Ibraco Bhd (Oct 9, no transaction)

Reiterate hold with an unchanged target price of 94 sen: In February, Ibraco Bhd unveiled its first property development outside Sarawak, namely The Continew (GDV: RM415 million) in Kuala Lumpur. It is a mixed development featuring four units of three-storey commercial shop/retail outlets, 30 units of retail/office space and 510 serviced apartments. Priced at RM900 psf, we note it is attractive as compared to surrounding projects that are generally priced at RM1,000 psf onwards.

In terms of take-up rate, we gather that it is now 49% sold. In September, Ibraco proposed to buy four parcels of vacant leasehold land in Petaling Jaya, Selangor, for RM37.4 million (or RM220 psf) to further build up its presence in the Klang Valley. Measuring a total of 15,811.16 sq m, the land is strategically located along the New Pantai Expressway.

Assuming an efficiency ratio of 75% and an average selling price of RM600 psf to RM700 psf, the land, which comes with a plot ratio of four times, could potentially generate a GDV of RM306 million to RM357 million. This is expected to boost the group’s outstanding GDV by about 5% to about RM6 billion.

On the construction front, the group has secured a contract to build a new airport in Mukah, Sarawak, for RM302.6 million in July. Note that the airport job is only the second public construction contract Ibraco has won since the construction unit was set up in 2002.

Nevertheless, we believe Ibraco is capable of handling the project, given that its construction unit has a proven track record of carrying out earthwork, civil, building and structural works for residential, commercial and industrial projects. We gather that the construction work commenced in August and it is expected to be completed within 36 months from the date of commencement.

According to management, the group will start recognising revenue from this contract in the fourth quarter ending Dec 31, 2017 (4QFY17), in the region of 10% to 15% of the project sum (RM30 million to RM45 million). Going forward, the group will continue to actively bid for construction and infrastructure projects offered by the government as well as the private sector. Overall, we are positive on the group’s diversification strategy to further grow its construction division which has only been focusing on the group’s in-house development in the past.

Besides construction and property development, it has recently ventured into another new segment — education services. Last week, the group announced that it has teamed up with HELP Education Services Sdn Bhd to offer education at the primary, secondary and pre-university levels.

For a start, we understand that the group will allocate approximately RM55 million to RM60 million for this new business segment over a development period of two years. We believe that this would diversify the group’s source of income as well as enhance the value of its upcoming launches within its new township, Northbank, in Kuching. Ibraco is working with HELP to set up an education centre in the development.

Ibraco prefers to keep its gearing ratio below 50%. Based on the group’s net debt level of RM137 million or net gearing ratio of 0.4 times as at June 2017, the new land acquisition and the estimated capital expenditure for the education business would increase Ibraco’s net gearing to approximately 0.6 times, assuming a 70/30 debt-equity ratio. We believe a strong capital position supports Ibraco’s future development and expansion plans as it embarkes on its next phase of growth. In view of heavy capital requirements, we do not discount the possibility of raising fresh equity to strengthen its balance sheet.

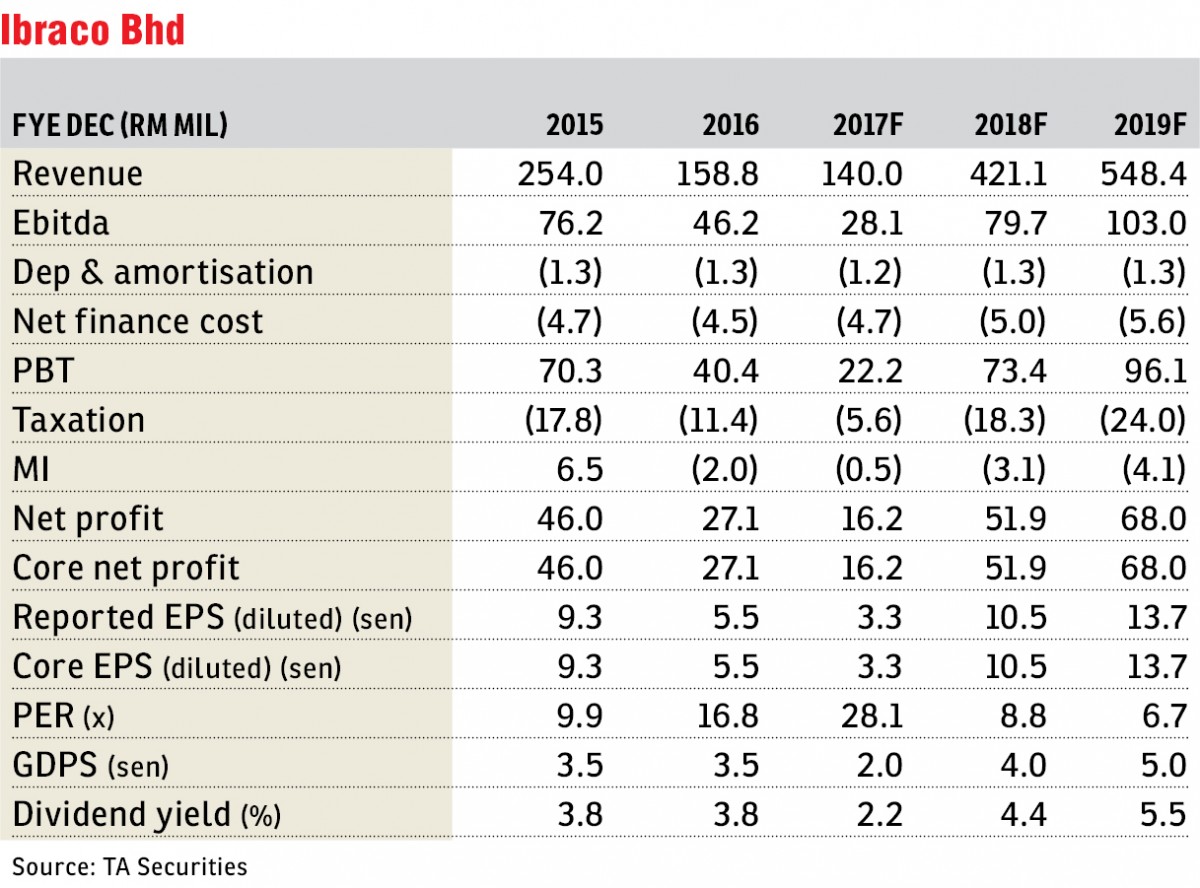

To recap, Ibraco recorded RM228.6 milion new sales in the first half of 2017. This came in within our FY17 sales assumption of RM356 million and tracked management’s sales target of RM350 million. As the pipeline launches are largely within our projections, we make no change to our FY17 to FY19 earnings estimates. Unbilled sales of RM291 million should sustain the group’s earnings for about two years. Our FY17/FY18/FY19 sales assumptions are RM356 million/RM440 million/RM550 million respectively. — TA Securities, Oct 9

This article first appeared in The Edge Financial Daily, on Oct 10, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Residensi Xtreme Meridian (Astoria Ampang)

Ampang, Kuala Lumpur

Aira Residence

Damansara Heights, Kuala Lumpur

Harmoni Apartment @ Eco Majestic

Semenyih, Selangor

Harmoni Apartment @ Eco Majestic

Semenyih, Selangor