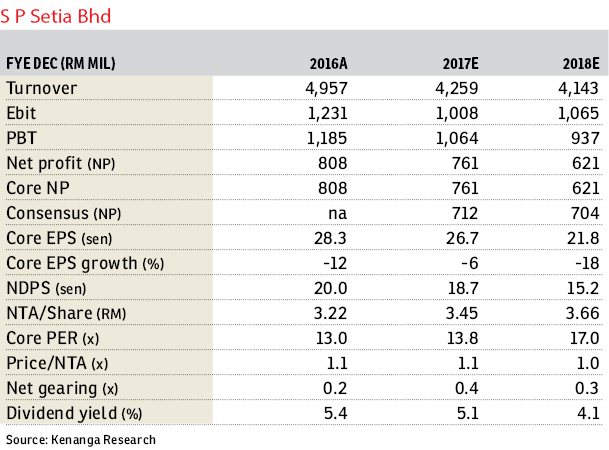

S P Setia Bhd (April 19, RM3.65)

Reiterate outperform with a higher target price (TP) of RM3.86:

S P Setia successfully tendered for 4.6 acres (1.86ha) of leasehold land along Toh Tuck Road, Singapore for S$265 million (RM847.6 million) from the Urban Redevelopment Authority. The acquisition is expected to be completed by the third quarter of 2017.

The land has a maximum permissible gross floor area of 0.28 million sq ft for a five-storey condominium with 327 units. It is located near Bukit Timah with the nearest MRT station 650m away.

The project has a gross development value (GDV) of S$457 million which is expected to be launched in the financial year 2018 (FY18) with a five-year development period which would be the group’s third Singapore project.

The land cost to GDV ratio is at 58% which is fair as land cost tends to make up 55% to 65% of GDV in Singapore. The acquisition will mainly be funded by borrowings and internal funds.

We expect FY17 net gearing to increase to 0.36 times from 0.30 times which is still at a comfortable level. Note that our estimates already accounted for the completion of the Seberang Prai and Bangi lands.

The project raises our fully diluted revalued net asset value by one sen to RM5.73. Overall, we are “neutral” to slightly positive on the announcement as the group is aggressively replenishing its overseas drivers.

Last week, the group signed an memorandum of intent to acquire I&P Group Sdn Bhd from PNB and ASB for RM3.50 billion to RM3.75 billion. Finalisation of the acquisition price and funding structure will be made known in three months’ time.

Given S P Setia’s ambition to achieve the RM15 billion market capitalisation size for inclusion in the FBM KLCI, we believe a one-for-two rights issue is likely. We view the acquisition positively. — Kenanga Research, April 19

This article first appeared in The Edge Financial Daily, on April 20, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Teega Residences, Puteri Harbour

Kota Iskandar, Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Sungai Kapar Indah Industrial Zone

Kapar, Selangor

Long Branch Residences

Kota Kemuning, Selangor

SS 21, Damansara Utama

Petaling Jaya, Selangor

Eco Botanic

Iskandar Puteri (Nusajaya), Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)