RIDING on a tide of good news over the past one year, Ekovest Bhd’s market capitalisation has surged over 140% to RM2.22 billion.

Ekovest has been granted two inner city highways that have added RM11.3 billion to its order book. On top of that, it has disposed of a 40% stake in the first and second phases of the Damansara-Ulu Kelang Expressway (Duke) to the Employees Provident Fund (EPF) for RM1.13 billion cash.

Against this backdrop, it is understood that a huge block of Ekovest shares is now up for sale — about 80 million or a 9.4% stake.

Only two of the largest shareholders will be able to muster this quantity of shares.

However, it is believed that Datuk Haris Onn Hussein, who holds a 9.49% stake, or 81.15 million shares through his vehicle Kota Jayasama Sdn Bhd, is looking for buyers for the stake.

After all, he has been steadily selling Ekovest shares since April last year, disposing of 91.28 million in total, mostly via private arrangements. Haris, better known as the brother of Defence Minister Datuk Seri Hishammuddin Hussein, is not a director of the company.

Meanwhile, Ekovest managing director Datuk Seri Lim Keng Cheng affirms that “we have no intention to sell shares or reduce the holdings in the company”.

The Lim family, which includes Lim’s uncle, executive chairman Tan Sri Lim Kang Hoo, controls 37.9% of the company.

“We can’t comment on other shareholders’ intentions to sell. But there is plenty of institutional interest in the company, so there should be no problem disposing of the shares,” says Lim.

He also refutes rumours that the family might acquire the block of 80 million shares, which would trigger a mandatory general offer.

Meanwhile, market sources say the block of shares is being offered at a slight discount. This is not unusual given the size of the block as well as Ekovest’s relatively high share price of RM2.60 apiece.

For Haris, however, who is believed to be the seller, it will still be a good deal. Less than one year ago, Ekovest’s share price was hovering at just below RM1.10. In short, his existing block of shares has gained RM121.7 million on paper.

Last April, he held 172.4 million Ekovest shares or a 20% stake in the company.

The bulk of the shares was disposed of via private arrangement. It is estimated that he has unlocked around RM150 million for selling 91.284 million shares to date.

This year alone,Bursa Malaysia filings showed that Haris disposed of 28.78 million shares for RM69.04 million, or an average of RM2.40 apiece. This is a 7.7% discount to Ekovest’s closing price of RM2.60 last Wednesday.

Assuming the same discount rate is used, Haris’ remaining block of 81.15 million shares should transact for about RM194.76 million. If the disposal is successful, Haris would have collected a cumulative RM344.78 million from disposing of Ekovest shares over the past 10 months.

Haris also disposed of RM804,991 worth of warrants over the past one month at an average price of RM1.20 per warrant. He still holds 23.97 million Ekovest warrants. Note that Ekovest’s warrants have a strike price of 1.35 and expire in 2019.

Is there more upside?

Against the backdrop of a major shareholder selling out of the company, investors might begin to wonder if there is more upside for Ekovest’s share price.

The share price barely budged even after the group announced that the government had given approval in principle for an RM6.32 billion inner-city highway project.

Although it is dubbed Duke Phase 2A, it is technically the fourth phase of the Duke highway. Ekovest secured the third phase of the Duke highway, worth RM5.05 billion, last year.

“For Duke 2A, Ekovest still needs to finalise approvals with all the respective government agencies. If Duke 3 is anything to go by, Duke 2A should be formally signed in early 2018. By mid-2018, we should complete financial close,” explains Lim.

The inclusion of Duke 2A will increase Ekovest’s construction order book to RM13 billion over the next five years, making it among the largest in the sector.

Lim defends the cost of Duke 2A, pointing out that the proposed 75.2km highway will be fully elevated.

He stresses the strategic importance of Duke 2A as it will act as a missing link in Kuala Lumpur’s intermediate ring road.

“Duke 2A will connect three major thoroughfares in KL. Firstly, it will connect the West Coast Expressway to Duke 2. Secondly, it will connect the old Istana road to Jalan Duta. Thirdly, it will connect Duke 1 at Jalan Kuching to Kampung Baru, via Jalan Tun Razak and Jalan Kuching. And from Kampung Baru, it will connect to Akleh highway (Ampang-Kuala Lumpur Elevated Highway),” says Lim.

