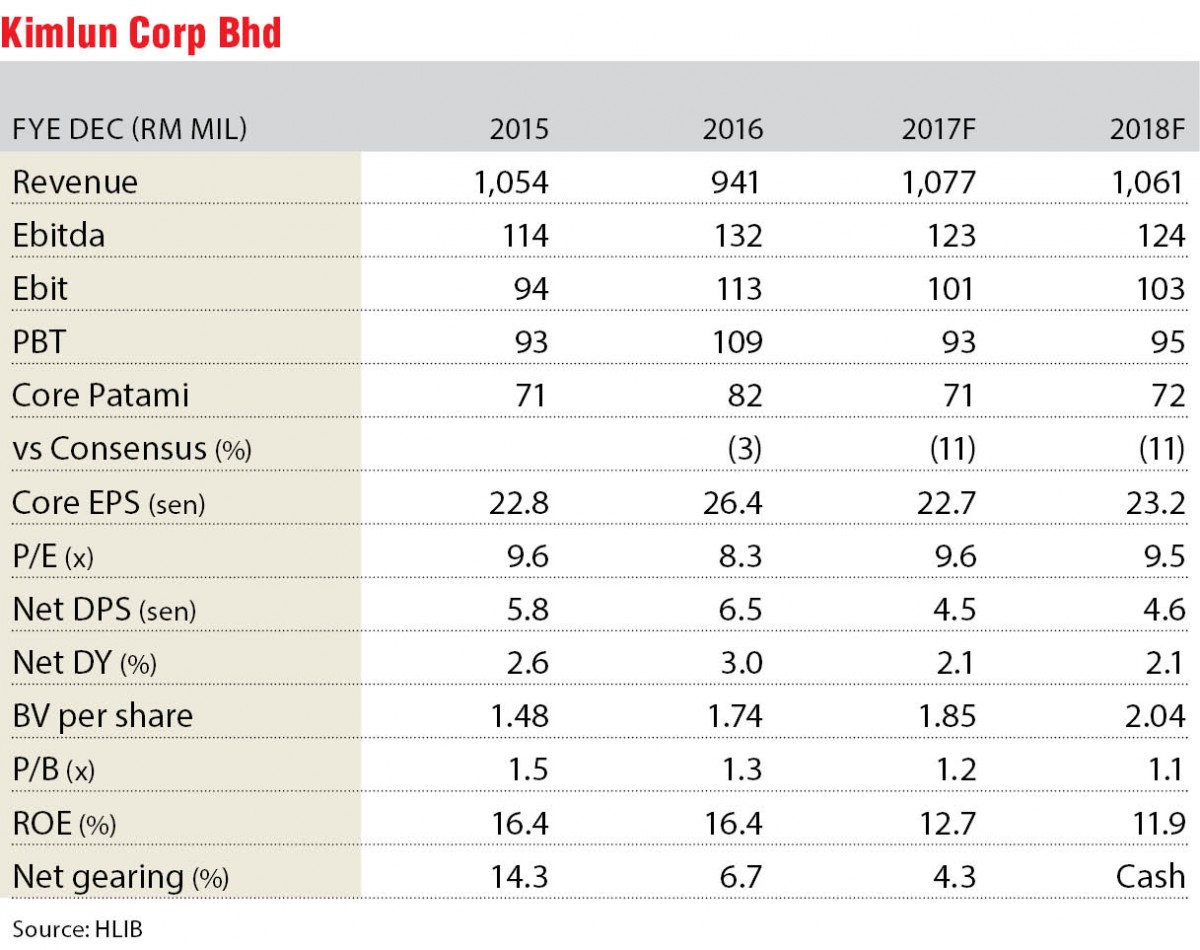

Kimlun Corp Bhd (March 10, RM2.17)

Downgrade to hold with a lower target price of RM2.27: Kimlun Corp Bhd posted record earnings for its financial year 2016 (FY16) with RM81.9 million (up 16% year-on-year [y-o-y]). The strong showing was attributed to y-o-y margin expansion for both construction (recognition of variation orders) and manufacturing (more Singapore deliveries as opposed to mass rapid transit Line 1 [MRT1], which had lower margins). Kimlun’s order book currently stands at RM1.9 billion, comprising RM1.7 billion for construction and RM260 million for manufacturing. This translates into an overall cover of 2.1 times on FY16 revenue, which is healthy considering the relatively fast turnaround nature of its jobs.

In view of the soft property market, Kimlun will focus more on non-residential jobs such as hospitals, malls, education facilities and religious buildings and infrastructure-based projects (highways and refinery and petrochemical integrated projects). It will continue to further reduce its dependency on Iskandar Malaysia for jobs given the soft property market there. Overall, management is comfortable to achieve new job wins of RM600 million to RM700 million for FY17. However, this could surprise on the upside should Kimlun manage to secure chunky jobs such as the light rail transit Line 3, where it has been invited to bid for two viaduct packages.

For the MRT2, production of segmental box girders has commenced while tunnel lining segments will begin in the second quarter of FY17. As production for the MRT2 is still in the early stage, this may be insufficient to make up for the SMRT Thompson Line in which deliveries are hitting its tail end. To help make up for this, Kimlun is actively bidding for other industrialised building systems orders and jacking pipes in Singapore.

We cut FY17 to FY18 earnings forecasts by 6% and 4% respectively after imputing normalisation of construction margins and potential timing gap for manufacturing. While FY16 was a record year, we expect earnings to decline by 14% in FY17 driven by the abovementioned factors. — HLIB Research, March 10

This article first appeared in The Edge Financial Daily, on March 13, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Taman Mutiara Bestari, Skudai

Johor Bahru, Johor

The Hills, Horizon Hills

Iskandar Puteri (Nusajaya), Johor

The Hills, Horizon Hills

Iskandar Puteri (Nusajaya), Johor

East Ledang

Iskandar Puteri (Nusajaya), Johor

The Astaka @ 1 Bukit Senyum

Johor Bahru, Johor

The Astaka @ 1 Bukit Senyum

Johor Bahru, Johor