PETALING JAYA (Oct 15): The National House Buyers Association (HBA) has called upon the Real Estate and Housing Developers Association (Rehda) to redefine its “outright unrealistic” definition of affordable housing, according to a New Straits Times report.

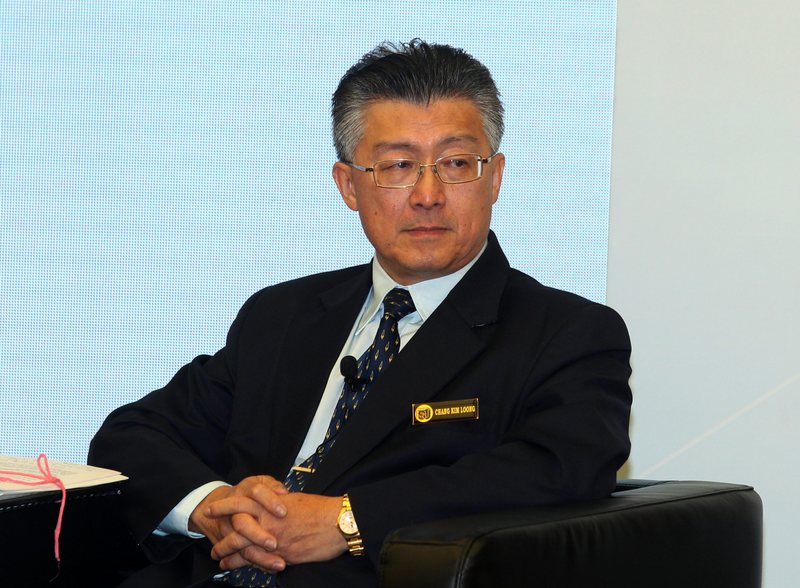

Affordable housing should be priced between RM150,000 and RM300,000 in Kuala Lumpur and offer at least 800 sq ft and two bedrooms, its honorary secretary-general Chang Kim Loong said.

Rehda must lower its threshold of affordably-priced homes, which is currently RM500,000 in KL (see Rehda Institute's proposed affordable housing price tiers here), to better match what those earning the median monthly income can actually afford.

Using figures from the Department of Statistics, he cited the median monthly income in KL as RM9,073 whereas the median income for the whole of Malaysia is RM5,228.

By multiplying the median monthly income in KL by a factor of 3.0 (RM9,073 times 12 months times 3), affordable properties in the city would be priced up to RM326,628.

He said this price was consistent with the HBA's recommendation of RM150,000 to RM300,000 for affordable housing.

In May, Bank Negara Malaysia had also refuted Rehda's affordable housing price range, saying RM282,000 – calculated from the median household income and international Housing Cost Burden Approach – was the maximum price of an affordable home.

Meanwhile, Chang lauded the central bank's proposal to extend the mortgage tenure by five years to 40 years, although he qualified that the move should not burden borrowers and four decades is the absolute maximum period.

“We are not in favour of housebuyers having to 'slave' throughout their life just to own a house,” he said.

He also urged the Housing and Local Government Ministry to set up a focus group with all stakeholders to examine compliance costs and other business costs that have increased housing prices.

TOP PICKS BY EDGEPROP

Elemen Residences @ Tropicana Aman

Telok Panglima Garang, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Periwinkle @ Bandar Rimbayu

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor