CapitaLand Malaysia Mall Trust (Jan 25, RM1.63)

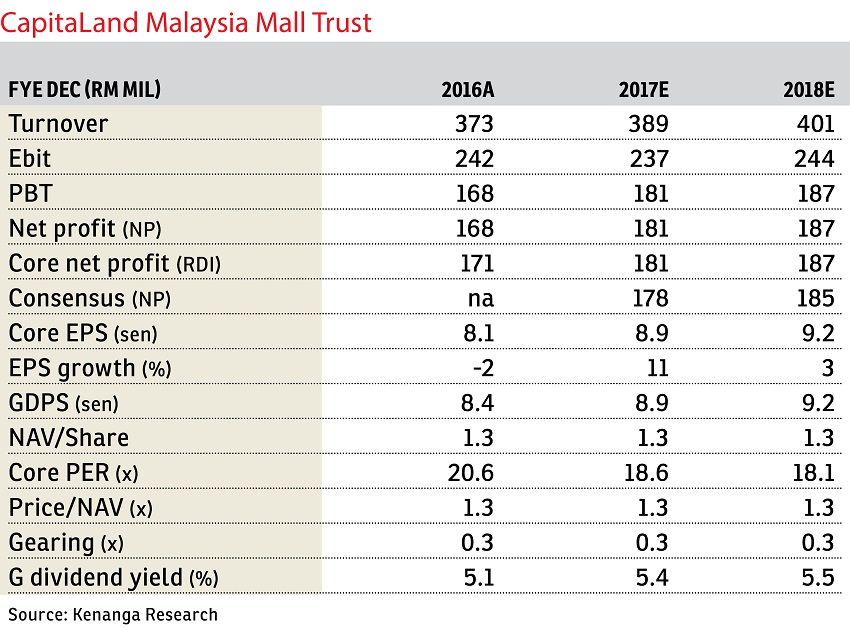

Maintain market perform with an increased target price of RM1.62: CapitaLand Malaysia Mall Trust’s (CMMT) financial year 2016 (FY2016) realised distributable income (RDI) of RM171.1 million came in within both our and consensus expectations at 99% and 102% respectively. The second interim distribution per unit (DPU) of 4.23 sen was declared, which included a 0.21 sen non-taxable portion, bringing FY2016 DPU to 8.43 sen. This also met our FY2016 target (99%) of 8.5 sen, implying a 5.1% yield.

Year-on-year, year to date (YTD) FY2016 gross rental income (GRI) improved (+8.1%) mainly on the back of new asset acquisitions, namely Tropicana City Mall and Tropicana City Office Tower (TCM and TCOT respectively) and positive rental reversions on most assets, primarily Gurney Plaza (GP) and The Mines.

All in, RDI increased by 5.1% after accounting for higher financing cost (+15.5%) to part finance the acquisition of TCM and TCOT, and additional revolving credit facilities being drawn down for capital expenditure (capex). Meanwhile, DPU declined by 1.9% from the placement for TCM and TCOT in the third quarter (3Q) of FY2015. Quarter-on-quarter GRI was flattish, while higher operating cost (+3%) from maintenance and other operating expenses dragged RDI down by 1.4%.

CMMT has spent RM48 million YTD on capex while management previously had allocated RM50 million for FY2016. In FY2017, management is targeting circa RM30 million on capex for general refurbishment and asset enhancement initiatives at GP and TCM. FY2017 will see 49% of leases up for expiry, mostly from GP and East Coast Mall, while we expect modest single-digit reversions (save for Sungai Wang Plaza [SWP]).

Meanwhile, we believe SWP may not see positive rental reversions in the near term of which we have already accounted for, but we expect rental reversions to improve closer to completion of construction works for the mass rapid transit 1 by end-FY2017.

CMMTs’ portfolio occupancy was stable at 96.5% from 96.3% in 3QFY2016. All assets recorded above 90% occupancy as management focuses on prioritising occupancy at malls to ensure they remain vibrant. TCOT saw a dip in occupancy to 95.2% in 4QFY2016 from 100% previously but management had since renewed the lease and tenancy is expected to be 100% in 1Q2017. — Kenanga Research, Jan 25

This article first appeared in The Edge Financial Daily, on Jan 26, 2017. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

The Canal Garden South, Horizon Hills

Iskandar Puteri, Johor

The Astaka @ 1 Bukit Senyum

Johor Bahru, Johor

Pekan Nanas Industrial

Pekan Nanas (Pekan Nenas), Johor

Kawasan Perindustrian Mount Austin

Johor Bahru, Johor