IJM Corp Bhd (March 15, RM3.40)

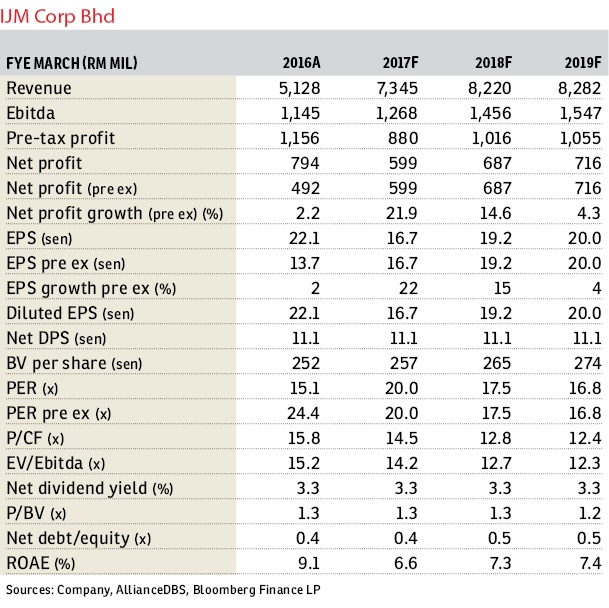

Maintain hold with an unchanged target price of RM3:30: We acknowledge IJM Corp Bhd’s strong management and execution track record. Its strong balance sheet enables it to fund and participate in larger-scale projects without having to raise equity. Nonetheless, given its diversified nature and record order book, additional incremental wins may not be an added catalyst for the stock. We think better earnings delivery would be a more important catalyst for the stock. But this may be difficult to achieve in the near to medium term given a still-soft property market, lower throughput for Kuantan Port given the moratorium on bauxite and drag from additional amortisation charges for its newer concessions.

Its peak quality order book of RM8.7 billion incorporates the recent Bukit Bintang City Centre development project win and can provide solid earnings visibility over the next two to three years; but this may also limit the group’s ability to take on other large-scale projects. Going forward, we expect incremental project wins to be sizeable at a minimum of RM500 million per contract and are likely to be margin enhancing. The company’s diversified and defensive nature also makes it a less attractive bet to potentially capitalise on more contract flows with the rollout of the 11th Malaysia Plan. We estimate every RM1 billion increase in new contract wins (versus our base case) would only raise financial year 2018 (FY2018) earning per share by less than 2%.

The focus for property will be on selling existing inventory by offering rebates, while future launches will be targeting the more affordable segment. This may be a dampener on margins in the near term. We expect IJM to end FY2017 with property sales of RM1.4 billion, flat year-on-year. It still has unbilled sales of RM1.76 billion, which implies decent visibility over the next one to two years. — AllianceDBS Research, March 15

This article first appeared in The Edge Financial Daily, on March 16, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Mayfair Residences @ Pavilion Embassy

Keramat, Kuala Lumpur

Semenyih Lake Country Club

Semenyih, Selangor

Oxford Residences @ Pavilion Embassy

Keramat, Kuala Lumpur

Oxford Residences @ Pavilion Embassy

Keramat, Kuala Lumpur

Oxford Residences @ Pavilion Embassy

Keramat, Kuala Lumpur