UEM Sunrise Bhd (March 14, RM1.23)

Maintain hold call with a target price (TP) of RM1.18: UEM Sunrise Bhd has proposed a disposal of 4.9 acres (1.98ha, 213,600 sq ft) of freehold land in Richmond in British Columbia, Canada, to a company related to South Street Development Group, by its wholly-owned subsidiary UEM Sunrise (Canada) Alderbridge Ltd for a total consideration of C$113 million (about RM372.6 million).

The property was acquired back in April 2014 at a cost of C$70.2 million with a planned gross development value (GDV) of C$516.9 million. The deal is expected to be completed by the third quarter of financial year 2017 (3QFY2017).

We are positive on the news as the estimated outright gain of about RM150 million on the sale of the land is higher than our previously imputed net present value (NPV) of RM51 million based on more conservative parameters. The book value of the subject land was C$72 million as at end-FY2015.

The pricing works out to be C$529 per sq ft (psf), translating into a gain of about 61% compared with the acquisition price of C$329 psf.

While the proposed land sale will reduce our group effective total GDV by 0.6%, the incremental NPV of about RM100 million will increase our estimated revised net asset value (RNAV) per share by 0.7% or two sen per share.

Furthermore, the estimated realised gain is immediate compared with the uncertainty associated with the initial planned mixed development that was expected to be realised over the next 10 years.

In line with the group’s strategy, the sale of the land in Canada will enable UEM Sunrise to concentrate on the domestic market in Malaysia and international market in Australia.

Despite trading at a steep discount to its RNAV, we see lack of near-term catalyst with a subdued sentiment for property outlook in Johor.

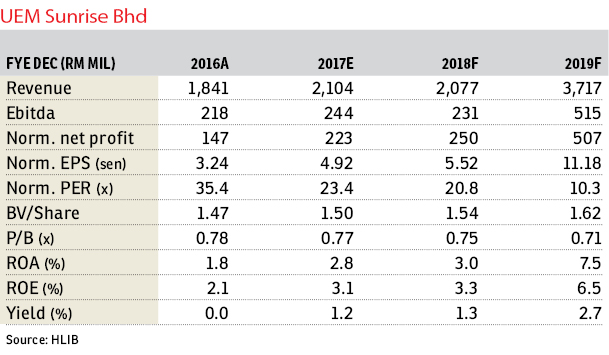

We maintain our “hold” call with a higher TP of RM1.18 by applying a lower discount of 60% to RNAV of RM2.95 following the increasing news flows on the property landscape in Johor. — Hong Leong Investment Bank Research, March 14

This article first appeared in The Edge Financial Daily, on March 15, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Springhill

Port Dickson, Negeri Sembilan

Elmina Green Three @ City of Elmina

Sungai Buloh, Selangor

Taman Desa Anggerik, Bandar Baru Nilai

Nilai, Negeri Sembilan

Setia Indah

Setia Alam/Alam Nusantara, Selangor