IT is only the second month into 2017, but Perbadanan PR1MA has already announced policy changes and introduced a special financing scheme for its 1Malaysia People’s Housing (PR1MA) programme in order to “enable more people to own a house under the programme,” it had said.

IT is only the second month into 2017, but Perbadanan PR1MA has already announced policy changes and introduced a special financing scheme for its 1Malaysia People’s Housing (PR1MA) programme in order to “enable more people to own a house under the programme,” it had said.

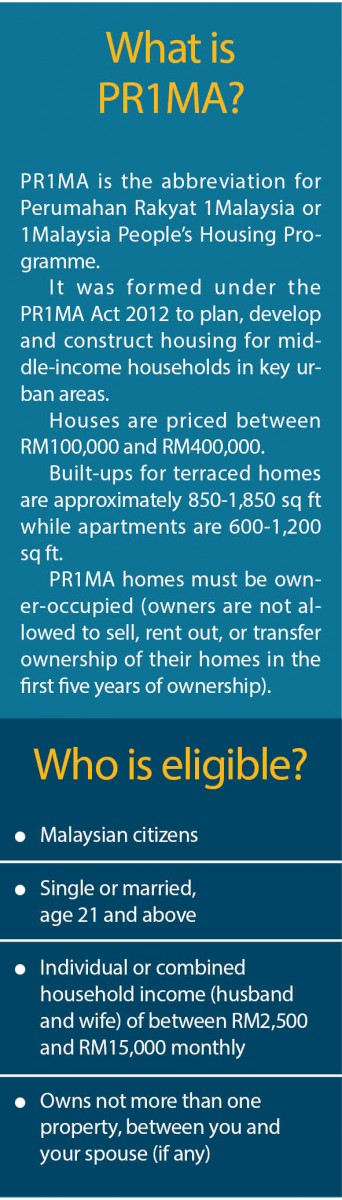

In January, Prime Minister Datuk Seri Najib Razak spoke of two changes to PR1MA. One was to raise the eligibility level from a household income level of RM10,000 to RM15,000 and the second was to shorten the moratorium on PR1MA house sale and rental from 10 years to five.

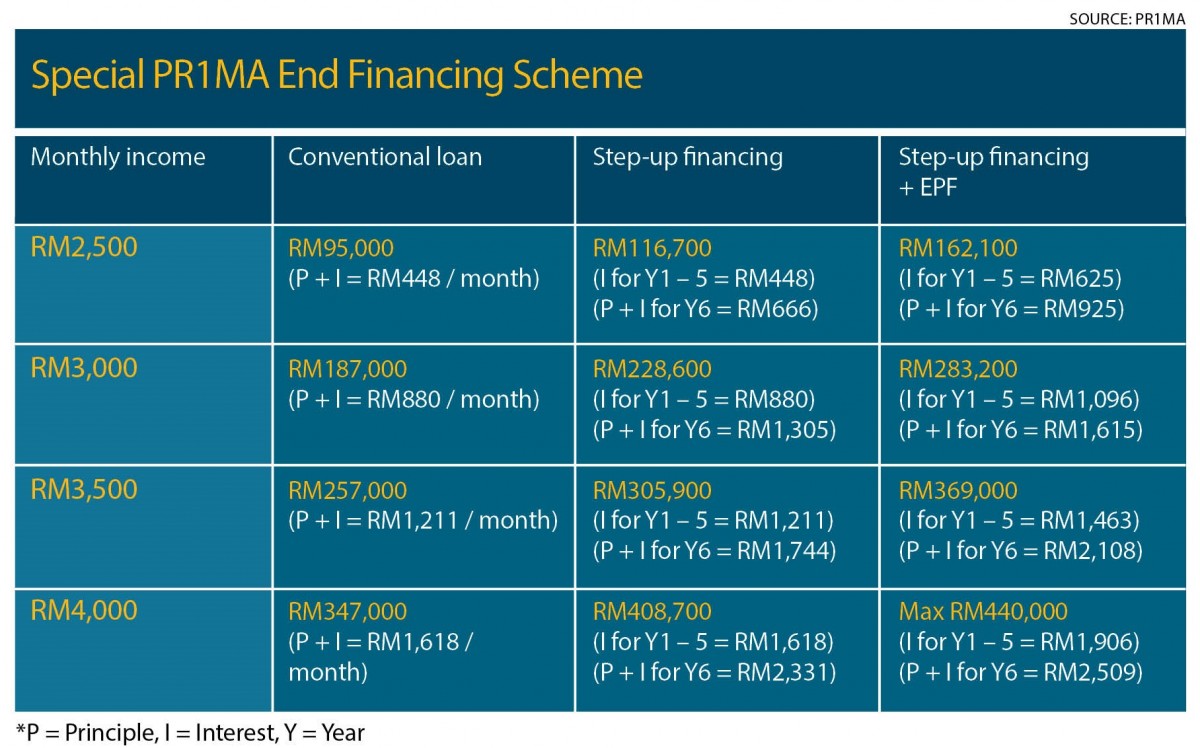

Meanwhile, on track with the Budget 2017 proposal of a step-up end-financing scheme for PR1MA homebuyers, the corporation had on Feb 14 announced details on the scheme’s implementation.

According to PR1MA, 60% of its homebuyers had to give up their booked units due to problems with end-financing, prompting the corporation to shift its focus to helping them secure a home loan.

The new scheme known as the Special PR1MA End Financing Scheme (SPEF) is established in collaboration with Bank Negara Malaysia, the Employees Provident Fund (EPF) and four local banks — Maybank, CIMB Bank, RHB Bank and Ambank.

While these measures are meant to ease the financing process and enable more people to own a home under PR1MA, what should homebuyers consider before signing themselves up?

Special PR1MA End Financing Scheme (SPEF)

Under SPEF, not only will homebuyers have access to larger loan amounts where banks will take the loan applicant’s EPF Account 2 monthly contribution into consideration when calculating the final eligible loan amount, their financial burden will also be eased slightly as only interest needs to be paid for the first five years.

Homebuyers who opt for the step-up end-financing scheme can choose to do it with or without the EPF Account 2 withdrawal option. However, those who prefer the latter should note that one can only make a withdrawal from EPF Account 2 once, at least until their PR1MA loan is settled. In other words, their EPF Account 2 will be ring-fenced, as described by EPF.

Executive director of Socio-economic Research Centre of The Associated Chinese Chamber of Commerce and Industry Malaysia Lee Heng Guie says although the intention is to raise the chances of getting a loan, he also hopes that banks will not compromise on the credit quality of borrowers.

“Given the rising household debt [in Malaysia], maintaining the loan quality is very important,” Lee tells TheEdgeProperty.com.

Borrowers also need to think long term and consider whether they would be able to repay the loan after five years.

“Paying only interest for the first five years will surely ease homebuyers’ financial burden but they need to make sure they can service the loan on time when the principal amount kicks in (after five years),” he adds.

Lee also advises homebuyers to take a step back before committing to buying a house.

“At the end of the day, the question is: are you ready to have a long-term [financial] commitment to own a house?

“Even if a house is at an affordable price range, you have to factor in your income level as well as your cost of living. As you see, more than 60% of PR1MA applicants were rejected by banks for their loan application, meaning that banks, having assessed their credit profile, think that they are not financially ready to own a home.

“If you’re unable to own a house now, you can always think about renting first until you’re ready and more financially stable,” he says.

Reduced moratorium

Meanwhile, on the five-year moratorium, Sunway University Business School economics professor Dr Yeah Kim Leng considers it too short and this may encourage speculative activities.

“Halving the moratorium period could encourage speculative purchases. Many, including those who were previously quite happy living with their parents may be tempted to own a PR1MA home to cash in on the potential upside,” says Yeah. To prevent speculation, he suggests that houses should be resold to PR1MA at cost within the 10-year holding period.

On the other hand, he admits that a shorter holding period will give buyers greater financial flexibility especially in monetising the price gains either for upgrading or for reducing their debt. “[And] for those whose work takes them to other places, the shorter period is [also] more flexible for them to relocate and unwind their home asset,” he notes.

PR1MA said the banks have agreed to the shorter moratorium and that it will allow homebuyers to upgrade their homes quicker as they need not hold on to the property for a decade.

Meanwhile, the corporation has submitted a proposal to the government for the moratorium to commence from the issuance date of the Certificate of Completion and Compliance and not when the land title is transferred to the end-purchaser. It said this was to discourage buyers from selling PR1MA homes for monetary gains, leading to speculative activities.

However, Lee who also thinks the five-year moratorium is too short, notes that most people who are looking to genuinely own a home under PR1MA, are looking to occupy the property for a longer period.

“Even if it is to give buyers a chance to upgrade their homes in five years, it is a bit too short a time for them to save enough to upgrade. A 10-year period is actually more suitable for homebuyers,” he adds.

Increased eligibility

According to Lee, loosening the eligibility by increasing the monthly household income from RM10,000 to RM15,000 will certainly attract more first-time homebuyers to consider PR1MA homes.

He thinks that RM15,000 is “just right” to cater to the target group. “I believe they raised the eligibility as they took into account those who are living in urban areas due to the higher cost of living in those areas,” he says.

However, Yeah has a different view as the increased eligibility may worsen the supply-demand gap. Citing data by the Malaysian Department of Statistics, Yeah notes that the median gross monthly income of the middle 40% of Malaysian households is around RM6,100 based on the 2014 Household Income Survey.

“Widening the eligibility to RM15,000 will defeat the purpose of affordable housing to the masses given that the current PR1MA applicants exceed the number of houses to be constructed by about five times.

“It will only worsen the supply-demand gap. The higher income range is best left to private developers,” he says.

The verdict

Overall, both economists agree that SPEF will help more PR1MA homebuyers get home loans but they hold concerns that the shortened moratorium period will invite speculative buyers.

“At the moment let’s see how these new measures will fare, especially in terms of increasing loan approval rates,” Lee says.

“As PR1MA continues to increase its supply [of affordable houses] and evenly distribute the houses across all states, this [programme] will [help] stabilise current property prices,” he concludes.

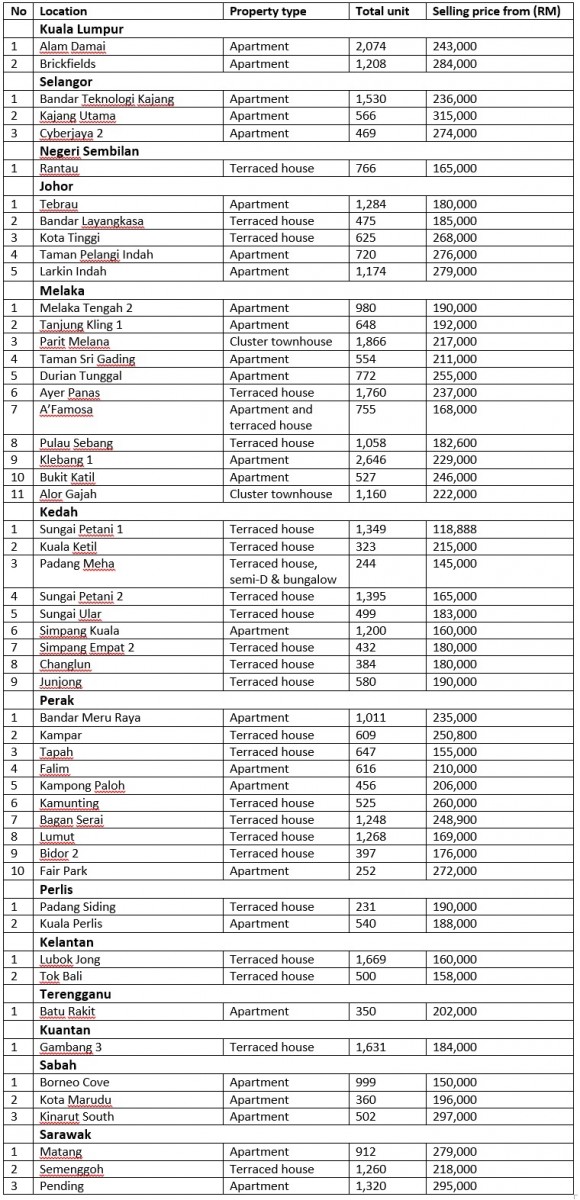

PR1MA projects available in the market as at February 2017

This story first appeared in TheEdgeProperty.com pullout on Feb 17, 2017, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Pangsapuri Seroja

Setia Alam/Alam Nusantara, Selangor

Persiaran Damansara Indah

Tropicana, Selangor

Pangsapuri Andorra, Taman Sri Muda

Shah Alam, Selangor

Emira Residence @ Shah Alam

Shah Alam, Selangor

Bandar Bukit Raja

Bandar Bukit Raja, Selangor