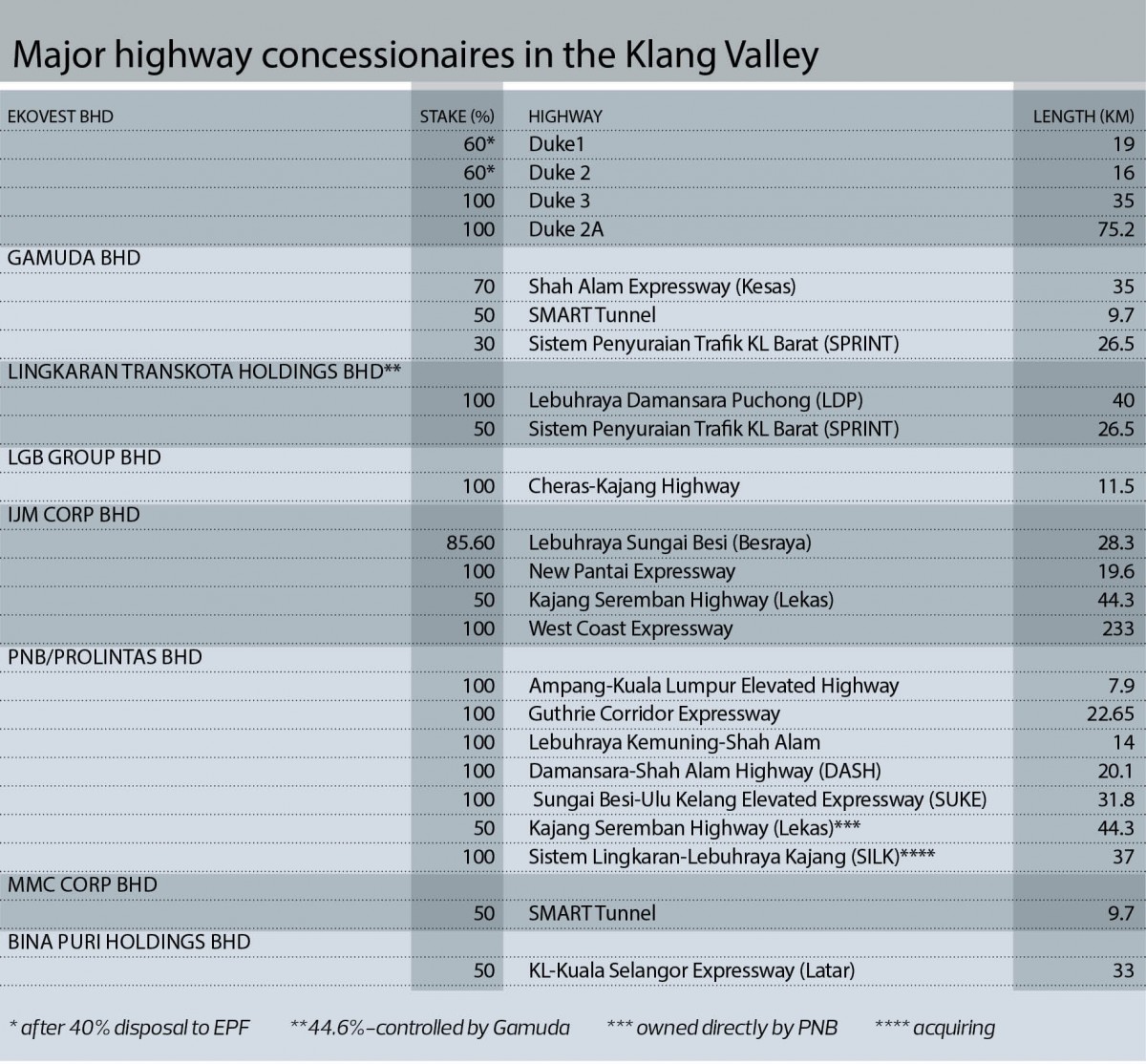

Taking a long-term view on Ekovest, the company has transformed itself into the largest inner-city highway concessionaire — with about 145.2km in total.

Since these assets cannot be replicated, it makes Ekovest a one-of-a-kind stock to hold. However, the returns from the highway concessions might take a long time to materialise. Note that Duke 2A is only expected to begin tolling operations in 2022.

Ekovest will be taking on heavy debts at the beginning to fund the construction of the highways. In fact, it is expected to make a cash call in 2018 to help fund Duke 2A.

Lim declines to comment, saying it is too early to comment on Duke 2A’s funding requirements.

It is not clear exactly how much the company needs to raise from the shareholders. Keep in mind that the group’s gross gearing is expected to fall from 4.93 times to 3.26 times following the disposal of 40% of Duke 1 and Duke 2 to EPF.

Assuming Ekovest also funds Duke 2A with 70% borrowings, the group’s balance sheet will have to take on an additional RM4.4 billion in debt. At current levels, this will increase the gross gearing to over 5.6 times. To keep gearing below four times, Ekovest will have to raise about RM2.6 billion from shareholders.

Otherwise, the company will have to monetise more of its assets.

It is important to keep in mind that Ekovest has shown its ability to secure lucrative funding from the government. For example, the government is providing Ekovest with a RM560 million interest-free advance to cover the first eight years of interest payments on the RM3.6 billion sukuk issued for Duke 3.

If Ekovest can secure similar support for Duke 2A, the financing should not be a problem.

In the more immediate future, however, shareholders can look forward to a two-for-five share split that should boost Ekovest’s trading activity. On top of that, the company will also pay out a special dividend of RM244 million from the proceeds of the disposal to EPF. That works out to a yield of about 11%.

This article first appeared in The Edge Malaysia on Jan 30, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Kawasan Industri Desa Aman

Sungai Buloh, Selangor

Mayfair Residences @ Pavilion Embassy

Keramat, Kuala Lumpur