S P Setia Bhd (April 17, RM3.67)

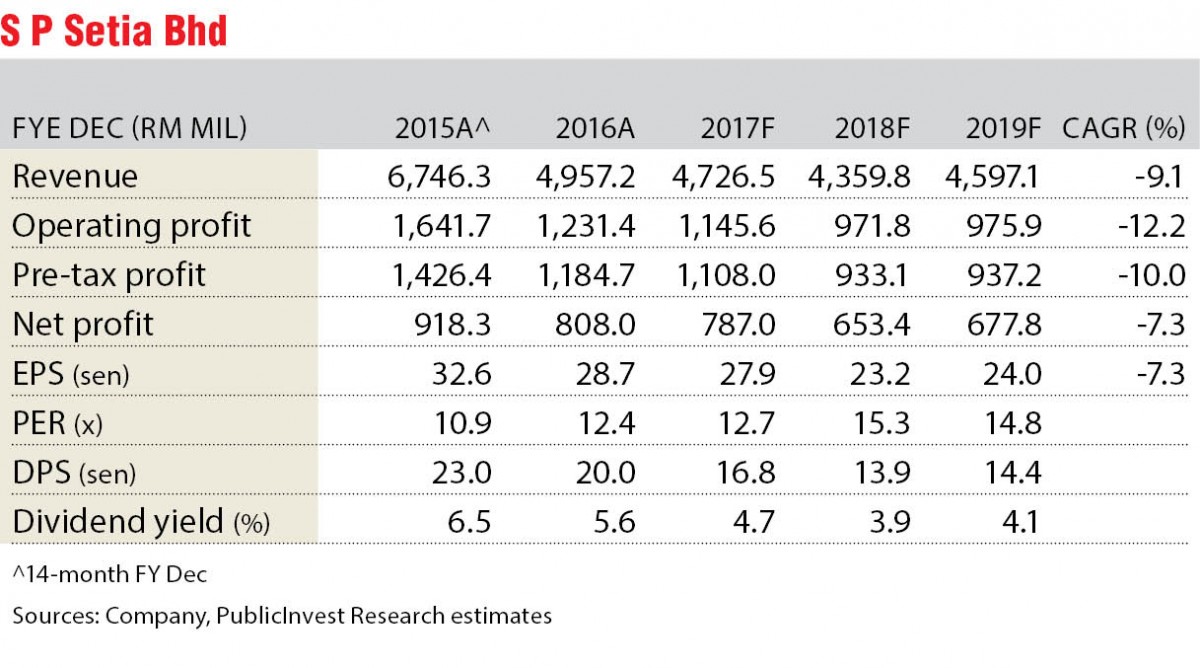

Maintain outperform with an unchanged target price of RM4.15: The market chatter that first surfaced in 2014 to merge all the property companies under PNB’s portfolio could finally happen. Instead of merging S P Setia Bhd, Island & Peninsular Sdn Bhd (I&P) and the property businesses of Sime Darby Bhd, S P Setia announced that it had entered into a memorandum of intent to only acquire I&P however. Concurrently, it also announced the acquisition of a 342.5-acre (138.6ha) plot of land in Bangi from a subsidiary of PNB. The corporate exercise, if it materialises, would substantially increase S P Setia’s land bank from 5,218 acres to 9,481 acres, making it the third largest in the country and would make it the largest listed property developer in the country.

The indicative I&P acquisition is estimated to be within the range of RM3.50 billion to RM3.75 billion while the Bangi land is expected to cost RM447.6 million (or RM30/sq ft) plus as a share of future profit before tax from development of up to RM3/sq ft. We are positive about the deal as it would fast track its land bank expansion plan and potentially enhance its market capitalisation to be included as one of the FBM KLCI component stocks. With the proposed acquisition cost for I&P only constituting around 9% to 10% of the estimated gross domestic value, we believe the deal should be value-accretive.

I&P is said to own 4,263 acres of land bank located in the Klang Valley, Selangor, Johor and Melaka. The profit after tax and minority interest for financial year 2013 (FY13), FY14 and FY15 are RM304.7 million, RM276.3 million and RM213.5 million respectively with zero net gearing. The financial performance is respectable in our view and also a good indicator of the marketability of I&P’s land bank. In addition, we understand the location of I&P’s land bank is within the growth areas in the Klang Valley and Johor and complements with S P Setia’s existing projects. The proposed deal is expected to be financed by equity, internally generated funds and borrowing.

The deal is expected to cost RM3.5 billion to RM3.75 billion, by assuming development profit of about 15% to 20%; the estimated development profits from I&P’s land bank is RM3.8 billion to RM4.7 billion or about RM0.3 billion to RM1 billion of surplus development profits. Additionally, we believe S P Setia could command higher selling prices due to its strong brand equity. — Public Investment Bank Research, April 17

This article first appeared in The Edge Financial Daily, on April 18, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor