YTL Corp Bhd (Jan 17, RM1.51)

Maintain buy with a higher target price of RM1.69: We are optimistic about YTL Corp Bhd’s chances to bid for the Kuala Lumpur-Singapore High-Speed Rail’s (HSR) operating company (OpCo) tender. OpCo is one of the three main components of the Kuala Lumpur-Singapore HSR’s structure — project delivery partner (PDP) and assets company (AssetsCo) being the other two. The OpCo tender, once it is called, would be more relevant to YTL Corp, in our view, given its experience in the 45%-owned Express Rail Link Sdn Bhd (ERL) — the sole domestic HSR service concession built at only RM35 million per km — arguably the lowest cost in the region.

We do not expect the OpCo tender to require a significant amount of capital expenditure compared to the AssetsCo, as a typical rail operating and maintenance model does not purchase the rolling stock and would mainly generate fare and non-fare revenues once the HSR is in operations. As such, the OpCo would therefore be the most relevant tender for YTL Corp’s ERL, given ERL’s 14-year track record in operating its 57km HSR service (both direct airport express and transit service).

While ERL’s chief executive officer has highlighted in an interview with Nikkei Markets that the company will be tendering for the Kuala Lumpur-Singapore HSR’s OpCo, we also gather that at the group level, YTL Corp, via its joint venture (JV) that is vying for a substantial package of the RM8.9 billion Gemas-Johor Bahru rail double-tracking project, would also be keen to bid for the PDP domestic portion of the Kuala Lumpur-Singapore HSR civil work. Alternatively, securing the Kuala Lumpur-Singapore HSR civil work portion is also a possibility given YTL Corp’s RM2.4 billion ERL construction track record.

YTL Corp has now emerged as one of the five known JV/consortiums that are bidding for the PDP, OpCo, and AssetsCo tenders for the Kuala Lumpur-Singapore HSR project. While it remains to be seen if YTL Corp or 45%-owned ERL would be looking to rake in foreign partners for the Kuala Lumpur-Singapore HSR tenders, we believe the group would be leveraging its existing domestic partnerships. ERL is currently 45% owned by YTL Corp, 36% by Lembaga Tabung Haji, 10% by SIPP Rail Sdn Bhd, and 9% by Trisilco Equity.

Even excluding Kuala Lumpur-Singapore HSR, the group is targeting a significant jump in outstanding order book of up to RM12 billion (RM400 million currently). While the press recently reported that the group had secured the RM8.9 billion Gemas-Johor Bahru rail project contract (via a JV with SIPP Rail), the group has yet to make an official announcement, which we suspect, is pending the finalisation of the details of the contract.

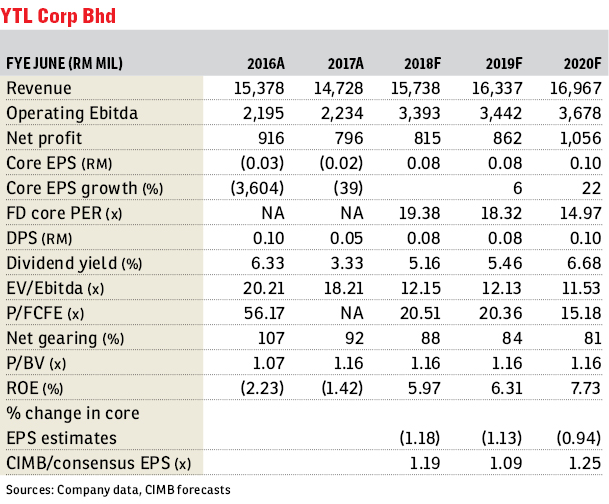

We trim financial year 2018 (FY18)-FY20 earnings per share forecast due to housekeeping. However, we raise our revalued net asset valuation (RNAV)-based TP as we narrow our RNAV discount from 20% to 10% to reflect the renewed construction outlook in 2018. — CIMB Research, Jan 16

This article first appeared in The Edge Financial Daily, on Jan 18, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

One Cochrane Residences

Kampung Pandan, Kuala Lumpur