YTL Hospitality REIT (Aug 15, RM1.21)

Maintain buy with an unchanged dividend discount model-derived target price (TP) of RM1.32. The report was issued after YTL REIT entered into a conditional sale and purchase agreement with Niseko Village K K, an indirect wholly-owned subsidiary of YTL Corp Bhd for the acquisition of the Green Leaf Niseko Village for a cash consideration of ¥6 billion (RM222.5 million). The property is located in Niseko-cho, Hokkaido, Japan. The 200-room, five-storey hotel was substantially renovated, refurbished and reopened in December 2010.

The acquisition is a related party transaction.

Upon completion of the proposed acquisition, YTL REIT will lease the hotel to the vendor under a 30-year lease agreement, with an option (granted to the vendor) to renew for a further term of 30 years. The initial annual rental payment is ¥315 million for the first five years, with a step-up provision of 5% every five years. The rental translates into an initial gross yield of 5.25%. YTL REIT intends to fund the acquisition via borrowings and internally-generated funds.

We are positive on the acquisition due to the long-term lease of 30 years with option for another 30 years to provide good earnings visibility. The gross yield is at 5.25% and the acquisition is expected to be earnings-accretive in view of the low borrowing cost of around 1% in Japan.

The yen-denominated borrowings will be viewed as a natural hedge for the rental income earned in yen. The acquisition should increase YTL REIT’s gross gearing to 40.3% from 37.4%, which is still viewed as manageable.

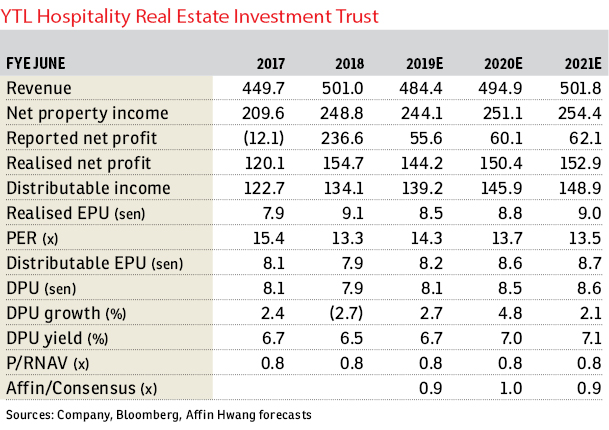

We maintain our earnings forecasts for now, pending completion of the proposed acquisition. At a 6.7% yield based on the forecast earnings for FY19, YTL REIT’s valuation looks attractive. The downside risks include a deterioration in the Australian hotel market, interest rate hikes and strengthening of the ringgit against the Australian dollar. — Affin Hwang Capital, Aug 15

This article first appeared in The Edge Financial Daily, on Aug 16, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor