Yes, residential units seem to be getting smaller, reflecting the shrinking size of the family unit. But if you think the family should stay together even after your children are married and have their own families, you may be looking for a sizeable property that offers enough space for each extended family to set up their own home within the home.

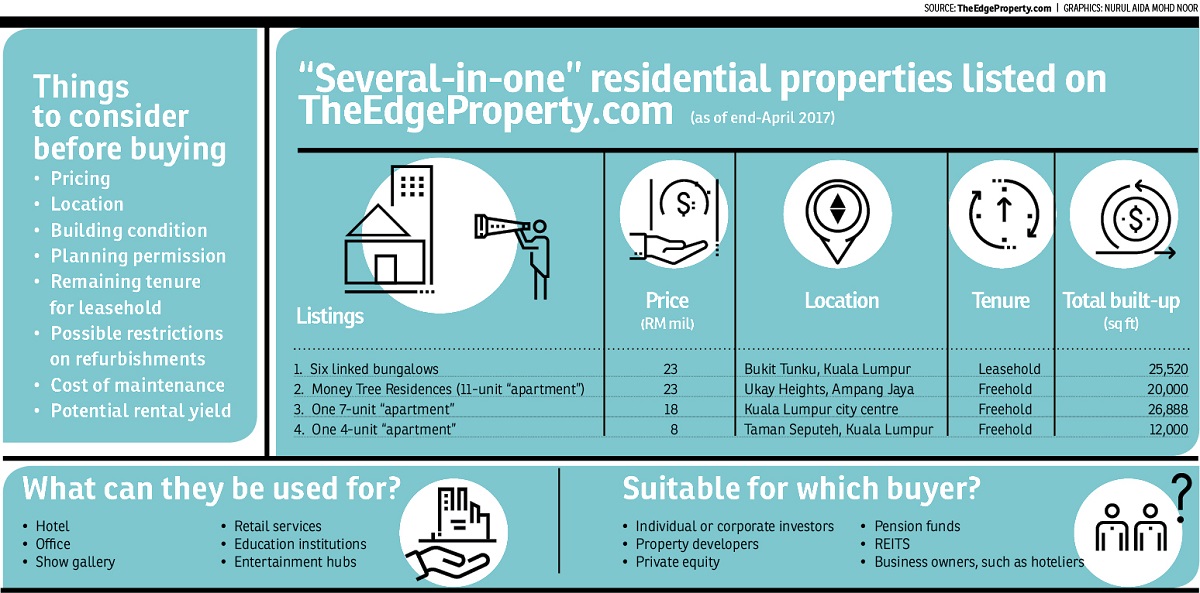

TheEdgeProperty.com found a handful of listings on the portal that could be right up your alley as the properties listed offer several “units” within the property with single ownership. These properties could also be suitable for an investor looking to rent out the extra space.

Although rare, among such “en-bloc sales” in Kuala Lumpur was the Cempenai Parc Residence in upmarket Damansara Heights, which was concluded in 2011 with a price tag of RM23 million.

Other similar sales in the past include the Chek Tan Terrace Condominium in Datuk Keramat, which was sold in 2009 at RM22.5 million and Villa Putra Putri in Taman U-Thant with a land area of 220,000 sq ft, which fetched RM30 million.

These type of properties usually have large built-ups and larger-than-usual land sizes for a single residential landed property. Hence, if the building is considerably old and located in a prime area, the land value precedes the building itself and could be ideal for redevelopment.

Laurelcap Sdn Bhd’s director Stanley Toh tells TheEdgeProperty.com that when a building has reached the end of its economic lifespan, what the buyers pay for is mainly the land portion. The buyers, usually property developers or investors, often eye the potential value of the land more than the building on it.

“As the density of an area grows, the development planning will also need to change. In addition, when a building has reached its economic life span, redevelopment can take place,” he says.

Maxland Real Estate Agency senior negotiator Frankie Tham says it is a natural progression for property developers to purchase land with existing buildings to be redeveloped due to land scarcity. (see sidebar) “If developers wish to build in prime city locations, where raw vacant land is scarce, acquiring old properties sited on large tracts of land would be viable options for them,” he adds.

Besides property developers, other property investors may also acquire the property to tap on future value appreciation of the prime site. These unique properties that offer multi-“units” within a unit may also appeal to entrepreneurs or small business operators who could refurbish the property for businesses such as cafes, showrooms or boutique hotels.

Available for sale

Among such residential properties that mimic stratified properties was one listed for sale on TheEdgeProperty.com and sold recently. The 3-storey building known as Bekay Court is located on a 65,046 sq ft site at Lorong Enau, KL. It has been on the market since 2015. According to a real estate agent, the more-than 20-year-old property owned by an individual comprises 27 walk-up “apartment” units. It was sold to an investor from China early this year for RM43 million.

