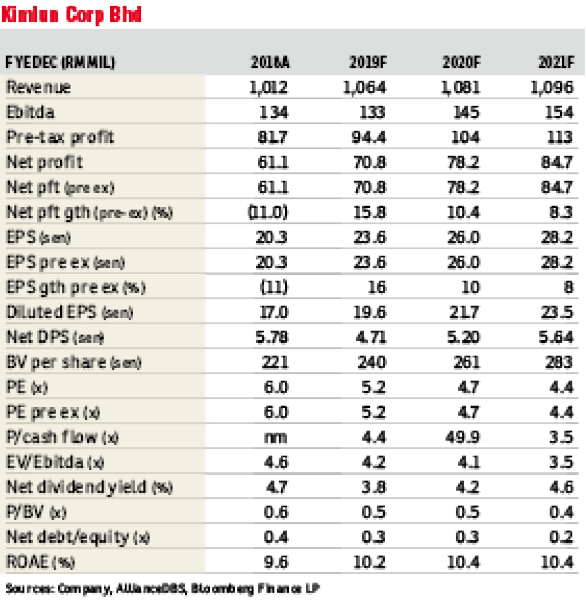

Maintain buy with an unchanged target price (TP) of RM2.16: As we move into the fourth quarter of 2019 and the forecast financial year 2020 (FY20F), we believe that Kimlun Corp Bhd’s manufacturing orders will accelerate. These orders will initially flow from Singapore and eventually Malaysia when some key projects are rolled out.

Its total manufacturing tender book is now at RM500 million which is largely skewed towards projects in Singapore, including Industrialised Building System (IBS) related jobs and Deep Tunnel Sewerage System 2. This does not include orders from the North South Corridor Expressway and Jurong Region Line.

Our FY19F earnings estimates are above consensus. Our forecast of a surge in manufacturing flows from Singapore is intact, with local construction wins likely to come in at the higher end of this forecast. Not enough recognition is given to Kimlun’s high-margin manufacturing business which should command a scarcity premium. Its IBS expertise will be crucial in clinching more local affordable housing projects.

Given its depressed valuations, incremental new orders for Kimlun’s construction and manufacturing segments beyond its total order book of RM2 billion would lift the stock. With its strategically located manufacturing plants in Negeri Sembilan and Johor, we believe it will be the front runner for the Tunnel Lining Segment and Segmental Box Girders portions of major transportation and infrastructure projects when they eventually kick off.

Our TP is set at RM2.16, based on sum-of-parts valuation. We think this better reflects Kimlun’s underlying business model. Its construction business is valued at RM1.62 a share with its manufacturing unit at 54 sen a share.

Low-margin wins is a major risk. The biggest risk is its perceived over-reliance on projects in Johor. This is mitigated by its stringent bidding process, only accepting projects with strong marketability. — AllianceDBS Research, Aug 19

This article first appeared in The Edge Financial Daily, on Aug 20, 2019.

Click here for more property stories.

TOP PICKS BY EDGEPROP

Georgetown UNESCO World Heritage Core Zone

Georgetown, Penang

Georgetown UNESCO World Heritage Core Zone

Georgetown, Penang

Georgetown UNESCO World Heritage Core Zone

Georgetown, Penang

One Cochrane Residences

Kampung Pandan, Kuala Lumpur

Alam Sanjung Serviced Apartment

Shah Alam, Selangor

Laman Anggerik, Nilai Impian

Nilai, Negeri Sembilan

Suria Residence by Sunsuria

Bukit Jelutong, Selangor