Housing projects designed specifically for mobile and independent retirees are nothing unusual in many developed countries. Often called retirement villages, these are not the old folks’ homes that Malaysians generally have in mind when they talk about housing for the elderly.

“The key difference between retirement villages and other forms of aged care is in the services and level of care provided. Retirement villages provide an opportunity for independent retirees to maintain a self-sufficient lifestyle and to live independently,” says Australian economic analysis firm Essential Economics managing partner Sean Stephens in an email interview with TheEdgeProperty.com.

In addition to a dwelling (typically an apartment unit), retirement villages often provide a range of community facilities that enable residents to partake in an active and social lifestyle.

He thinks there is a need to change the perception of retirement villages from being an “old folks’ home” to being a place where older residents choose to live a lifestyle that they may otherwise not get the opportunity to enjoy.

In many developed countries, such as the US, Australia and New Zealand, retirement villages are thriving and is a mature industry.

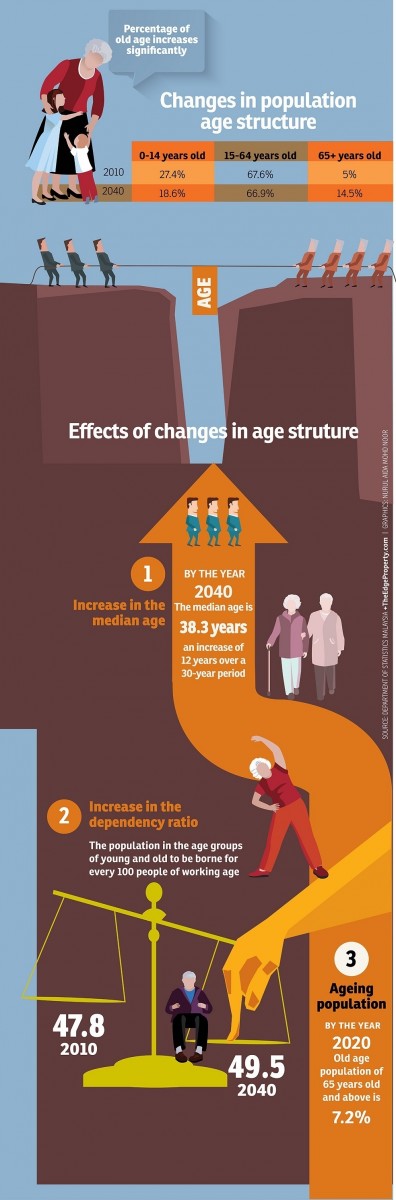

“Over the next 15 years, the share of the Malaysian population aged 65 years and over will increase from around 6% to at least 11%. This growth pattern will increase the population of older Malaysians by around 2.2 million people. From a property development perspective, that market is worth investing in,” Stephens says, citing World Bank statistics.

Meanwhile, the Department of Statistics Malaysia expects the percentage of its population aged 65 years and over to reach 7.2% by 2020 from the 5% as at November 2016. This is expected to double to 14.5% in 2040.