Currently still available for sale is another property with eight units located in Ampang Hilir on a land area of 18,000 sq ft that is asking for RM20 million.

Another listing featured is a 7-unit apartment-like property located near KL city centre, which is asking for RM18 million. The owner had initially built the property with the intention of having all his children stay with their parents but his children ended up deciding to stay elsewhere.

The “apartment” comes with European imported fittings. According to agent L K Ong from Reapfield Properties Sdn Bhd, the bank valuation for this apartment is just slightly below the asking price.

He says the property has the potential to be turned into offices or a nursing home. However, the potential seems to have escaped many as he has not received many enquiries on it.

If you prefer bungalows or landed properties, real estate agent Yvonne Chong from Tech Realtors Properties Sdn Bhd says she is currently selling a “6-linked bungalows in one” residential property located in Bukit Tunku or Kenny Hills. She says the owner had also originally planned to have all his children stay in the linked bungalows but realised later that his children had different plans.

“These are brand new bungalows designed in Balinese style. Things just did not turn out as planned so the couple ended up putting the six-in-one bungalow on the market,” she explains. However, she points out that this is not a fire sale as the owner is in no hurry to cash out, but is looking for a suitable buyer who appreciates such an unusual property.

The linked bungalows are located on a 34,018 sq ft leasehold site with a total gross built-up area of 25,520 sq ft or 4,253 sq ft for each unit. The 6-linked bungalows now carry a price tag of RM25 million.

In Taman Seputeh, there is a three-storey residence designed like a four-unit apartment that can house four families. According to the agent who is handling the sale of this property, the owner had faced a similar predicament as he had bought the old building, refurbished it and invited his family members to stay together but the plan did not materialise.

Waiting for suitable buyers

Although there are some good deals in the current market, Laurelcap’s Toh says there are no fire sales yet.

For buyers, Toh says they may want to consider the investment potential of such “multi-unit in one” properties for rental yield or the future capital appreciation of its land value.

Nevertheless, he believes most buyers would redevelop the asset in order to churn some returns on their investment in a shorter term.

“For individuals with resources and who knows how to manage such properties, they could consider buying for rental returns.”

Things to look out for

When buying such buildings especially when they are old, besides price and location, Toh advises one to also check the building condition, planning permission and the surrounding environment as well as future developments nearby.

Meanwhile, Maxland’s Tham offers other considerations such as the property type, the tenancy lease and rental yield if any, availability of car parks, tenure of the land and land title, the restrictions or by-laws and guidelines of the local authorities on renovations and redevelopment.

He stresses that buyers also need to gauge the cost of maintenance if they intend to repurpose the building.

“For developers, cost and redevelopment potential of the land, its feasibility to be redeveloped with higher plot ratio or conversion of land use or rezoning to achieve higher development values would be their main considerations,” adds Tham.

Opportunity in redevelopment

Maxland Real Estate Agency senior negotiator Frankie Tham notes numerous established and ongoing projects by property developers and investors (local and foreign) on prime land in Kuala Lumpur’s Golden Triangle resulted from acquisitions of land with existing old buildings on them.

One example is The Intermark mixed commercial development which was formerly the Empire office tower, City Square shopping mall, Crown Princess Hotel and Plaza Ampang.

Some school land has also been acquired and turned into luxury residential developments, such as St Mary’s School land where the St Mary Residences by E&O Bhd (in joint venture with Lion Group) now stands.

“In Petaling Jaya, the older industrial areas have seen some new redevelopment projects. For instance, the former Jaya Supermarket shopping mall at Section 14 has been redeveloped as the new Jaya Shopping Centre and the industrial area of Section 13 has seen new commercial developments, such as Jaya One, Jaya 33, Plaza 33 and Centrestage PJ.

“Over at Damansara Jaya, there is the redevelopment of the old Atria shopping centre into a mixed commercial development with Atria Shopping Gallery and SoFo suites,” he adds.

There are some future developments worth taking note of including the Lai Meng School land located along Jalan Ampang, which was acquired by Magna Prima Bhd and has been approved for a mixed commercial development.

While some redevelop, others refurbish the property. One example was Wisma Shun Li in Old Klang Road in KL. The mixed development has been turned into high-end serviced apartments after Bukit Kiara Properties Sdn Bhd bought over the building and redeveloped it into VERVE Suites KL South.

“It all boils down to the pricing, as there must be room for the new owner to sell at a higher price, or to renovate the units and sell it at a profit,” says Tham.

This story first appeared in TheEdgeProperty.com pullout on May 26, 2017. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Sungai Kapar Indah Industrial Zone

Kapar, Selangor

The Fennel @ Sentul East

Sentul, Kuala Lumpur

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Southbank Residence

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor