Gamuda Bhd (March 24, RM5.29)

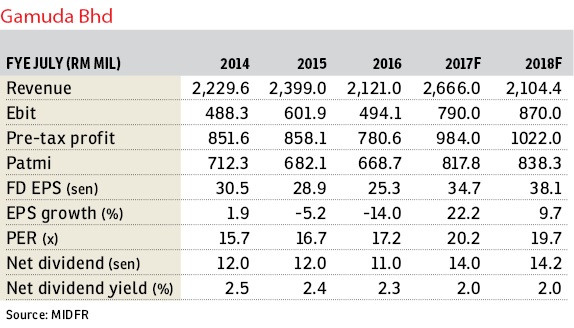

Downgrade to neutral with an unchanged target price (TP) of RM5.50: Gamuda’s six months (6MFY2017) profit after tax and minority interest (Patami) came in higher at RM1.35 billion (30.6% year-on-year [y-o-y]), reflecting strong recovery from all key segments. Its 6MFY2017 cumulative earnings were rather disappointing, meeting only 40% and 47% of ours and street’s expectations of full-year forecasts respectively.

Earnings momentum is overdue with net profit chalking up only RM328.4 million (2.2% y-o-y). The compression in its bottom line was largely due to the fallow period of project awards. In contrast, property division’s revenue bucked the trend by growing from RM359.3 million in 6MFY2016 to RM515 million in 6MFY2017 (43.3% y-o-y) driven by sales pickup from Gamuda and Celadon City in Ho Chi Minh City. (We have reasoned that property sales from Vietnam will make a comeback).

Key drivers would continue to be the construction segment but property will make a comeback. We are expecting our RM2 billion target of order book replenishment to be met this year from Light Rail Transit 3 and Gemas-Johor Bahru double tracking projects. Hence, we make no changes to our earnings estimates.

Having said that, we reckon that overseas property sales from Gem Residences in Toa Payoh, Singapore and 661 Chapel Street, Melbourne projects will make a comeback. We are expecting the projects will contribute circa RM81 million to our earnings forecast this year.

We downgrade our recommendation to “neutral” with a TP of RM5.50 per share based on sum-of-parts valuation supported by prospective price earnings ratio (PER) of 18 times which is on the higher end of our big-cap construction 14 times to 19 times PER range. The change in our recommendation is reflected by the surge in Gamuda’s share price (+11.2% year to date). — MIDF Research, March 24

This article first appeared in The Edge Financial Daily, on March 27, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Seksyen 17, Petaling Jaya

Petaling Jaya, Selangor