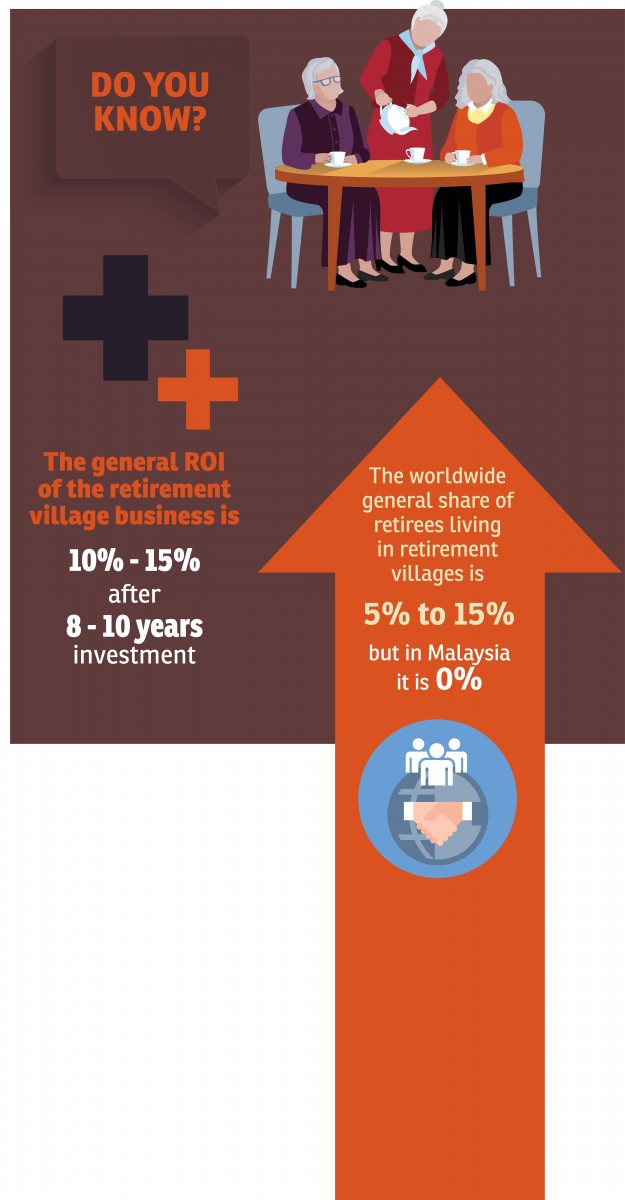

“The share of older persons living in retirement villages in the most established retirement village markets in the world ranges from around 5% to 15%. In Malaysia, this share is virtually zero,” he notes.

Why is it not moving?

Stephens believes one of the reasons the industry is hardly moving in Malaysia is the lack of robust regulatory framework and government leadership.

“In particular, regulation of retirement village standards and consumer protection will be needed to ensure that a reputable retirement village industry is developed in Malaysia. In addition, local urban planning regulations to specifically allow for retirement villages will be needed,” Stephens suggests.

In 2014, the government had under the Economic Transformation Programme (ETP) noted the lack of attention to senior-living, including retirement villages, and had encouraged the development of a structural approach to provide for an ageing population.

“Malaysia does not have a retirement village industry or any facility that resembles what is now commonly available in the West. The government is only just trying to address this issue as we grow towards ageing nation status,” says Eden-on-the-Park managing director Sdn Bhd Victor Fong.

Located in Kuching, Sarawak, Eden-on-the-Park was chosen as the retirement village Entry Point Project under the ETP. “It is the first and only integrated facility that provides for both active seniors to those who need assistance and high-level care, all in one development,” Fong tells TheEdgeProperty.com.

Located on an 8.5-acre site, Eden-on-the-Park has a total gross development value of about RM120 million. It comprises 104 apartment units, 14 villas and a care residence of some 120,000 sq ft with 140 beds, and support amenities like kitchen and dining rooms, activity rooms, physiotherapy, consultation rooms, staff facilities, an auditorium, training facilities and even a beauty salon, among others.

Typically, the apartments at Eden-on-the-Park are priced at around RM800,000 to RM880,000 for a 2-room dual-key unit with a built-up of 1,200 sq ft or 1,500 sq ft. The villas are priced at around RM1.2 million. Both are open to people who are over 55 years of age with no health issues, although for bank financing purposes, some of the joint owners may be below this age.

The care residence is for residents who need medical care. Residents have to go through a standard assessment to determine the level of care required and this will be reflected in the monthly charges that the residents have to pay.

“The apartments and villas are due for completion in early 2017. Without a public launch the units are 85% sold,” Fong says.

Meanwhile, the care residence was partly completed earlier in 2016. “It [the care residence] has been receiving residents, the available rooms are well-occupied. The remaining rooms will be open as soon as it receives full Ministry of Health licensing,” Fong notes.

He adds that Eden provides care along with activities which are aimed at keeping residents mentally and physically active and healthy. “We support the concept of ageing-in-place, where residents buy a place when they are young and healthy, and live among friends as they age while enjoying their friendship and communal support.”

Fong agrees that laws and regulations have to be put in place to guide and regulate senior-living facilities and developments.

“Besides allowing funding options through the insurance scheme contribution, withdrawal of provident funds to buy such properties and tax relief for children, maybe stamp duty [exemption] for ‘last homeowner’ and not only ‘first-time homeowner’ will help [the industry to grow],” Fong notes.

Meanwhile, over in Meru, Perak, GreenAcres Retirement Village is ready to open its doors by the middle of this year.

Meanwhile, over in Meru, Perak, GreenAcres Retirement Village is ready to open its doors by the middle of this year.

Developed by Total Investment Sdn Bhd, the five-phase development is said to be the first retirement village in Peninsular Malaysia. The first phase comprises 26 units of villas which will be completed soon, while the overall 13-acre project will be completed in 2020.

GreenAcres is a lifelong leasing property. A 55-year old couple pays a leasing deposit ranging from RM300,000 to RM452,000 for a 2-bedroom villa. Tenants will not need to pay any monthly rent after that. However, tenants will need to pay the monthly utility fees and maintenance fees of 47 sen psf.

Total Investment executive director John Chong explains: “Let’s say a couple chooses the RM300,000 unit, they can stay in the fully-furnished home for life. If they decide to move out earlier, we will refund part of the leasing deposit according to the property market price at that time. Our earnings stream is from the maintenance and management fees. What we are actually aiming to earn is the property value appreciation.”

GreenAcres offers a club house, walking track, green environment, shuttle bus to and from Ipoh town, day trips and activities for its residents.

Chong also says the industry needs incentives and help to grow because this is not a sector that the investor or developer will see immediate or significant return on investment (ROI) (see story above).

“The lack of both government help and private developer involvement are hampering the growth of the industry. Most developers look at the ROI, so many steer away from this business because they have to answer to their shareholders. However, we know that they [developers] are studying the viability of this sector,” Chong says.

Key issues in developing retirement villages in Malaysia

• Lack of industry maturity

• Lack of robust regulatory framework and government leadership

• Lack of fundamental research to determine market demand

• Lack of operators with successful business models

• Mandated retirement savings only applies to private sector employees

• The prevalence of Asian filial piety

What’s the ROI for developing retirement villages?

The return on investment (ROI) for retirement villages may not be as attractive as other types of property developments, but it could be a sustainable business that can offer recurring income, according to Total Investment executive director John Chong.

“It is a service industry that involves many after sales services. It can contribute recurrent income if you manage it well,” he says. Total Investment is the developer of GreenAcres Retirement Village in Perak.

Meanwhile, Essential Economics managing partner Sean Stephens says generally, an accepted ROI in the industry is around 10% to 15% for a commercially operated retirement village, but this will require eight to 10 years’ investment.

“Right now, it is considered a relatively risky investment proposition with few examples on the ground,” says Stephens. But the demographic trends indicate that demand for some form of independent retirement living product will gain traction in the market place in years to come, he notes.

“In a global context, the independent living retirement village market in Malaysia is in its infancy. However, the sector is attracting a lot of attention from developers, investors and potential operators,” says Stephens, adding that there are several senior-living developments that are being planned or are in the design concept phase.

“The government needs to lead a continuing national dialogue about the key issues, namely, the best way to care for elderly Malaysians in the future, while the private sector, including developers and operators, need to push the boundaries by proposing innovative models of looking after the elderly,” he says.

Furthermore, he adds, Malaysia would need to develop a model that suits its specific market characteristics, customs and cultures.

Meanwhile, co-founder of Total Investment YL Siew believes now is the right time to introduce the retirement village concept to Malaysians.

“In the Asian tradition, the parents pass on their assets to the next generation and rely on them when they are old. However, the Malaysian society is changing.

“Many parents do not want to burden their children when they retire. They want to be free to go or stay wherever they want to,” Siew says, adding that the concept of a retirement village is aimed at creating a secure and comfortable living environment for the elderly.

This story first appeared in TheEdgeProperty.com pullout on Feb 10, 2017. Download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Kawasan Industri Desa Aman

Sungai Buloh, Selangor

Sutera Heights, Taman Juara Jaya

Cheras, Selangor

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur