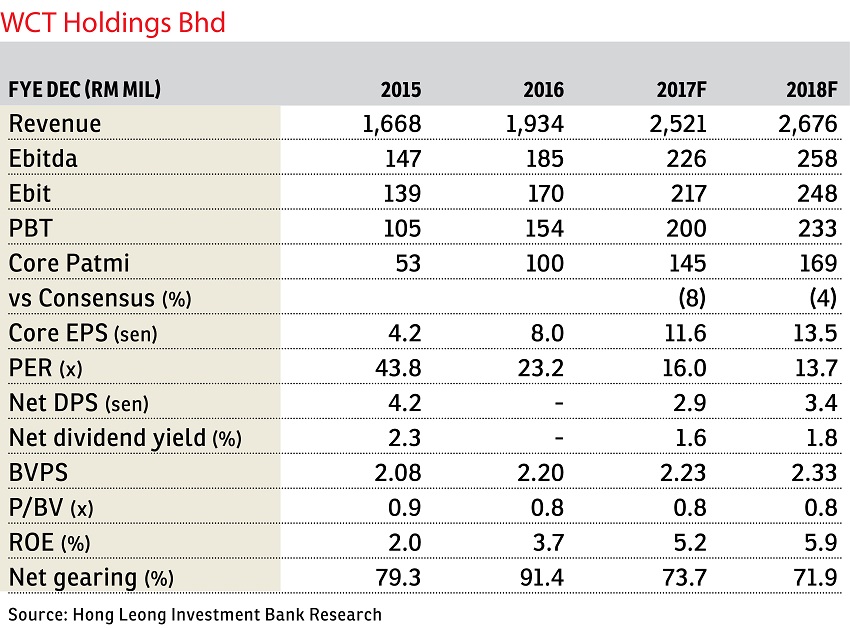

WCT Holdings Bhd (Feb 27, RM1.84)

Maintain hold with a target price (TP) of RM1.97: WCT Holdings Bhd’s order book currently stands at RM5 billion, an all-time high which translates into a strong cover ratio of 3.2 times on financial year 2016 (FY2016) construction revenue. Looking ahead, management is targeting to add RM2 billion in new job wins this year. It has submitted RM2.5 billion in tenders and has another RM2.5 billion to RM3 billion which is under preparation.

After adjusting for extraordinary items, WCT’s construction earnings before interest and tax margins remained thin at 3.8% (FY2015: 3.7%). Management guides that this should improve in FY2017 as more infrastructure-based jobs are executed versus building-related ones. We were made to understand that historically, WCT garnered higher margins from infrastructure jobs given its forte in that segment. Currently, 84% of its order book comprises infrastructure-related jobs. Management indicated that it had sufficient capacity to secure more infrastructure contracts.

In efforts to de-gear, WCT is in the midst of exploring the possible sale of its AEON BBT and Paradigm malls. It is currently in talks with both a real estate investment trust (REIT) and fund for the potential sale. Previous indications were that WCT is looking at a price tag of RM500 million for AEON BBT and RM700 million for Paradigm. We do not discount the possibility of a disposal to Pavilion REIT (“hold”; TP: RM1.77) given that its common major shareholder with WCT is Tan Sri Desmond Lim.

Despite having no new launches slated for FY2017, management is targeting for property sales of RM500 million. This is solely derived from existing and incoming inventory amounting to around RM1 billion. To drive sales, WCT will be offering attractive rebates and incentives for developments with low land cost (example: Klang). However, we feel that its target of RM500 million will be a Herculean task given the soft property market conditions. Putting things into perspective, even with new launches, WCT only managed to hit RM281 million in sales for FY2016 versus its initial target of RM600 million. — Hong Leong Investment Bank Research, Feb 27

This article first appeared in The Edge Financial Daily, on Feb 28, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Residensi Aman Bukit Jalil

Bukit Jalil, Kuala Lumpur

Harmoni Apartment @ Eco Majestic

Semenyih, Selangor

D'Cassia Apartment @ Setia EcoHill

Semenyih, Selangor

D'Cerrum Apartment @ Setia EcoHill

Semenyih, Selangor

Country Heights Kajang

Country Heights, Selangor

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

SkyLuxe On The Park @ Bukit Jalil

Bukit Jalil, Kuala Lumpur

SkyLuxe On The Park @ Bukit Jalil

Bukit Jalil, Kuala Lumpur